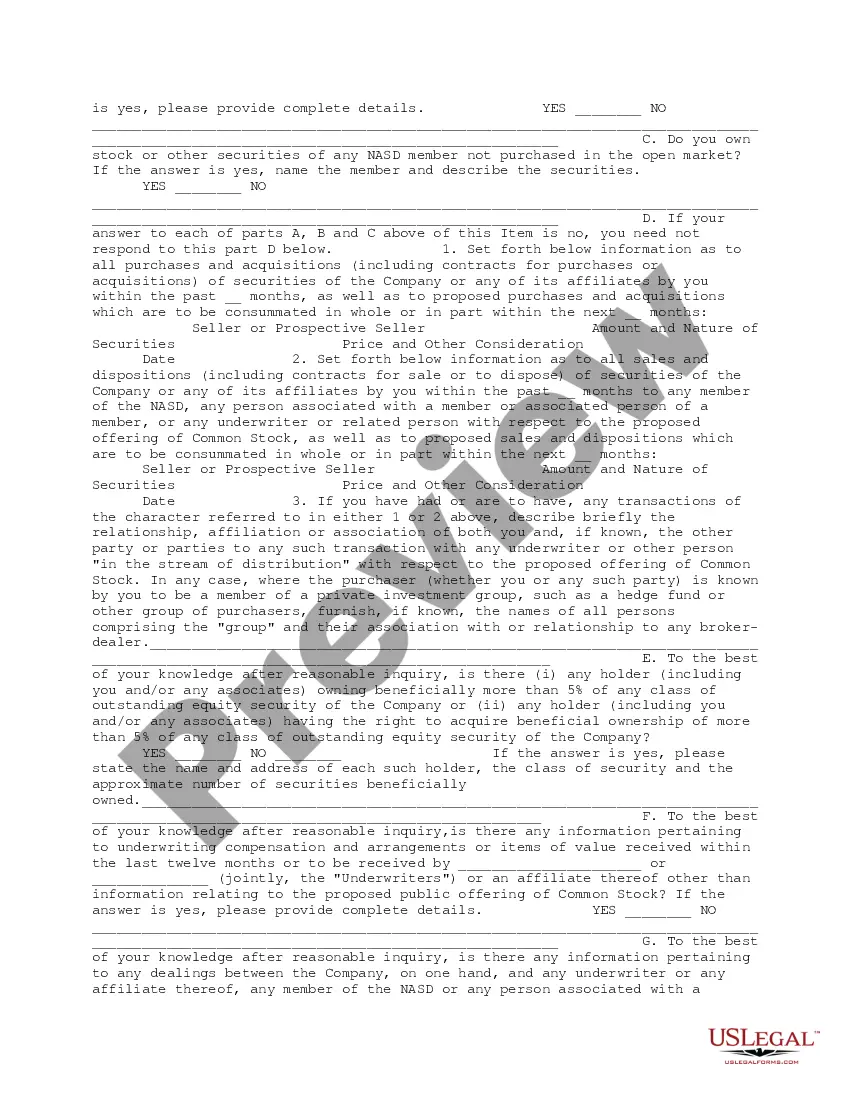

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

Allegheny Pennsylvania Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather important information from individuals who hold at least a five percent stake in the company. This questionnaire enables the company to evaluate the composition of its shareholders and ascertain key details about its officers and directors. The questionnaire is tailored to meet the specific regulatory requirements and reporting obligations in Allegheny, Pennsylvania. It ensures that the company complies with relevant laws and regulations, particularly those related to shareholder disclosure and transparency. This comprehensive questionnaire covers a range of topics and asks detailed questions to gain a deeper understanding of the shareholders, officers, and directors. It may include sections such as: 1. Personal Information: This section collects the personal details of shareholders, officers, and directors, including their full names, addresses, contact information, and social security numbers. 2. Shareholding Information: Here, respondents are asked to provide information about their shareholdings, including the total number and percentage of shares owned, acquisition dates, and cost basis. 3. Corporate Affiliations: This section focuses on the involvement of shareholders, officers, and directors in other companies. It may ask for details about affiliations, positions held, and any potential conflicts of interest arising from these affiliations. 4. Legal Actions and Disciplinary Matters: Shareholders, officers, and directors are required to disclose any legal proceedings, regulatory investigations, or disciplinary actions that they have been involved in. This information helps evaluate the potential risks and liabilities associated with the individuals. 5. Related Party Transactions: To ensure transparency, respondents must disclose any transactions or dealings they have had with the company or its subsidiaries in which they or their close associates have an interest. This information prevents potential conflicts of interest. 6. Compliance with Laws and Regulations: This section assesses the respondent's compliance with various regulations, including securities laws, anti-corruption laws, and insider trading regulations. It aims to ensure that all shareholders, officers, and directors are acting within the legal boundaries. Furthermore, "Allegheny Pennsylvania Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent" may have variations or different editions depending on the specific needs of the company and the regulatory environment. For example, there might be separate questionnaires for different types of shareholders, such as institutional investors or individual shareholders. Additionally, the format and level of detail in the questionnaire may vary depending on the company's industry, size, or listing requirements. The customization ensures that the questionnaire meets the specific needs of the company and aligns with the relevant regulatory framework.Allegheny Pennsylvania Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather important information from individuals who hold at least a five percent stake in the company. This questionnaire enables the company to evaluate the composition of its shareholders and ascertain key details about its officers and directors. The questionnaire is tailored to meet the specific regulatory requirements and reporting obligations in Allegheny, Pennsylvania. It ensures that the company complies with relevant laws and regulations, particularly those related to shareholder disclosure and transparency. This comprehensive questionnaire covers a range of topics and asks detailed questions to gain a deeper understanding of the shareholders, officers, and directors. It may include sections such as: 1. Personal Information: This section collects the personal details of shareholders, officers, and directors, including their full names, addresses, contact information, and social security numbers. 2. Shareholding Information: Here, respondents are asked to provide information about their shareholdings, including the total number and percentage of shares owned, acquisition dates, and cost basis. 3. Corporate Affiliations: This section focuses on the involvement of shareholders, officers, and directors in other companies. It may ask for details about affiliations, positions held, and any potential conflicts of interest arising from these affiliations. 4. Legal Actions and Disciplinary Matters: Shareholders, officers, and directors are required to disclose any legal proceedings, regulatory investigations, or disciplinary actions that they have been involved in. This information helps evaluate the potential risks and liabilities associated with the individuals. 5. Related Party Transactions: To ensure transparency, respondents must disclose any transactions or dealings they have had with the company or its subsidiaries in which they or their close associates have an interest. This information prevents potential conflicts of interest. 6. Compliance with Laws and Regulations: This section assesses the respondent's compliance with various regulations, including securities laws, anti-corruption laws, and insider trading regulations. It aims to ensure that all shareholders, officers, and directors are acting within the legal boundaries. Furthermore, "Allegheny Pennsylvania Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent" may have variations or different editions depending on the specific needs of the company and the regulatory environment. For example, there might be separate questionnaires for different types of shareholders, such as institutional investors or individual shareholders. Additionally, the format and level of detail in the questionnaire may vary depending on the company's industry, size, or listing requirements. The customization ensures that the questionnaire meets the specific needs of the company and aligns with the relevant regulatory framework.