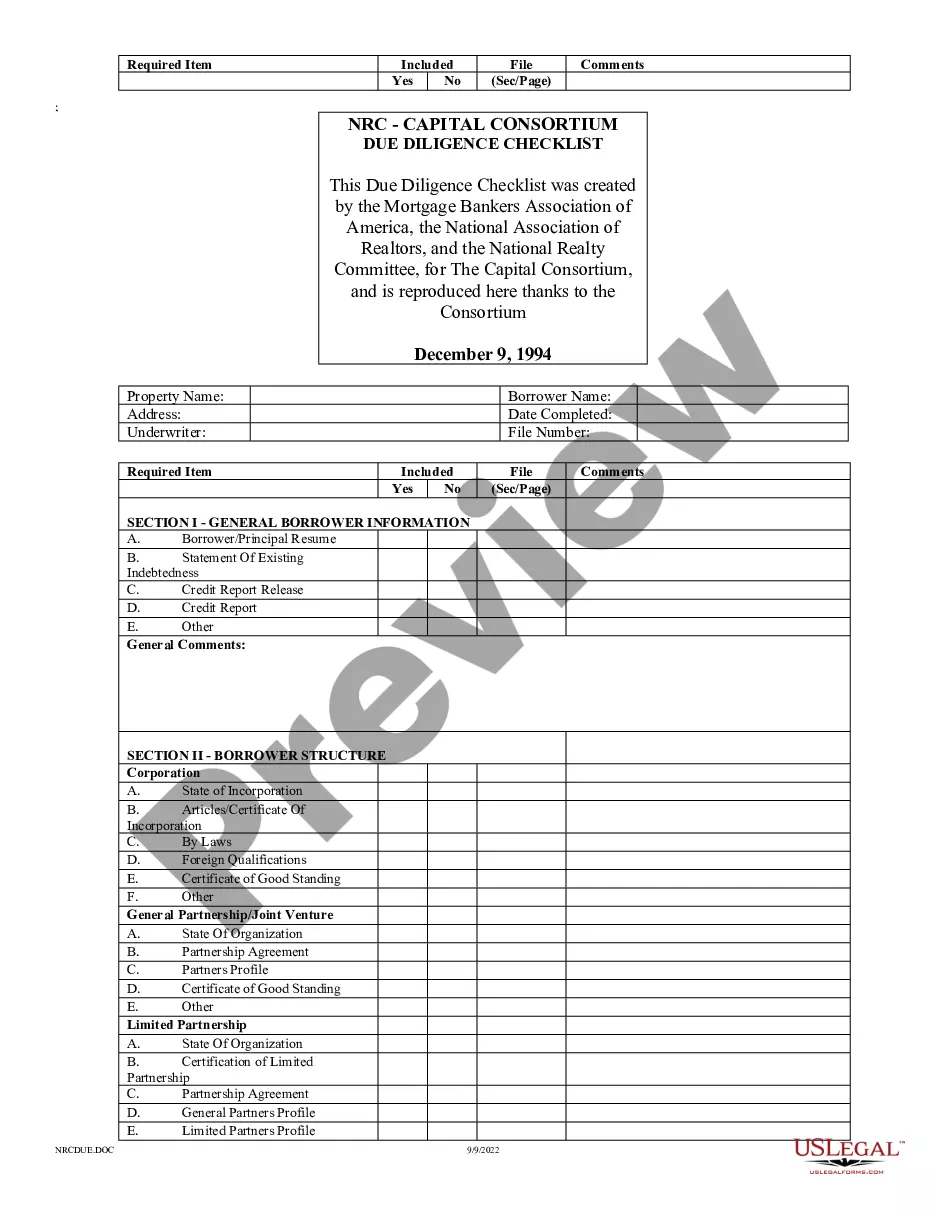

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

San Bernardino California Capital Consortium Due Diligence Checklist serves as a comprehensive guide when conducting a thorough examination and evaluation of potential investment opportunities within the region. It assists investors, businesses, and organizations in making well-informed decisions by capturing vital information and highlighting crucial factors to consider before committing funds. By focusing on relevant keywords, let's delve into the details of this checklist and explore its different types, if any. The San Bernardino California Capital Consortium Due Diligence Checklist covers numerous aspects essential for a successful investment endeavor. It encompasses various areas such as financial, legal, operational, and market-related factors. This checklist aims to ensure that investors acquire a comprehensive understanding of the investment opportunity and any potential risks associated with it. Some key keywords relevant to the San Bernardino California Capital Consortium Due Diligence Checklist include: 1. Investment Opportunity Analysis: This section evaluates the attractiveness of the investment opportunity, analyzing factors such as growth potential, market demand, competition, and market positioning. It helps potential investors assess the viability and sustainability of the proposed investment. 2. Financial Due Diligence: This category entails a rigorous examination of financial records, statements, and forecasts. It involves reviewing historical financial performance, analyzing cash flows, assessing revenue models, evaluating costs, and identifying any financial risks or liabilities. 3. Legal Compliance: Ensuring legal conformity is crucial for any investment. This section of the checklist involves conducting a thorough review of legal documentation, contracts, permits, licenses, and regulatory compliance. It helps highlight any potential legal barriers or issues that could impact the investment. 4. Operational Assessment: This part evaluates the operational aspects of the investment opportunity. It involves analyzing the business processes, infrastructure, supply chain, technology systems, and overall operational efficiency. This assessment assists in determining the feasibility and scalability of the investment. 5. Risk Analysis: This section of the checklist focuses on identifying and analyzing potential risks associated with the investment. It encompasses risk factors such as market volatility, regulatory changes, economic trends, geopolitical risks, and industry-specific risks. This analysis enables investors to gauge the level of risk exposure and develop mitigation strategies. 6. Environmental and Social Impact Assessment: This component addresses the environmental and social impact of the investment opportunity. It involves assessing factors like sustainability practices, environmental regulations, social responsibility, and community engagement. This assessment ensures that investments align with sustainable and ethical business practices. As for different types of San Bernardino California Capital Consortium Due Diligence Checklists, it is possible that variations might exist based on the specific industry, sector, or investment type. For example, a real estate investment checklist may include additional criteria such as property valuation, zoning regulations, and tenant occupancy analysis. Similarly, a startup investment checklist may focus on intellectual property evaluation, team assessment, and market disruption potential. However, the general San Bernardino California Capital Consortium Due Diligence Checklist provides a fundamental framework applicable to various investment opportunities within the region.