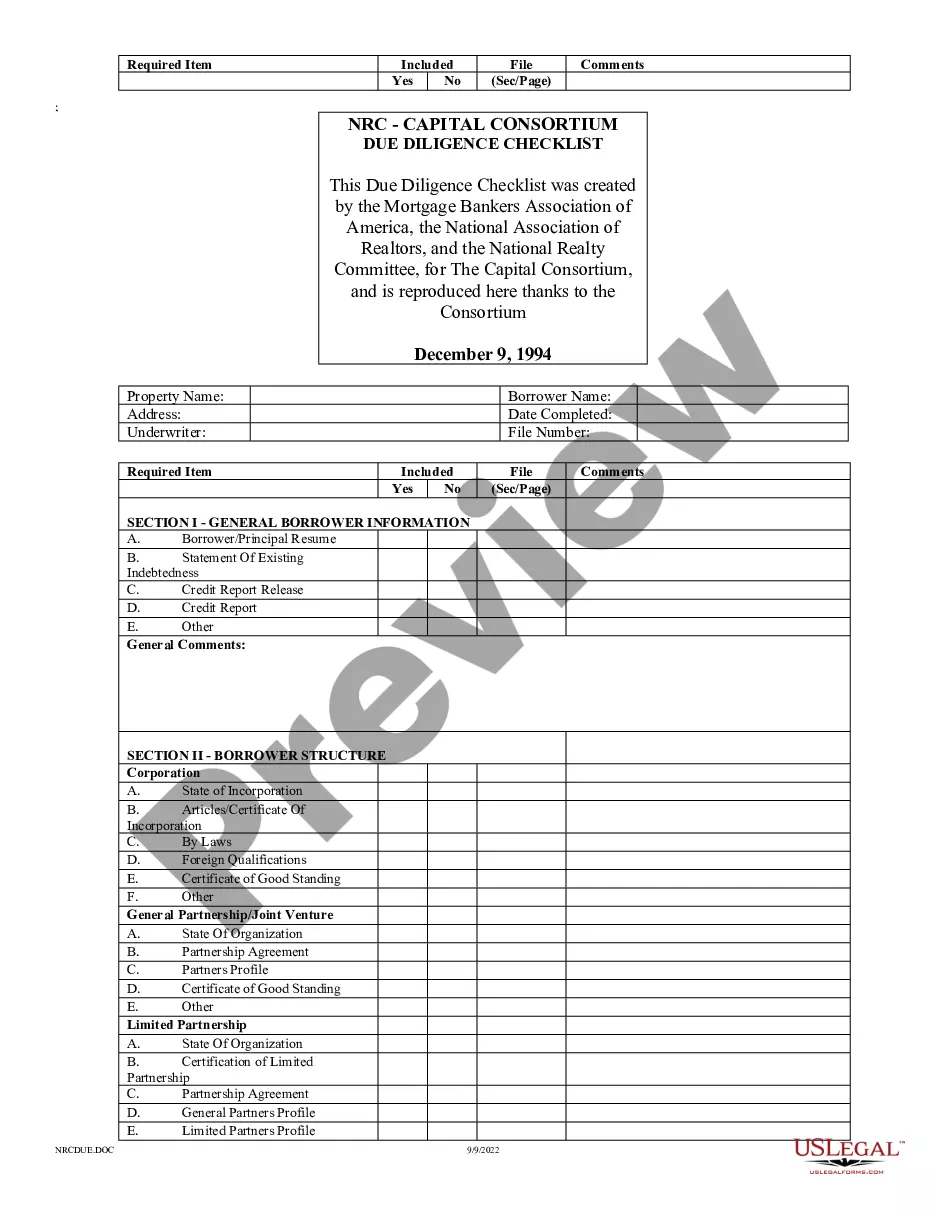

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

The San Diego California Capital Consortium Due Diligence Checklist is a comprehensive tool used to assess the viability and analyze the various aspects of a potential investment opportunity within the San Diego region. This checklist assists individuals or organizations involved in the due diligence process to ensure they thoroughly evaluate and understand the risks, benefits, and key factors associated with the investment. The checklist covers multiple key areas and addresses various critical factors that should be considered before making an investment decision. Some keywords related to this due diligence checklist include: 1. Market Analysis: This section focuses on understanding the market dynamics within San Diego, including the current economic conditions, industry trends, and competitive landscape. It assesses factors like market size, growth potential, customer base, and regulatory environment. 2. Financial Assessment: This part involves a thorough examination of the financial health and stability of the investment opportunity. It includes analyzing financial statements, profitability ratios, cash flow projections, debt obligations, and assessing the overall financial risk associated with the investment. 3. Legal and Compliance: In this section, the checklist covers aspects related to legal and regulatory compliance. It includes reviewing permits, licenses, contracts, intellectual property rights, litigation history, and identifying any potential legal risks. 4. Operational Analysis: Here, the focus is on scrutinizing the operational aspects of the investment opportunity. This involves analyzing the company's organizational structure, management team, operational processes, supply chains, and technological capabilities. 5. Risk Assessment: This part aims to identify and evaluate any potential risks associated with the investment. It includes assessing factors such as market risks, financial risks, operational risks, legal risks, and external risks like political or environmental factors. 6. Due Diligence Documentation: This section ensures that all necessary documentation is properly collected, reviewed, and validated. It includes gathering information such as financial statements, legal agreements, customer contracts, employee records, and any other relevant documents. It is worth noting that while the San Diego California Capital Consortium Due Diligence Checklist provides a comprehensive framework for evaluating investment opportunities within the San Diego region, variations of this checklist may exist depending on the specific requirements and goals of individual investors or organizations. These variations may entail additional or more specific factors to be considered based on the nature of the investment being assessed.