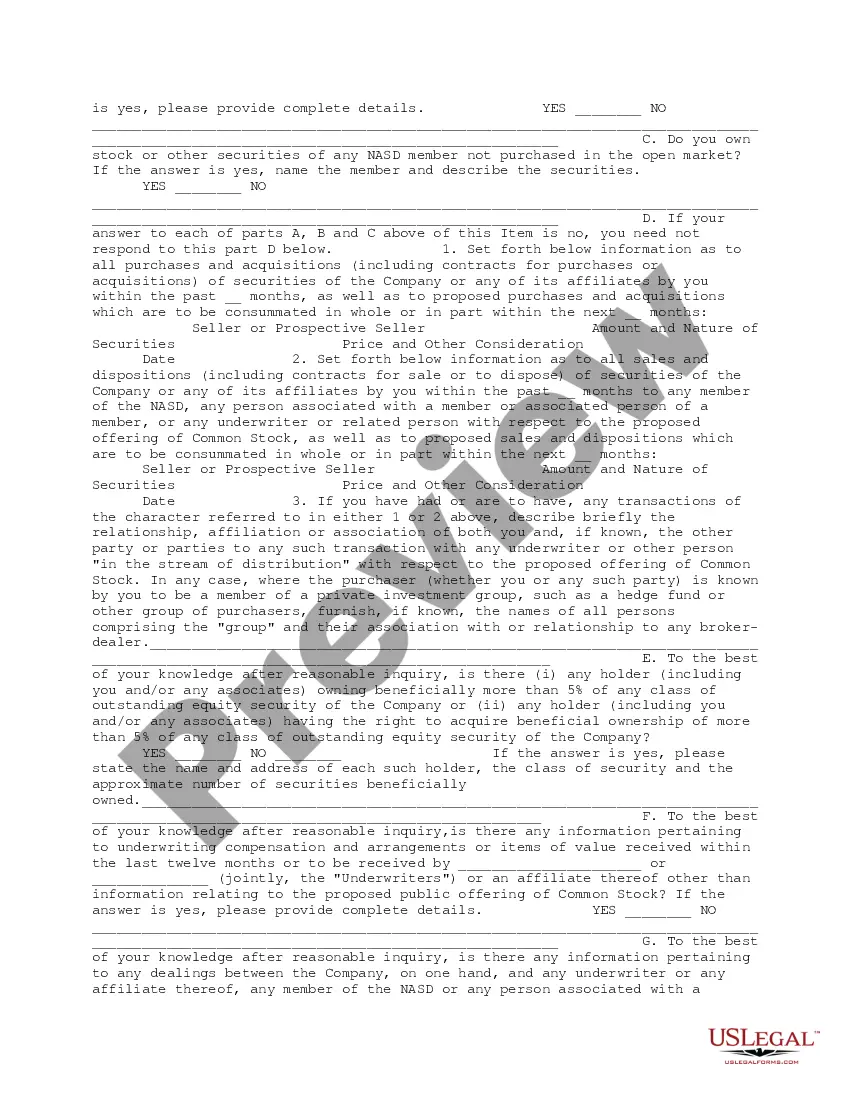

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

The Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather detailed information about shareholders, officers, and directors who hold at least five percent of the company's shares. This questionnaire is an important tool used by the Harris Texas company to ensure transparency, compliance, and effective governance. This questionnaire covers a wide range of areas and aims to collect information such as: 1. Shareholder Information: The questionnaire seeks details about the shareholders, including their names, contact information, social security numbers or tax identification numbers, and any affiliation with other companies or organizations. 2. Ownership Details: Shareholders are required to provide information about their ownership stake in the company, including the number of shares they hold, the percentage of ownership, and the acquisition dates of their shares. 3. Officer and Director Information: The questionnaire also gathers data on the company's officers and directors who hold at least five percent of the company's shares. This includes their names, positions within the company, contact information, and any additional business interests they possess. 4. Affiliations and Relationships: The questionnaire aims to uncover any potential conflicts of interest in requesting information on shareholders' affiliations, relationships, or roles in other companies, particularly if they are competitors, suppliers, or customers of Harris Texas. 5. Legal and Regulatory Compliance: Shareholders, officers, and directors are required to disclose any civil, criminal, or regulatory actions taken against them personally or against any companies they are associated with. This information helps the company assess potential risks and ensure compliance with legal and regulatory requirements. 6. Financial Information: The questionnaire may also ask shareholders to provide financial statements, tax returns, and other relevant documents to ascertain their financial stability and credibility. It's important to note that there may be different versions or variations of the Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, customized to specific industry regulations or compliance needs. Some possible variations may include questionnaires tailored for publicly traded companies, private companies, or those operating in highly regulated industries, such as finance or healthcare. By utilizing the Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, the company can gather essential information to make informed decisions, ensure compliance with relevant laws and regulations, identify and manage potential conflicts of interest, and maintain transparent and effective corporate governance practices.

The Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather detailed information about shareholders, officers, and directors who hold at least five percent of the company's shares. This questionnaire is an important tool used by the Harris Texas company to ensure transparency, compliance, and effective governance. This questionnaire covers a wide range of areas and aims to collect information such as: 1. Shareholder Information: The questionnaire seeks details about the shareholders, including their names, contact information, social security numbers or tax identification numbers, and any affiliation with other companies or organizations. 2. Ownership Details: Shareholders are required to provide information about their ownership stake in the company, including the number of shares they hold, the percentage of ownership, and the acquisition dates of their shares. 3. Officer and Director Information: The questionnaire also gathers data on the company's officers and directors who hold at least five percent of the company's shares. This includes their names, positions within the company, contact information, and any additional business interests they possess. 4. Affiliations and Relationships: The questionnaire aims to uncover any potential conflicts of interest in requesting information on shareholders' affiliations, relationships, or roles in other companies, particularly if they are competitors, suppliers, or customers of Harris Texas. 5. Legal and Regulatory Compliance: Shareholders, officers, and directors are required to disclose any civil, criminal, or regulatory actions taken against them personally or against any companies they are associated with. This information helps the company assess potential risks and ensure compliance with legal and regulatory requirements. 6. Financial Information: The questionnaire may also ask shareholders to provide financial statements, tax returns, and other relevant documents to ascertain their financial stability and credibility. It's important to note that there may be different versions or variations of the Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, customized to specific industry regulations or compliance needs. Some possible variations may include questionnaires tailored for publicly traded companies, private companies, or those operating in highly regulated industries, such as finance or healthcare. By utilizing the Harris Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, the company can gather essential information to make informed decisions, ensure compliance with relevant laws and regulations, identify and manage potential conflicts of interest, and maintain transparent and effective corporate governance practices.