San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist is a comprehensive tool that assists potential investors in performing a thorough review and evaluation of investment opportunities within the real estate market. This checklist is specifically tailored for those interested in investing in a Landlord Tenant Investment Trust REIT located in San Diego, California, ensuring that proper due diligence is conducted before making any investment decisions. Key areas covered in the San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist include: 1. Property Evaluation: This section entails assessing the location, size, condition, and potential value of the investment property. It involves evaluating factors such as neighborhood demographics, nearby amenities, market demand, and overall property viability. 2. Tenant Analysis: This part focuses on reviewing the current tenant profile, lease agreements, and rental history. It is crucial to examine factors like tenant quality, lease terms, vacancy rates, rent escalations, and the stability of rental income. 3. Financial Assessment: This segment involves conducting a detailed financial analysis of the investment opportunity. It encompasses evaluating the REIT's financial statements, cash flow projections, debt levels, operating expenses, and return on investment. Additionally, the checklist may include assessing rent collection, historical performance, and potential risks. 4. Legal and Compliance Review: This section encompasses examining legal documents such as lease agreements, property management contracts, and any pending litigation. It may also involve verifying compliance with local regulations, zoning laws, and building codes. 5. Management Evaluation: Here, investors assess the competence and experience of the property management team responsible for overseeing day-to-day operations. Evaluating their track record, responsiveness, communication, and overall reputation is essential. Different types of San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklists may exist, as they can be specific to different property types or investment strategies. For instance, alternative checklists may be available for residential, commercial, or mixed-use properties, each emphasizing relevant factors for the respective market segment. By employing a San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist, investors can effectively evaluate the potential risks and rewards associated with investing in real estate. This checklist serves as a valuable tool to aid in decision-making and ensure that thorough due diligence is conducted before committing capital to an investment opportunity.

San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist

Description

How to fill out San Diego California Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist?

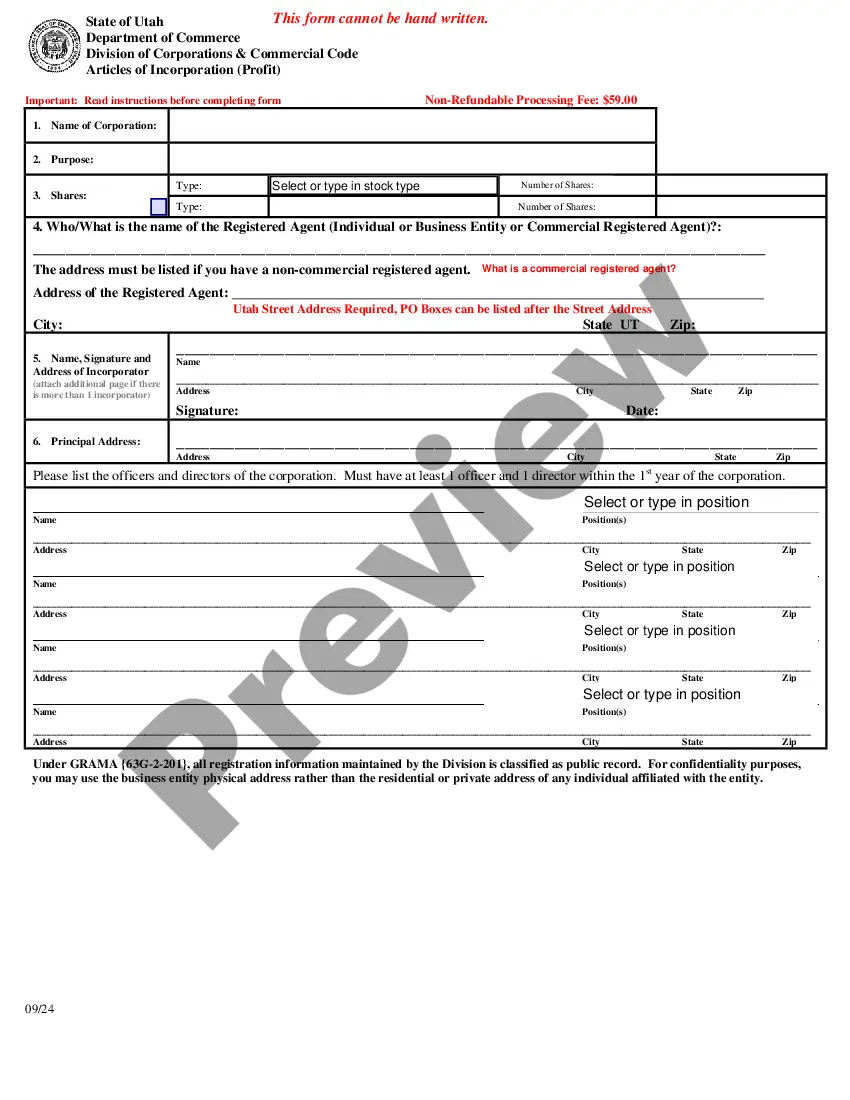

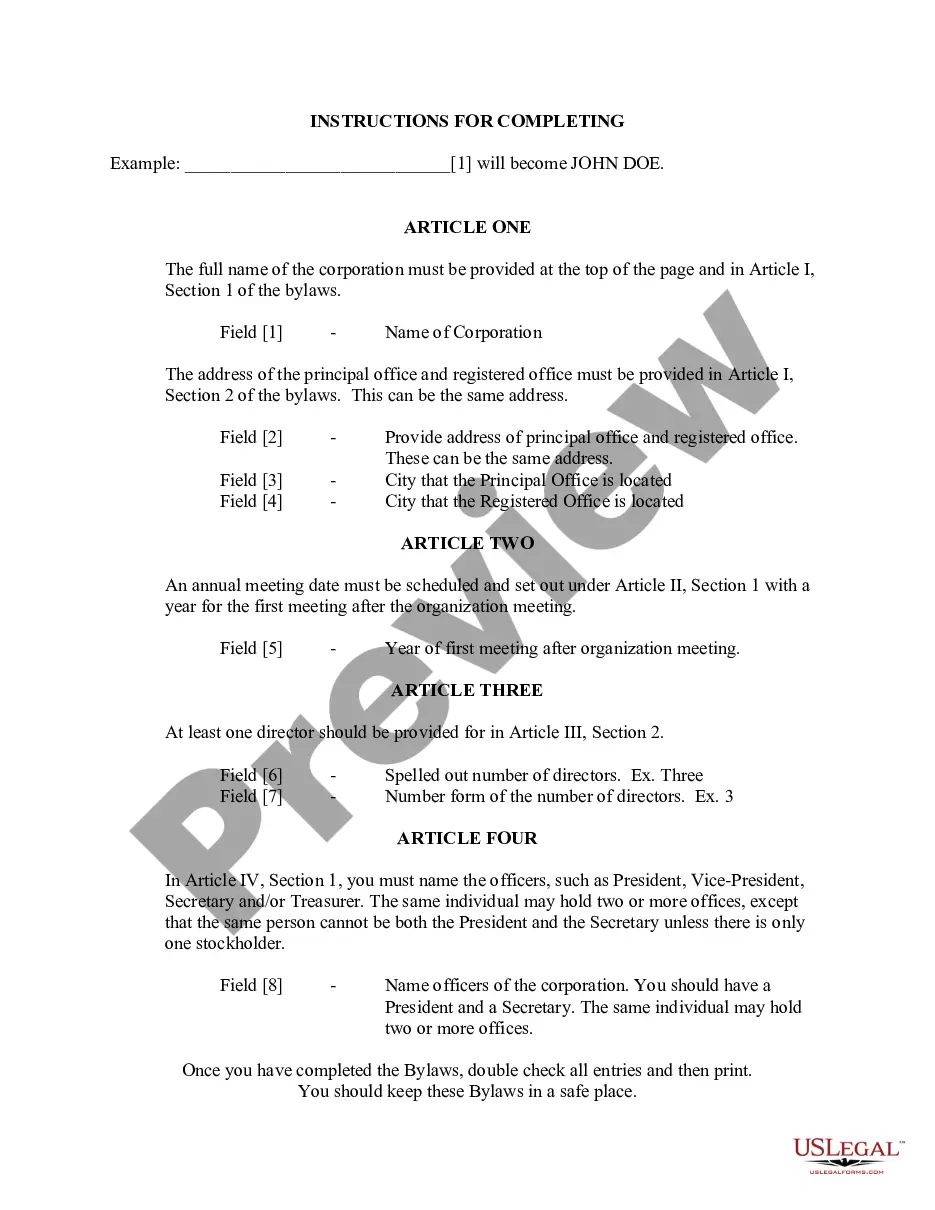

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a San Diego Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Aside from the San Diego Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your San Diego Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!