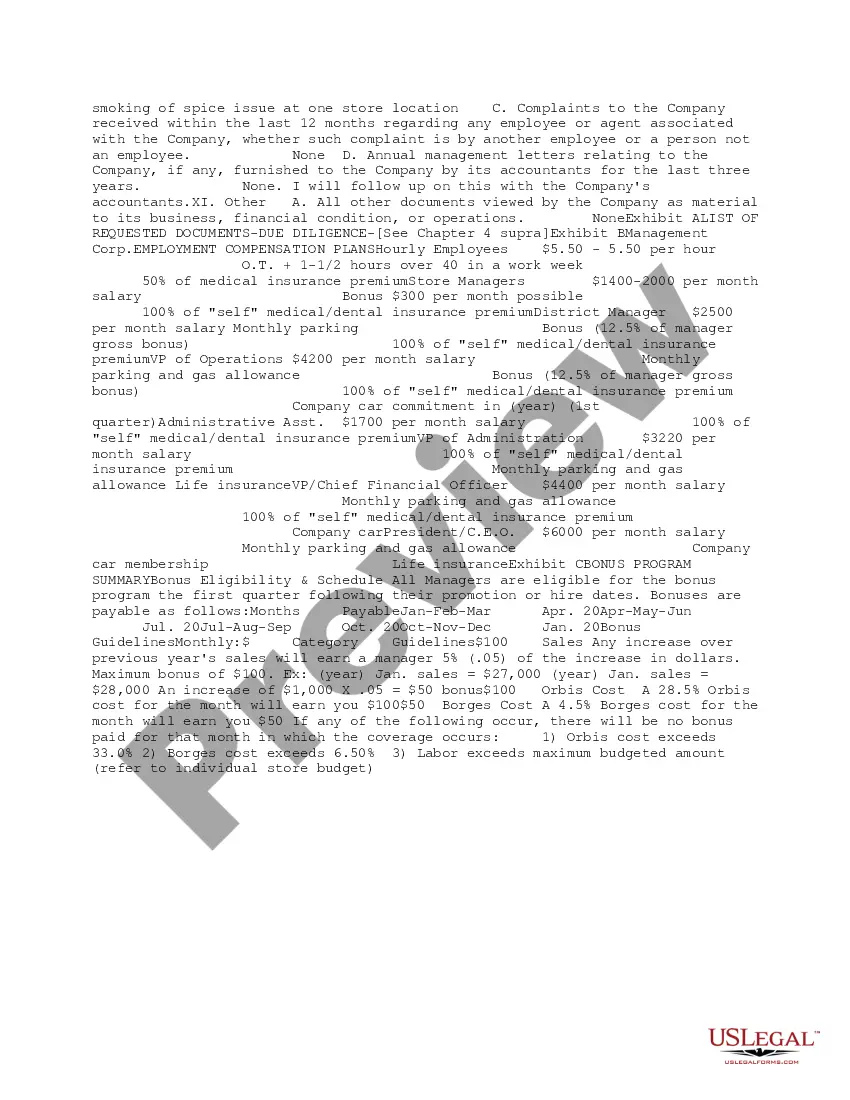

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Franklin Ohio Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Franklin Ohio Summary Initial Review Of Response To Due Diligence Request?

If you need to get a trustworthy legal paperwork provider to get the Franklin Summary Initial Review of Response to Due Diligence Request, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support make it simple to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Franklin Summary Initial Review of Response to Due Diligence Request, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Franklin Summary Initial Review of Response to Due Diligence Request template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate agreement, or complete the Franklin Summary Initial Review of Response to Due Diligence Request - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

20 Key Due Diligence Activities In A Merger And Acquisition... Financial Matters.Technology/Intellectual Property.Customers/Sales.Strategic Fit with Buyer.Material Contracts.Employee/Management Issues.Litigation.Tax Matters.

Due Diligence Review (DDR) is a process, whereby an individual or an organization, seeks sufficient information about a business entity to reach an informed judgment as to its value for a specific purpose. Dictionary meaning of 'Due' is 'Sufficient' & 'Diligence' is 'Persistent effort or work'.

The due diligence process will look a little different for every investigating company, but there are some key areas that you can expect, including: A complete financial inspection analyzing historical and forecasted financial reports, structures, assets, costs, and liabilities. Analysis of the target consumer market.

Questions to ask during due diligence begin with financial information....1. Financial Information Credit reports. Tax returns. Audit and revenue reports. List of all physical assets. List of expenses (fixed and variable) Gross profit margins. Owner's benefit. Any debt.

A due diligence questionnaire, referred to by the acronym DDQ, is a list of questions designed to evaluate aspects of an organization prior to a merger, acquisition, investment or partnership.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Generally speaking, any given response to a due diligence request should: Determine what question the potential buyer is truly trying to answer. Determine if existing / prior documents can satisfy their request. If necessary, reframe or refocus the request to align with available information.

Here's our 6-step due diligence process for successful M&A. Prepare documents. During the due diligence process, potential bidders carefully scrutinize every aspect of the target company.Set up a virtual data room.Share documents.Document review.Due diligence Q&A.Post due diligence reporting and compliance.

1. Company information Who owns the company? What is the company's organizational structure? Who are the company's shareholders?What are the company's articles of incorporation? Where is the company's certificate of good standing from the state in which the business is registered? What are the company bylaws?