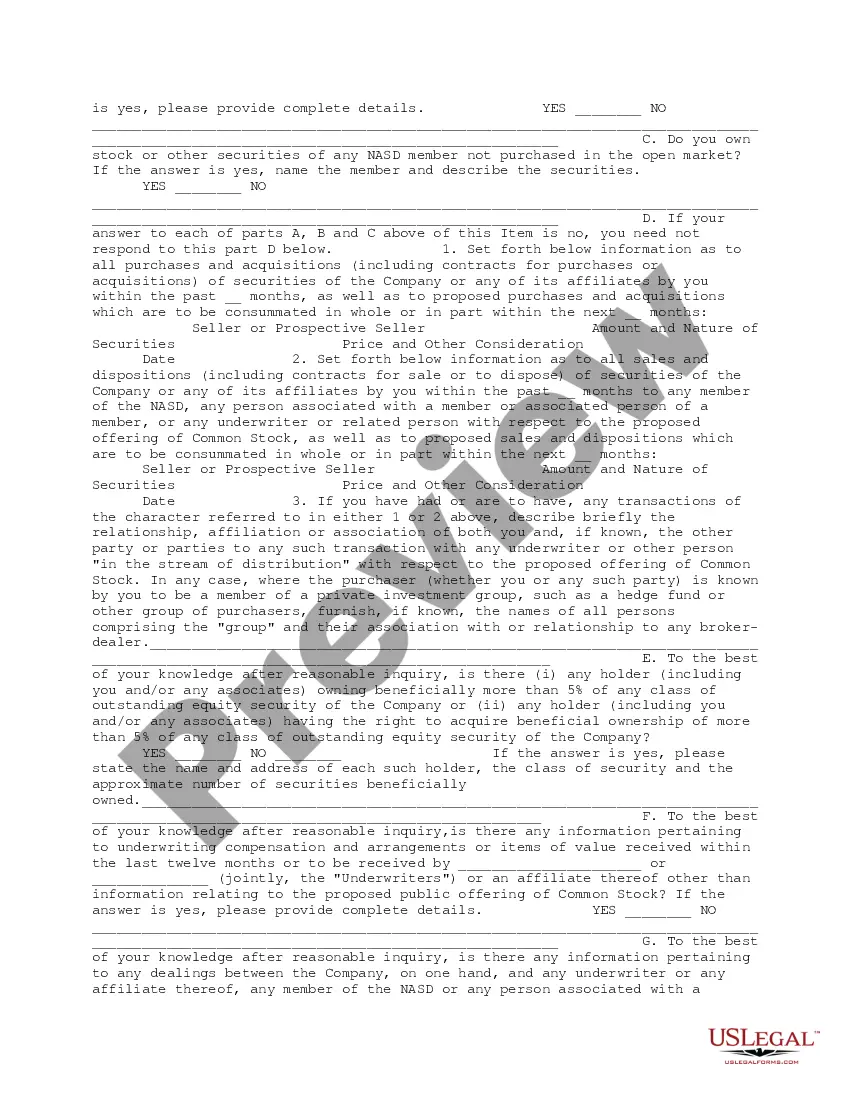

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

The Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather crucial information about individuals who own a significant stake in a company, as well as the key decision-makers within the organization. This questionnaire aims to delve into the details of shareholding and identify the extent of ownership among officers and directors. By employing the Hennepin Minnesota Comprehensive Questionnaire, companies gain a comprehensive understanding of their ownership structure, ensuring transparency and compliance with regulatory requirements. This questionnaire facilitates the collection of accurate data, which aids in strategic decision-making, corporate governance, and investor relations. Key Elements of the Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent: 1. Shareholder Identification: This section requires detailed information about the shareholders, including their names, addresses, contact details, and social security numbers. It also addresses the nature of the shareholder's interest and the specific number and type of shares held. 2. Organizational Roles: This segment focuses on officers and directors holding at least five percent of the share capital. It seeks to ascertain the individual's title, responsibilities, and duration of service within the organization. This information helps identify key decision-makers within the company. 3. Related Party Transactions: This section scrutinizes any transactions between the company and its officers, directors, or significant shareholders. It aims to detect any potential conflicts of interest or unethical practices. 4. Leverage and Collateral: This area explores whether the shareholders have used their shares as collateral for obtaining loans or other financial arrangements. It enables better risk assessment and helps identify potential financial vulnerabilities. 5. Reporting Obligations: This segment outlines reporting obligations and requirements for shareholders, officers, and directors, ensuring compliance with laws and regulations. It covers reporting deadlines, filing formats, and penalties for non-compliance. Types of Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent: 1. Standard Questionnaire: This is the primary version of the Hennepin Minnesota Comprehensive Questionnaire, designed for most companies that need to gather information on their shareholders, officers, and directors. 2. Enhanced Questionnaire: This version of the questionnaire includes additional sections and more in-depth inquiries. It is used for companies with significant complexities, such as those operating in highly regulated industries where additional scrutiny is required. 3. Customized Questionnaire: This variant is tailored to individual company needs, accommodating specific requirements regarding ownership structures and reporting standards. It caters to unique situations, ensuring the questionnaire aligns precisely with the company's objectives. In conclusion, the Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a vital tool for companies seeking a thorough understanding of their ownership structure. It provides a robust framework for gathering essential information, enhancing transparency, and ensuring compliance with regulatory obligations.The Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a comprehensive survey designed to gather crucial information about individuals who own a significant stake in a company, as well as the key decision-makers within the organization. This questionnaire aims to delve into the details of shareholding and identify the extent of ownership among officers and directors. By employing the Hennepin Minnesota Comprehensive Questionnaire, companies gain a comprehensive understanding of their ownership structure, ensuring transparency and compliance with regulatory requirements. This questionnaire facilitates the collection of accurate data, which aids in strategic decision-making, corporate governance, and investor relations. Key Elements of the Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent: 1. Shareholder Identification: This section requires detailed information about the shareholders, including their names, addresses, contact details, and social security numbers. It also addresses the nature of the shareholder's interest and the specific number and type of shares held. 2. Organizational Roles: This segment focuses on officers and directors holding at least five percent of the share capital. It seeks to ascertain the individual's title, responsibilities, and duration of service within the organization. This information helps identify key decision-makers within the company. 3. Related Party Transactions: This section scrutinizes any transactions between the company and its officers, directors, or significant shareholders. It aims to detect any potential conflicts of interest or unethical practices. 4. Leverage and Collateral: This area explores whether the shareholders have used their shares as collateral for obtaining loans or other financial arrangements. It enables better risk assessment and helps identify potential financial vulnerabilities. 5. Reporting Obligations: This segment outlines reporting obligations and requirements for shareholders, officers, and directors, ensuring compliance with laws and regulations. It covers reporting deadlines, filing formats, and penalties for non-compliance. Types of Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent: 1. Standard Questionnaire: This is the primary version of the Hennepin Minnesota Comprehensive Questionnaire, designed for most companies that need to gather information on their shareholders, officers, and directors. 2. Enhanced Questionnaire: This version of the questionnaire includes additional sections and more in-depth inquiries. It is used for companies with significant complexities, such as those operating in highly regulated industries where additional scrutiny is required. 3. Customized Questionnaire: This variant is tailored to individual company needs, accommodating specific requirements regarding ownership structures and reporting standards. It caters to unique situations, ensuring the questionnaire aligns precisely with the company's objectives. In conclusion, the Hennepin Minnesota Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent is a vital tool for companies seeking a thorough understanding of their ownership structure. It provides a robust framework for gathering essential information, enhancing transparency, and ensuring compliance with regulatory obligations.