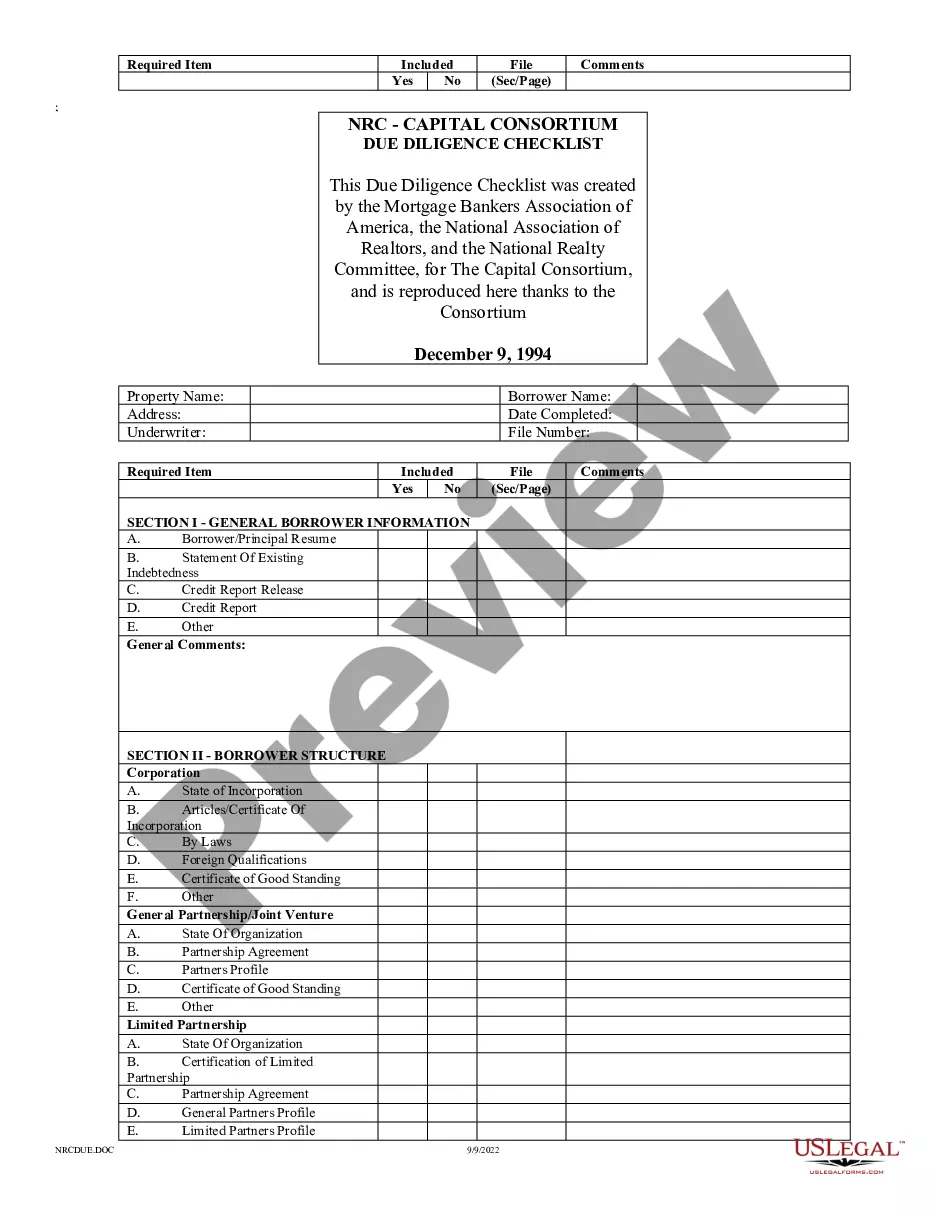

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

The Cook Illinois Capital Consortium Due Diligence Checklist is an essential tool used during the due diligence process to evaluate potential investment opportunities. This checklist is specifically designed to meet the requirements and principles set forth by the Cook Illinois Capital Consortium in order to mitigate risks and make well-informed investment decisions. The checklist incorporates a comprehensive review of various aspects related to the investment, ensuring all necessary aspects are thoroughly evaluated. It includes examination and analysis of financial, operational, legal, and regulatory factors. The checklist is used as a systematic guide to ensure all critical elements are considered and addressed before finalizing any investment. The Cook Illinois Capital Consortium Due Diligence Checklist covers key areas such as financial statements, including balance sheets, income statements, and cash flow statements. It assesses the financial health and stability of the potential investment by analyzing historical performance, trends, and projections. It also scrutinizes the company's financial position, capital structure, debt obligations, contracts, and obligations to evaluate any potential risks or liabilities. Operational due diligence is another crucial element covered in the checklist. It examines the company's operational processes, manufacturing capabilities, supply chain management, distribution channels, and technological infrastructure. Evaluating these aspects helps in determining the efficiency, scalability, and sustainability of the investment opportunity. Legal due diligence is an essential component to identify any legal disputes, pending litigation, or regulatory compliance issues that may impact the investment. It scrutinizes contracts, agreements, licenses, permits, intellectual property rights, and any legal obligations to ensure the investment is not exposed to legal risks. Furthermore, the Cook Illinois Capital Consortium Due Diligence Checklist also considers other aspects such as management and governance structure, market analysis, competition assessment, customer relationships, and risks associated with industry-specific factors. While there may not be distinct types of Cook Illinois Capital Consortium Due Diligence Checklists, it can be tailored or expanded based on the industry, sector, or specific requirements of the investment opportunity. For instance, there could be a specific checklist for real estate investments, technology startups, or healthcare ventures, outlining additional due diligence elements required for those sectors. In summary, the Cook Illinois Capital Consortium Due Diligence Checklist is a comprehensive guide that enables investors to conduct a systematic evaluation of potential investment opportunities. It covers financial, operational, legal, and regulatory aspects to ensure a thorough analysis of the investment's viability, risks, and potential rewards.