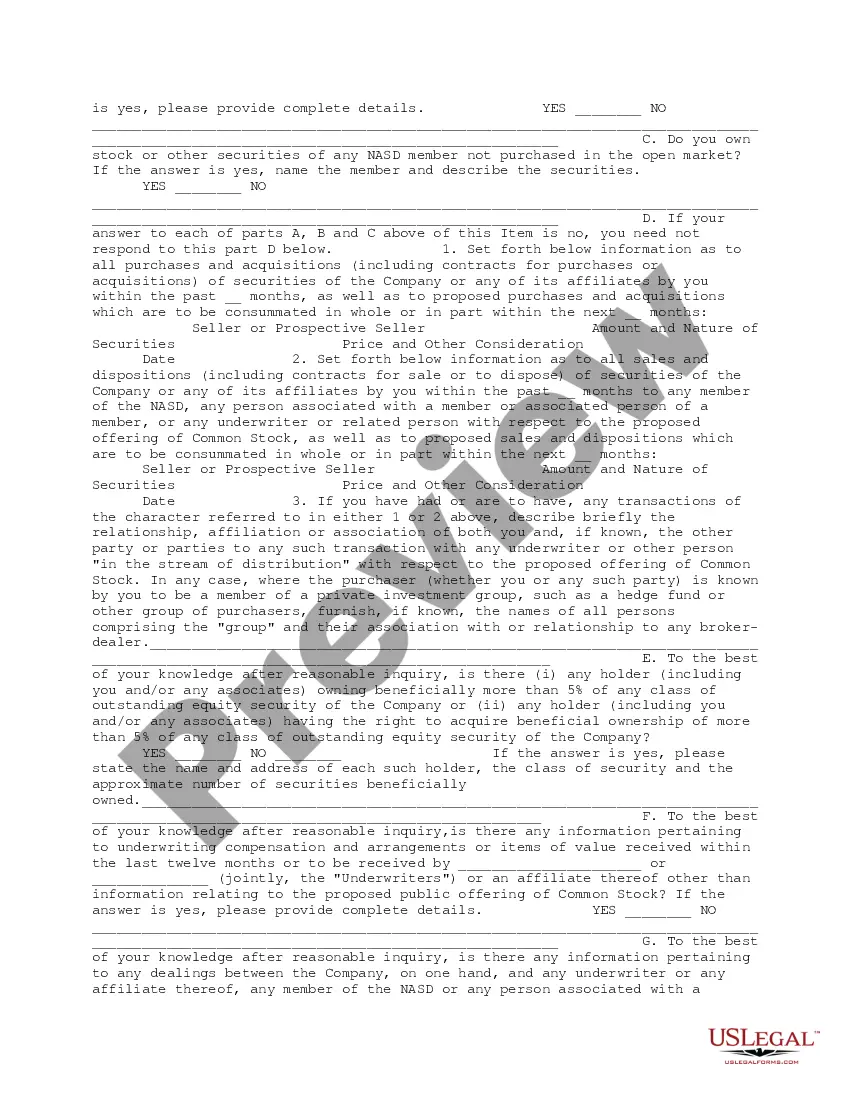

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

Title: Exploring Chicago Illinois Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent Introduction: Chicago, Illinois holds a significant place in the global finance and business landscape. As a way to ensure transparency and accountability, comprehensive questionnaires are often developed for shareholders, officers, and directors who hold at least five percent of the company's shares. In this article, we will delve into the details of the Chicago Illinois Comprehensive Questionnaire and the different types associated with it. 1. Meaning and Importance of the Chicago Illinois Comprehensive Questionnaire: The Chicago Illinois Comprehensive Questionnaire is a crucial document designed to collect substantial information from shareholders, officers, and directors holding at least five percent of a company's shares. Its primary objective is to enhance transparency, prevent conflicts of interest, and safeguard the interests of stakeholders. 2. Purpose of the Questionnaire: The questionnaire aims to gather a range of relevant data to ensure compliance with local laws and regulations, promote good governance practices, and assess any potential risks that shareholders, officers, and directors may pose to the company. 3. Key Components of the Questionnaire: i. Personal Information: The questionnaire collects personal details such as full name, address, contact information, and social security number/tax identification number of the parties involved. ii. Shareholdings: It seeks comprehensive information on the percentage of shares held by each individual, any recent transfers, dividends received, or any pledged shares. iii. Background and Business Interests: This section scrutinizes the individual's professional background, employment history, directorships held within other companies, financial investments, and business relations that may give rise to conflicts of interest. iv. Legal Issues and Litigation: Individuals are required to disclose any past or ongoing litigation, regulatory actions, or criminal cases to evaluate their integrity and evaluate potential risks. v. Financial Statements: Shareholders and directors, in particular, may be asked to provide detailed financial statements, tax returns, and other financial information to scrutinize their financial health. 4. Types of Chicago Illinois Comprehensive Questionnaire: While the questionnaire itself remains constant in terms of its overall objective, its application may differ based on the context and specific requirements. Some common types include: i. Initial Shareholder Questionnaire: Administered when a shareholder acquires at least five percent or more of a company's shares for the first time. ii. Annual Shareholder Questionnaire: A yearly requirement to update the shareholder's information, including any changes in share ownership, employment, or other relevant aspects. iii. Officer and Director Questionnaire: Focuses on officers and directors who hold a five percent or more stake, collecting information on their personal and professional backgrounds, affiliations, and potential conflicts of interest. Conclusion: The Chicago Illinois Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent plays a vital role in ensuring transparency, accountability, and good governance practices within corporations. Its various types address different aspects of an individual's involvement with a company and are employed to assess potential risks and conflicts of interest. By complying with these questionnaires, businesses can foster trust, protect stakeholders' interests, and ultimately contribute to a thriving corporate landscape in Chicago, Illinois.Title: Exploring Chicago Illinois Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent Introduction: Chicago, Illinois holds a significant place in the global finance and business landscape. As a way to ensure transparency and accountability, comprehensive questionnaires are often developed for shareholders, officers, and directors who hold at least five percent of the company's shares. In this article, we will delve into the details of the Chicago Illinois Comprehensive Questionnaire and the different types associated with it. 1. Meaning and Importance of the Chicago Illinois Comprehensive Questionnaire: The Chicago Illinois Comprehensive Questionnaire is a crucial document designed to collect substantial information from shareholders, officers, and directors holding at least five percent of a company's shares. Its primary objective is to enhance transparency, prevent conflicts of interest, and safeguard the interests of stakeholders. 2. Purpose of the Questionnaire: The questionnaire aims to gather a range of relevant data to ensure compliance with local laws and regulations, promote good governance practices, and assess any potential risks that shareholders, officers, and directors may pose to the company. 3. Key Components of the Questionnaire: i. Personal Information: The questionnaire collects personal details such as full name, address, contact information, and social security number/tax identification number of the parties involved. ii. Shareholdings: It seeks comprehensive information on the percentage of shares held by each individual, any recent transfers, dividends received, or any pledged shares. iii. Background and Business Interests: This section scrutinizes the individual's professional background, employment history, directorships held within other companies, financial investments, and business relations that may give rise to conflicts of interest. iv. Legal Issues and Litigation: Individuals are required to disclose any past or ongoing litigation, regulatory actions, or criminal cases to evaluate their integrity and evaluate potential risks. v. Financial Statements: Shareholders and directors, in particular, may be asked to provide detailed financial statements, tax returns, and other financial information to scrutinize their financial health. 4. Types of Chicago Illinois Comprehensive Questionnaire: While the questionnaire itself remains constant in terms of its overall objective, its application may differ based on the context and specific requirements. Some common types include: i. Initial Shareholder Questionnaire: Administered when a shareholder acquires at least five percent or more of a company's shares for the first time. ii. Annual Shareholder Questionnaire: A yearly requirement to update the shareholder's information, including any changes in share ownership, employment, or other relevant aspects. iii. Officer and Director Questionnaire: Focuses on officers and directors who hold a five percent or more stake, collecting information on their personal and professional backgrounds, affiliations, and potential conflicts of interest. Conclusion: The Chicago Illinois Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent plays a vital role in ensuring transparency, accountability, and good governance practices within corporations. Its various types address different aspects of an individual's involvement with a company and are employed to assess potential risks and conflicts of interest. By complying with these questionnaires, businesses can foster trust, protect stakeholders' interests, and ultimately contribute to a thriving corporate landscape in Chicago, Illinois.