This checklist is an outline of all matters considered and reviewed in by the due diligence team in the acquisition of a company.

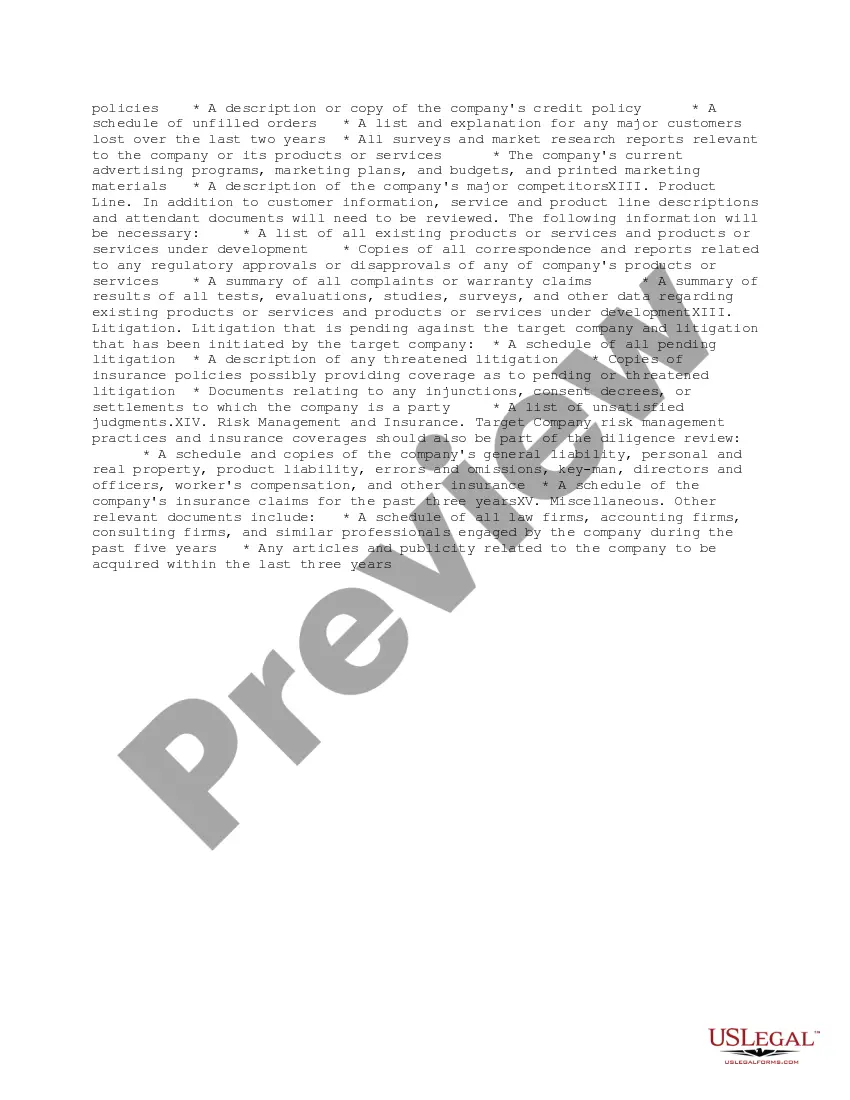

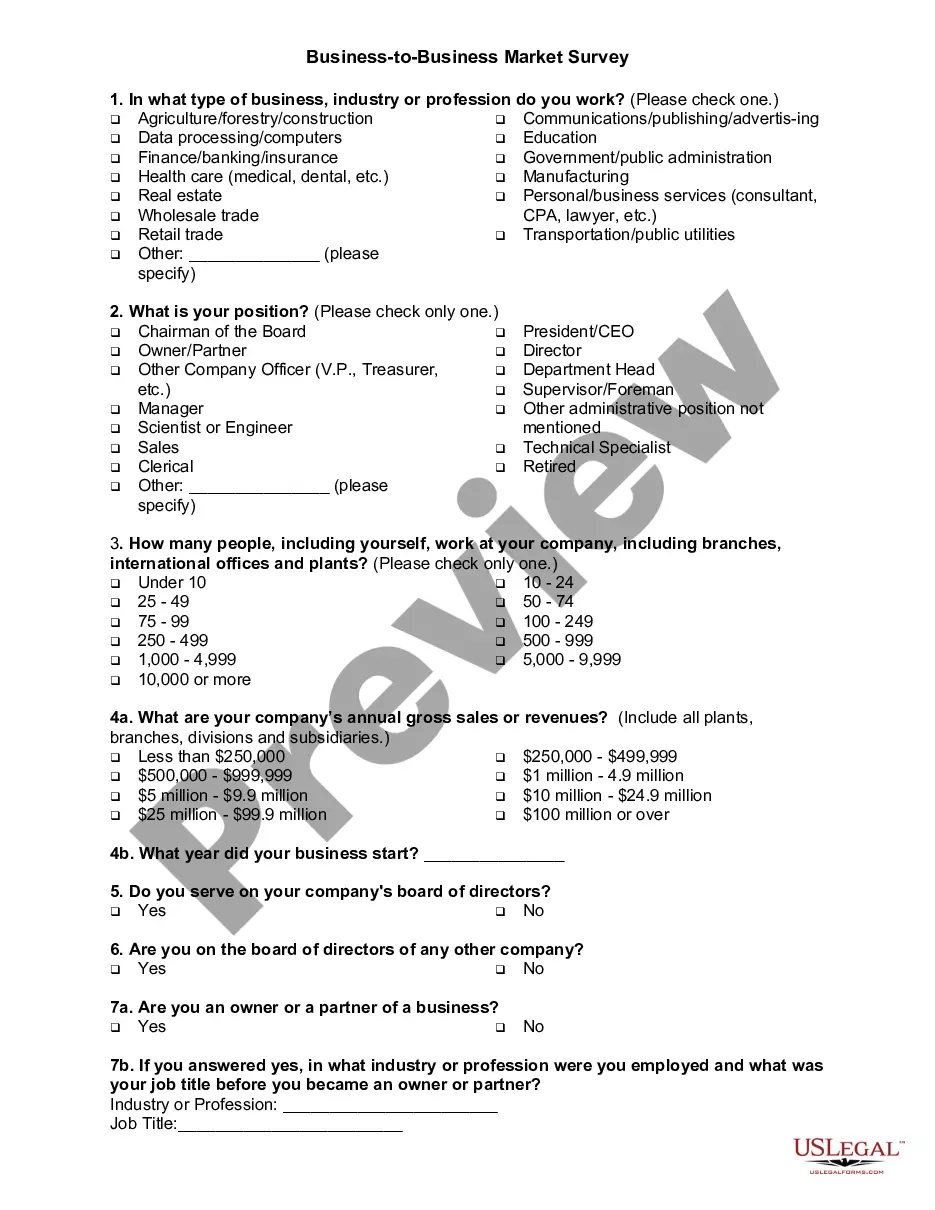

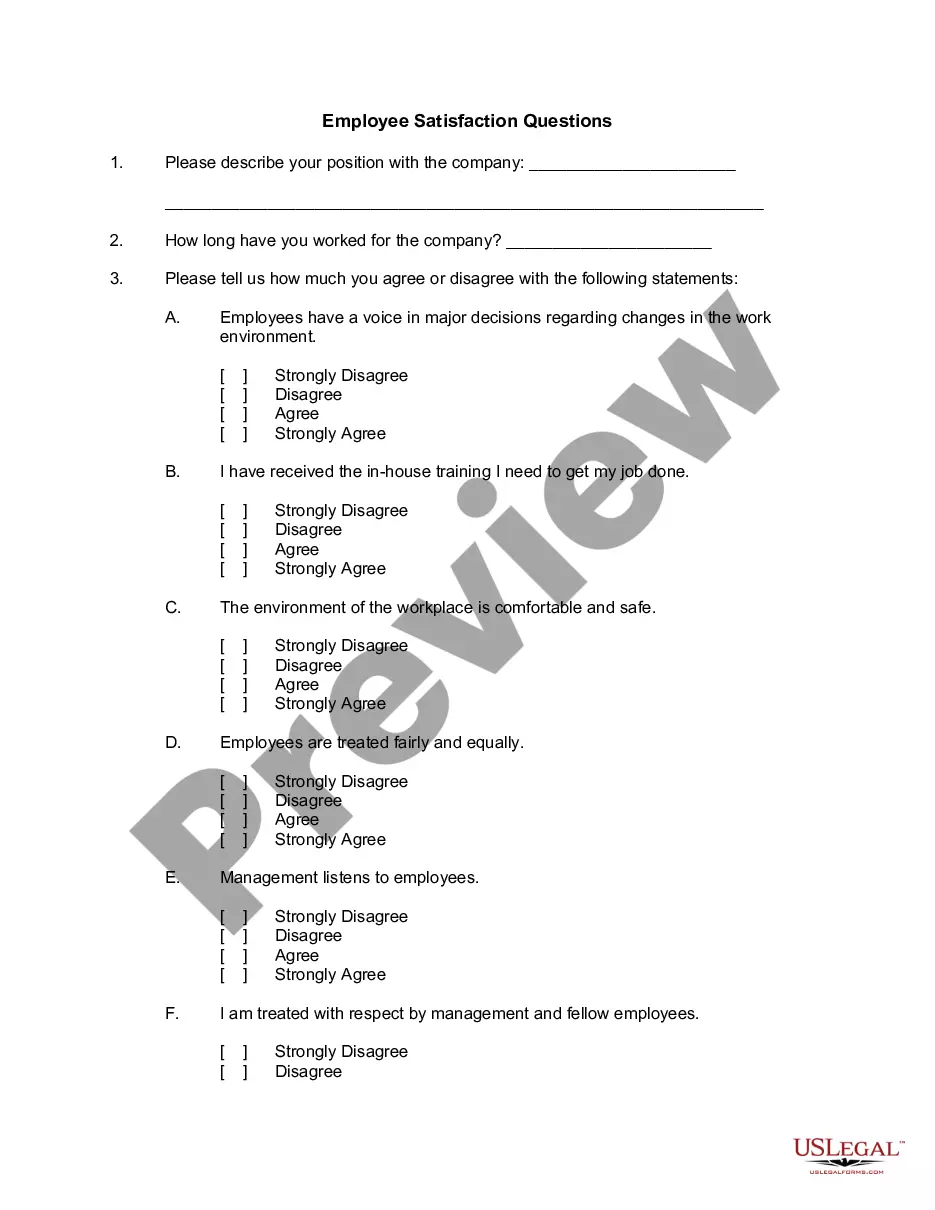

Mecklenburg North Carolina Checklist Due Diligence for Acquisition of a Company: Due diligence is an essential process that potential buyers undertake before acquiring a company to evaluate its financial, operational, and legal aspects. In Mecklenburg, North Carolina, there are several types of checklists for due diligence when acquiring a company. Each checklist encompasses a detailed examination of different areas. Let's delve into the key aspects to consider: 1. Financial Due Diligence: Financial due diligence focuses on assessing the target company's financial health, including its historical financial statements, revenue sources, profitability, cash flow, and debt obligations. This analysis helps potential buyers understand the financial risks and opportunities associated with the acquisition. Keywords: Financial statements, revenue sources, profitability, cash flow, debt obligations. 2. Legal Due Diligence: Legal due diligence aims to scrutinize the company's legal framework, contracts, licenses, permits, intellectual property rights, litigation history, and compliance with federal, state, and local regulations. This process ensures that the acquisition will not pose any undue legal risks. Keywords: Contracts, licenses, permits, intellectual property, litigation history, compliance. 3. Operational Due Diligence: Operational due diligence involves evaluating the company's operations, infrastructure, supply chain, manufacturing capabilities, technology systems, and key personnel. This assessment helps potential buyers determine if the target company's operations align with their business objectives. Keywords: Operations, infrastructure, supply chain, manufacturing capabilities, technology systems, key personnel. 4. Human Resources Due Diligence: Human resources due diligence focuses on evaluating the target company's workforce, including employment contracts, employee benefits, organizational structure, compensation plans, and potential legal risks associated with labor laws. Understanding the workforce ensures smoother integration and facilitates future human resource planning. Keywords: Employment contracts, employee benefits, organizational structure, compensation plans, labor laws. 5. Environmental Due Diligence: Environmental due diligence assesses the target company's compliance with environmental regulations, any potential environmental liabilities, and risks that may arise due to contaminated properties or hazardous activities. Recognizing these factors helps mitigate potential legal and financial risks. Keywords: Environmental regulations, environmental liabilities, contaminated properties, hazardous activities. 6. Commercial Due Diligence: Commercial due diligence involves analyzing the target company's market position, customer base, competitive landscape, industry trends, and growth potential. This assessment provides insight into the company's future performance and the opportunities it possesses in the market. Keywords: Market position, customer base, competitive landscape, industry trends, growth potential. By conducting thorough due diligence in each area, potential buyers gain a comprehensive understanding of the target company's financial, legal, operational, human resource, environmental, and commercial aspects. This knowledge helps in the decision-making process and ensures a smooth acquisition in Mecklenburg, North Carolina.Mecklenburg North Carolina Checklist Due Diligence for Acquisition of a Company: Due diligence is an essential process that potential buyers undertake before acquiring a company to evaluate its financial, operational, and legal aspects. In Mecklenburg, North Carolina, there are several types of checklists for due diligence when acquiring a company. Each checklist encompasses a detailed examination of different areas. Let's delve into the key aspects to consider: 1. Financial Due Diligence: Financial due diligence focuses on assessing the target company's financial health, including its historical financial statements, revenue sources, profitability, cash flow, and debt obligations. This analysis helps potential buyers understand the financial risks and opportunities associated with the acquisition. Keywords: Financial statements, revenue sources, profitability, cash flow, debt obligations. 2. Legal Due Diligence: Legal due diligence aims to scrutinize the company's legal framework, contracts, licenses, permits, intellectual property rights, litigation history, and compliance with federal, state, and local regulations. This process ensures that the acquisition will not pose any undue legal risks. Keywords: Contracts, licenses, permits, intellectual property, litigation history, compliance. 3. Operational Due Diligence: Operational due diligence involves evaluating the company's operations, infrastructure, supply chain, manufacturing capabilities, technology systems, and key personnel. This assessment helps potential buyers determine if the target company's operations align with their business objectives. Keywords: Operations, infrastructure, supply chain, manufacturing capabilities, technology systems, key personnel. 4. Human Resources Due Diligence: Human resources due diligence focuses on evaluating the target company's workforce, including employment contracts, employee benefits, organizational structure, compensation plans, and potential legal risks associated with labor laws. Understanding the workforce ensures smoother integration and facilitates future human resource planning. Keywords: Employment contracts, employee benefits, organizational structure, compensation plans, labor laws. 5. Environmental Due Diligence: Environmental due diligence assesses the target company's compliance with environmental regulations, any potential environmental liabilities, and risks that may arise due to contaminated properties or hazardous activities. Recognizing these factors helps mitigate potential legal and financial risks. Keywords: Environmental regulations, environmental liabilities, contaminated properties, hazardous activities. 6. Commercial Due Diligence: Commercial due diligence involves analyzing the target company's market position, customer base, competitive landscape, industry trends, and growth potential. This assessment provides insight into the company's future performance and the opportunities it possesses in the market. Keywords: Market position, customer base, competitive landscape, industry trends, growth potential. By conducting thorough due diligence in each area, potential buyers gain a comprehensive understanding of the target company's financial, legal, operational, human resource, environmental, and commercial aspects. This knowledge helps in the decision-making process and ensures a smooth acquisition in Mecklenburg, North Carolina.