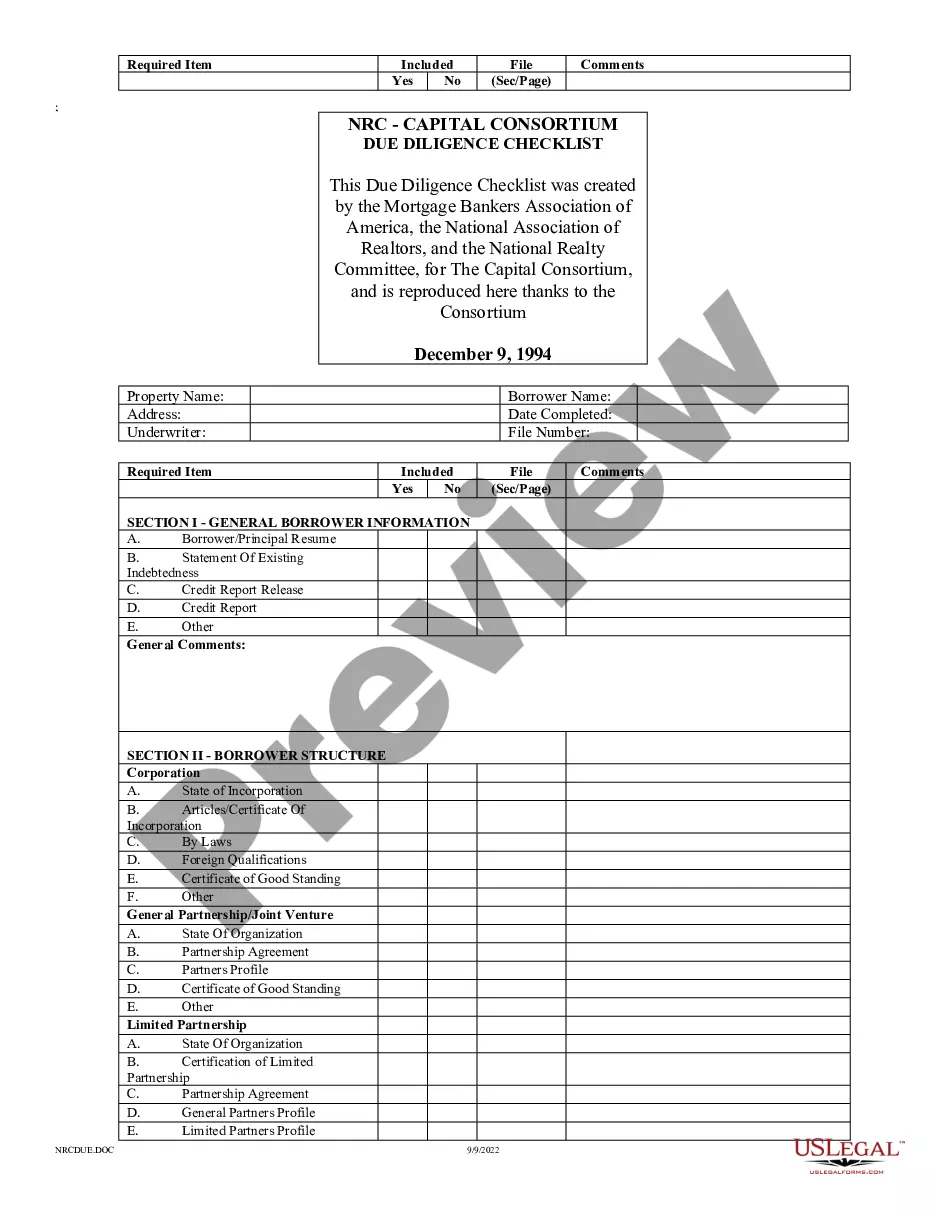

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

Collin Texas Capital Consortium Due Diligence Checklist is a comprehensive tool designed to thoroughly evaluate and assess various aspects related to investments and funding opportunities within the Collin County region. This checklist helps investors, entrepreneurs, and financial organizations in conducting due diligence on potential investments and ensuring that crucial areas are properly examined before making any financial commitment. The Collin Texas Capital Consortium Due Diligence Checklist comprises several key sections that cover a wide range of factors crucial to investment decisions. These sections may include: 1. Legal Documentation: This involves assessing the legal aspects such as company formation documents, contracts, licenses, permits, patents, copyrights, trademarks, and any potential litigation or legal issues. 2. Financial Analysis: This section focuses on evaluating the financial health of a company or venture, including financial statements, cash flow analysis, debt and equity structure, profitability, and projections. 3. Business Model and Market Analysis: A thorough examination of the business model, target market, competitive landscape, market trends, growth potential, and market positioning is essential to determine the viability of the investment. 4. Management and Team Evaluation: This section assesses the qualifications, experience, and track record of the management team, their leadership capabilities, and their ability to execute the business plan successfully. 5. Operational Assessment: It involves analyzing the operational efficiency, supply chain management, manufacturing processes, IT infrastructure, and any potential risks related to operations. 6. Compliance and Regulatory Considerations: This involves ensuring that the company or venture operates in compliance with all relevant laws, regulations, industry standards, and norms applicable to its operations. 7. ESG (Environmental, Social, and Governance) factors: This section evaluates the company's practices regarding environmental sustainability, social responsibility, and corporate governance. By conducting due diligence using the Collin Texas Capital Consortium Due Diligence Checklist, investors can mitigate risks, make informed decisions, and evaluate potential investment opportunities effectively. While there may not be different types of the Collin Texas Capital Consortium Due Diligence Checklist, it can be customized or adapted based on specific industry requirements or investment types, such as real estate due diligence, venture capital due diligence, or merger and acquisition due diligence. Tailoring the checklist to align with the specific investment scenario ensures that all relevant factors are adequately considered during the due diligence process.Collin Texas Capital Consortium Due Diligence Checklist is a comprehensive tool designed to thoroughly evaluate and assess various aspects related to investments and funding opportunities within the Collin County region. This checklist helps investors, entrepreneurs, and financial organizations in conducting due diligence on potential investments and ensuring that crucial areas are properly examined before making any financial commitment. The Collin Texas Capital Consortium Due Diligence Checklist comprises several key sections that cover a wide range of factors crucial to investment decisions. These sections may include: 1. Legal Documentation: This involves assessing the legal aspects such as company formation documents, contracts, licenses, permits, patents, copyrights, trademarks, and any potential litigation or legal issues. 2. Financial Analysis: This section focuses on evaluating the financial health of a company or venture, including financial statements, cash flow analysis, debt and equity structure, profitability, and projections. 3. Business Model and Market Analysis: A thorough examination of the business model, target market, competitive landscape, market trends, growth potential, and market positioning is essential to determine the viability of the investment. 4. Management and Team Evaluation: This section assesses the qualifications, experience, and track record of the management team, their leadership capabilities, and their ability to execute the business plan successfully. 5. Operational Assessment: It involves analyzing the operational efficiency, supply chain management, manufacturing processes, IT infrastructure, and any potential risks related to operations. 6. Compliance and Regulatory Considerations: This involves ensuring that the company or venture operates in compliance with all relevant laws, regulations, industry standards, and norms applicable to its operations. 7. ESG (Environmental, Social, and Governance) factors: This section evaluates the company's practices regarding environmental sustainability, social responsibility, and corporate governance. By conducting due diligence using the Collin Texas Capital Consortium Due Diligence Checklist, investors can mitigate risks, make informed decisions, and evaluate potential investment opportunities effectively. While there may not be different types of the Collin Texas Capital Consortium Due Diligence Checklist, it can be customized or adapted based on specific industry requirements or investment types, such as real estate due diligence, venture capital due diligence, or merger and acquisition due diligence. Tailoring the checklist to align with the specific investment scenario ensures that all relevant factors are adequately considered during the due diligence process.