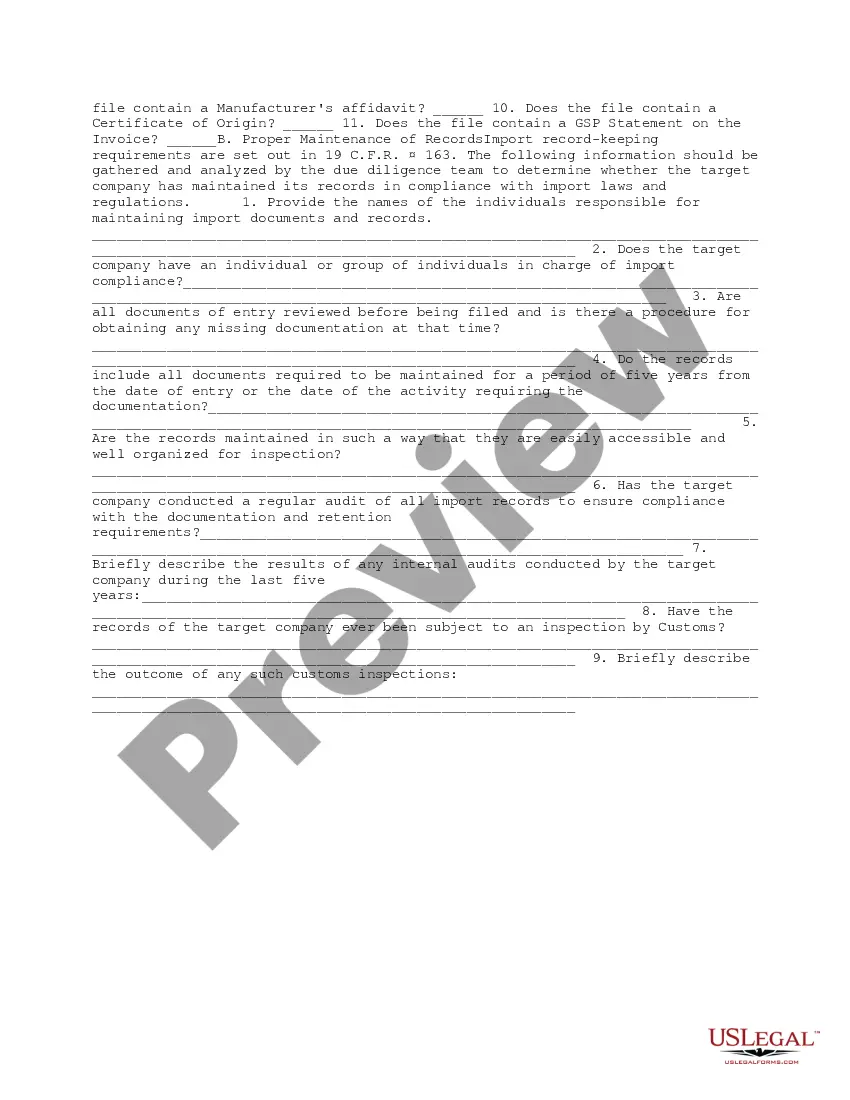

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Travis Texas Import Compliance and Records Review Due Diligence is an essential aspect of international trade operations, particularly for businesses involved in importing goods into the United States. This comprehensive procedure ensures that all import activities comply with relevant laws, regulations, and documentation requirements set forth by the U.S. Customs and Border Protection (CBP). By conducting meticulous import compliance and records review due diligence, businesses aim to mitigate potential risks, avoid penalties, and maintain a smooth flow of goods across borders. Travis Texas Import Compliance involves a series of actions to ensure adherence to import regulations. This includes verifying that imported products meet safety standards, obtaining necessary licenses or permits, calculating and paying applicable duties and taxes, and complying with any special requirements based on specific product categories. Import compliance also encompasses implementing record-keeping processes, such as maintaining accurate import documents, including invoices, packing lists, bills of lading, and customs declarations. Records Review Due Diligence, on the other hand, focuses on thoroughly reviewing and examining the documentation associated with import activities. This is crucial to ensure that all required records are complete, accurate, and maintained for the specified duration as mandated by CBP regulations. Conducting regular records review allows businesses to identify any gaps or discrepancies, rectify them promptly, and demonstrate compliance during CBP audits or requests for information. Different types of Travis Texas Import Compliance and Records Review Due Diligence may include: 1. Import Classification Review: This involves accurately classifying imported goods according to the Harmonized System (HS) Code, an internationally standardized system for classifying products. Accurate classification is crucial for determining applicable duty rates, tariffs, and import restrictions. 2. Customs Valuation Compliance: Validating the declared value of imported goods is essential to ensure compliance with customs valuation rules and to avoid potential penalties. This process involves verifying the accuracy and completeness of the commercial invoice and supporting documentation. 3. Country of Origin Verification: Verifying the country of origin for imported goods is necessary to determine eligibility for preferential trade agreements, assess import duties, and comply with labeling and marking requirements. Through due diligence, businesses must confirm that the origin declared matches the product's actual manufacturing location. 4. Import Documentation Audit: This involves a comprehensive examination of import documents to ensure compliance with CBP regulations. The audit may include reviewing bills of lading, commercial invoices, packing lists, arrival notices, customs declarations, and other relevant paperwork. 5. Compliance Program Assessment: Carrying out routine assessments of import compliance programs allows businesses to evaluate the effectiveness of their processes, identify areas for improvement, and ensure continued compliance with ever-evolving customs regulations. By conducting Travis Texas Import Compliance and Records Review Due Diligence, businesses aim to maintain a transparent and compliant import process, reduce the risk of penalty, and foster efficient international trade operations.Travis Texas Import Compliance and Records Review Due Diligence is an essential aspect of international trade operations, particularly for businesses involved in importing goods into the United States. This comprehensive procedure ensures that all import activities comply with relevant laws, regulations, and documentation requirements set forth by the U.S. Customs and Border Protection (CBP). By conducting meticulous import compliance and records review due diligence, businesses aim to mitigate potential risks, avoid penalties, and maintain a smooth flow of goods across borders. Travis Texas Import Compliance involves a series of actions to ensure adherence to import regulations. This includes verifying that imported products meet safety standards, obtaining necessary licenses or permits, calculating and paying applicable duties and taxes, and complying with any special requirements based on specific product categories. Import compliance also encompasses implementing record-keeping processes, such as maintaining accurate import documents, including invoices, packing lists, bills of lading, and customs declarations. Records Review Due Diligence, on the other hand, focuses on thoroughly reviewing and examining the documentation associated with import activities. This is crucial to ensure that all required records are complete, accurate, and maintained for the specified duration as mandated by CBP regulations. Conducting regular records review allows businesses to identify any gaps or discrepancies, rectify them promptly, and demonstrate compliance during CBP audits or requests for information. Different types of Travis Texas Import Compliance and Records Review Due Diligence may include: 1. Import Classification Review: This involves accurately classifying imported goods according to the Harmonized System (HS) Code, an internationally standardized system for classifying products. Accurate classification is crucial for determining applicable duty rates, tariffs, and import restrictions. 2. Customs Valuation Compliance: Validating the declared value of imported goods is essential to ensure compliance with customs valuation rules and to avoid potential penalties. This process involves verifying the accuracy and completeness of the commercial invoice and supporting documentation. 3. Country of Origin Verification: Verifying the country of origin for imported goods is necessary to determine eligibility for preferential trade agreements, assess import duties, and comply with labeling and marking requirements. Through due diligence, businesses must confirm that the origin declared matches the product's actual manufacturing location. 4. Import Documentation Audit: This involves a comprehensive examination of import documents to ensure compliance with CBP regulations. The audit may include reviewing bills of lading, commercial invoices, packing lists, arrival notices, customs declarations, and other relevant paperwork. 5. Compliance Program Assessment: Carrying out routine assessments of import compliance programs allows businesses to evaluate the effectiveness of their processes, identify areas for improvement, and ensure continued compliance with ever-evolving customs regulations. By conducting Travis Texas Import Compliance and Records Review Due Diligence, businesses aim to maintain a transparent and compliant import process, reduce the risk of penalty, and foster efficient international trade operations.