This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

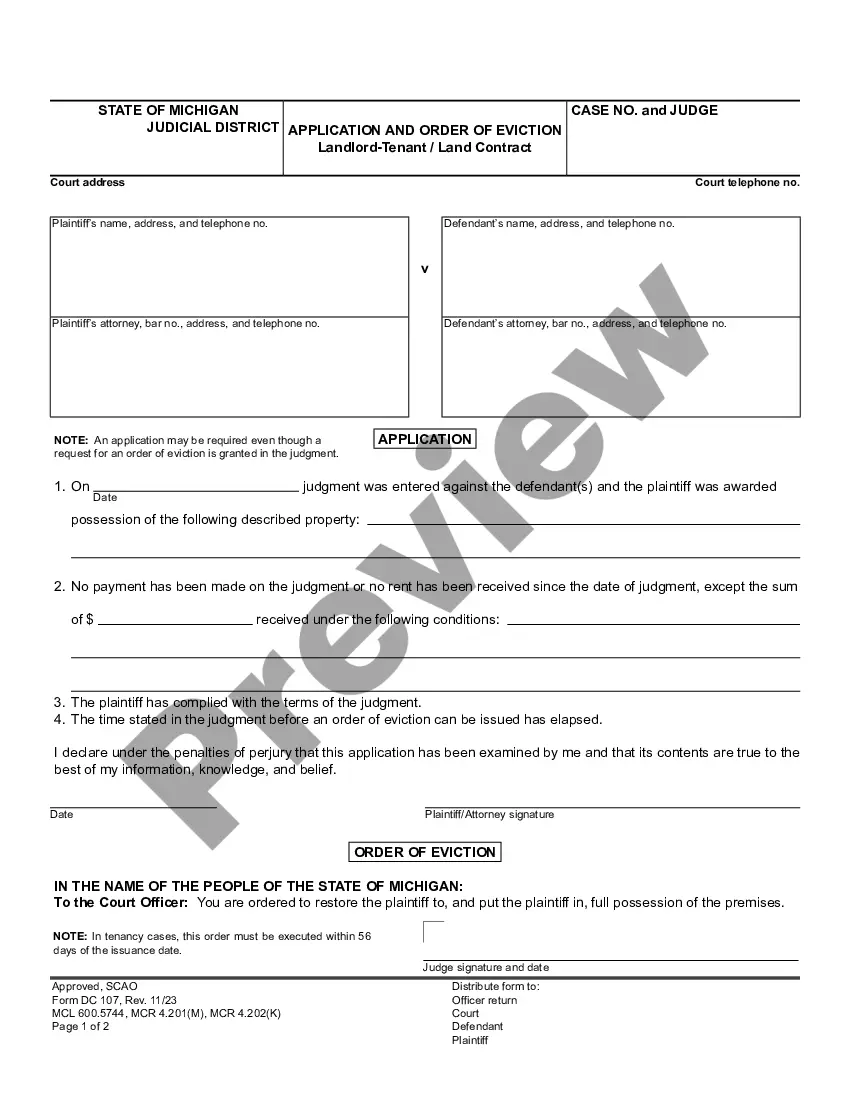

Title: Understanding the Phoenix, Arizona: Outline of Considerations for Transactions Involving Foreign Investors Introduction: Phoenix, Arizona, is a prominent city in the southwestern United States known for its rapidly growing economy, business-friendly environment, and attractive investment opportunities. This article provides a comprehensive guide to help foreign investors navigate the various aspects and considerations involved in conducting transactions in Phoenix, Arizona. 1. Overview of Phoenix, Arizona: — Explore the diverse and vibrant city of Phoenix, including its booming real estate market, strong job growth, and favorable business climate. — Highlight key economic sectors such as technology, healthcare, manufacturing, tourism, and renewable energy, that present excellent investment prospects for foreign investors. 2. Legal and Regulatory Framework: — Provide an overview of the legal and regulatory environment governing foreign investment in Phoenix, Arizona. — Discuss federal and state laws, including regulations related to ownership restrictions, tax implications, and reporting requirements. 3. Market Analysis: — Conduct an in-depth analysis of the Phoenix real estate market, including residential, commercial, and industrial sectors. — Examine property trends, investment returns, market demand, rental rates, and emerging opportunities for foreign investors. 4. Financing Options: — Explore financing options available to foreign investors in Phoenix, Arizona, including traditional bank loans, private lenders, and government-backed programs. — Discuss the eligibility criteria, interest rates, down payment requirements, and loan duration associated with each financing option. 5. Tax Considerations: — Summarize the tax-related considerations for foreign investors in Phoenix, Arizona, including federal and state tax obligations. — Discuss tax incentives, exemptions, and deductions specific to foreign investment, and explore the benefits of tax planning strategies. 6. Due Diligence: — Outline the essential due diligence measures foreign investors must undertake before engaging in transactions in Phoenix, Arizona. — Emphasize the importance of evaluating property titles, conducting property inspections, assessing market risks, financial analysis, and complying with legal requirements. 7. Cultural and Language Considerations: — Highlight the cultural diversity and inclusivity in Phoenix, Arizona. — Discuss linguistic considerations and available resources to bridge potential language barriers for foreign investors. Conclusion: — Summarize the significance of Phoenix, Arizona, as an investment hub for foreign investors. — Re-emphasize the various considerations discussed in this outline and highlight the potential returns and growth opportunities available in Phoenix, Arizona. *Note: There are no specific types of the "Phoenix Arizona Outline of Considerations for Transactions Involving Foreign Investors." This outline covers a detailed overview of the considerations relevant to foreign investors in general while conducting transactions in Phoenix, Arizona.