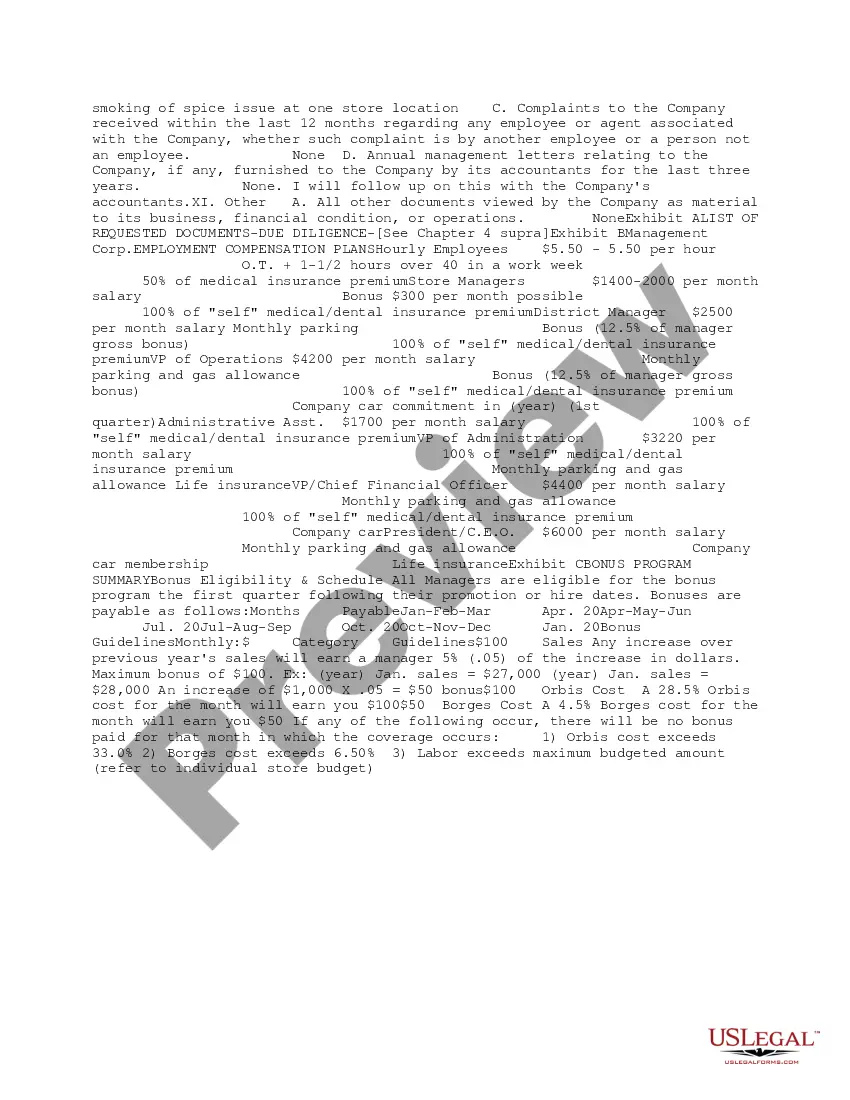

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Phoenix, Arizona — A Vibrant Desert City of Opportunities In this detailed description, we will delve into the essence of Phoenix, Arizona, its captivating features, and why it has become a hotspot for businesses and individuals seeking growth and opportunity. Our focus here will be on the initial review of response to due diligence requests, commonly encountered in the process of evaluating potential business ventures in Phoenix. Phoenix, often referred to as the "Valley of the Sun," is the capital and largest city of Arizona. Situated in the southwestern United States, it is renowned for its remarkable climate, breathtaking natural beauty, and a thriving economy that has attracted numerous industries across various sectors. The initial review of responses to due diligence requests in Phoenix play a vital role in determining the potential for success in these ventures. When conducting an initial review of response to due diligence requests in Phoenix, it is essential to consider key areas that encompass the city's diverse economic landscape. Phoenix boasts a strong presence in industries such as healthcare, technology, finance, manufacturing, tourism, and education. Each sector offers unique opportunities for investment, expansion, and collaboration, making it imperative to evaluate the responses received during due diligence comprehensively. In the healthcare sector, Phoenix is home to world-class medical facilities, research institutions, and an ever-expanding network of healthcare providers. A detailed assessment of the response to due diligence requests reveals the quality of the healthcare infrastructure, technological advancements, and potential areas for investment, such as specialized medical services or innovative healthcare solutions. Phoenix's dynamic technology industry continues to evolve, attracting startups, established corporations, and investors from around the globe. An initial review of responses to due diligence requests in this sector involves examining the depth of expertise, innovation, and emerging technologies present in the city. Companies can evaluate partnerships, acquisitions, or investments that align with their business goals and the response provided during due diligence. The financial sector in Phoenix, characterized by banking, insurance, and investment-related businesses, exhibits substantial growth potential. A detailed analysis of responses to due diligence requests in this industry sheds light on the stability of financial institutions, market trends, and the regulatory environment. Investors can make informed decisions based on the financial stability and growth potential portrayed in the responses received. Phoenix's vibrant manufacturing sector is another key dimension that necessitates a comprehensive initial review of responses to due diligence requests. Evaluating potential partnerships, supply chain capabilities, and manufacturing processes can help companies ascertain their synergy with local manufacturers and identify areas for collaboration or investment. As a premier tourist destination, Phoenix's initial review of responses to due diligence requests in the tourism industry encompasses evaluating attractions, accommodations, transport infrastructure, and visitor trends. Such analysis allows businesses to gauge the potential for growth and collaboration within this robust industry. Lastly, Phoenix's robust educational landscape, comprising prestigious universities, technical institutions, and research centers, presents opportunities for businesses seeking partnerships or strategic investments. A meticulous review of responses to due diligence requests in education unveils collaborations, research capabilities, and workforce development opportunities. Considering the diverse sectors in Phoenix, an initial review of responses to due diligence requests in each sector is crucial to gain a comprehensive understanding of the business landscape and identify potential opportunities. By thoroughly assessing the responses received, businesses can overcome challenges, mitigate risks, and drive success in their ventures within this growing desert oasis.