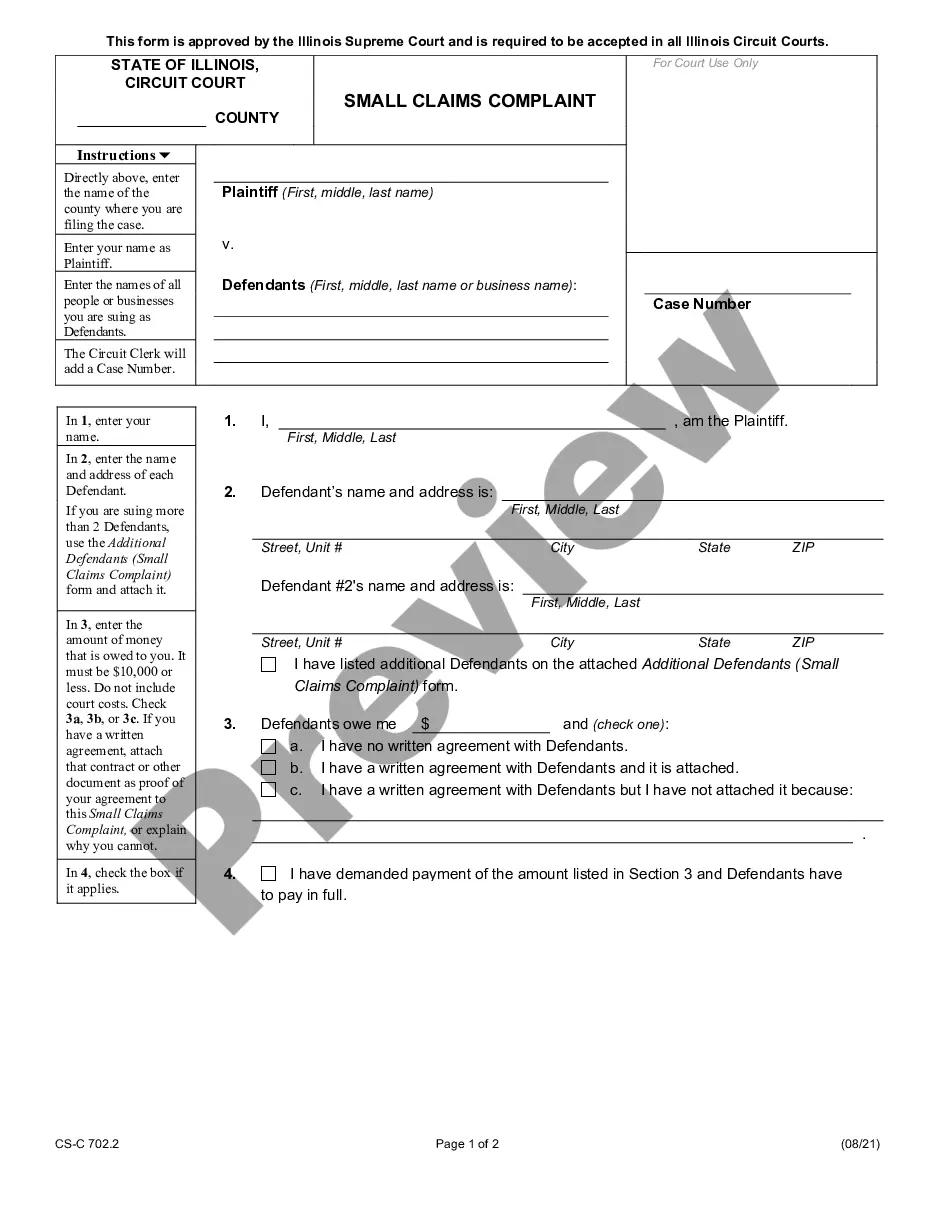

Orange California Mortgage Review Worksheets are comprehensive forms used by lenders, borrowers, and mortgage professionals in the state of California to evaluate and assess mortgage applications, review borrower qualifications, and determine the feasibility of granting a mortgage loan. These worksheets serve as essential tools throughout the mortgage application process, allowing lenders to gather essential information from borrowers, analyze their financial standings, and assess the risk associated with providing a mortgage loan. They are designed to ensure that borrowers meet the necessary eligibility criteria and can make timely mortgage payments. The Orange California Mortgage Review Worksheets typically consist of various sections that cover different aspects of a borrower's financial profile. These sections might include detailed personal information such as name, address, social security number, employment history, and income details. They may also encompass sections for detailing assets, liabilities, and credit history. Additionally, there may be sections dedicated to property details, such as location, appraised value, and any existing liens or encumbrances. Other sections might include an analysis of the borrower's debt-to-income ratio, credit score, and overall financial stability. These worksheets aim to facilitate a comprehensive review and evaluation process to determine if the borrower qualifies for a mortgage loan and how much they can afford to borrow. Lenders may refer to the Orange California Mortgage Review Worksheets to assess the risk involved, calculate interest rates, and establish the terms and conditions of the mortgage agreement. Different types of Orange California Mortgage Review Worksheets may exist, tailored for specific categories of borrowers or specific types of mortgage loans. For instance, there may be worksheets specifically designed for first-time homebuyers, refinancing applications, or for borrowers with non-traditional income sources. Each type of worksheet may include additional sections or different evaluation criteria to accommodate the unique circumstances of the borrower. In summary, Orange California Mortgage Review Worksheets are crucial documents used in the mortgage application process in California. These worksheets enable lenders and mortgage professionals to collect and evaluate relevant borrower information and determine the feasibility of granting a mortgage loan. With their comprehensive nature, they play a vital role in ensuring responsible lending practices and helping borrowers secure suitable mortgage options.

Orange California Mortgage Review Worksheets

Description

How to fill out Orange California Mortgage Review Worksheets?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Orange Mortgage Review Worksheets, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any tasks associated with document execution simple.

Here's how to find and download Orange Mortgage Review Worksheets.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the similar forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Orange Mortgage Review Worksheets.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Orange Mortgage Review Worksheets, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to deal with an extremely difficult situation, we advise using the services of an attorney to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!