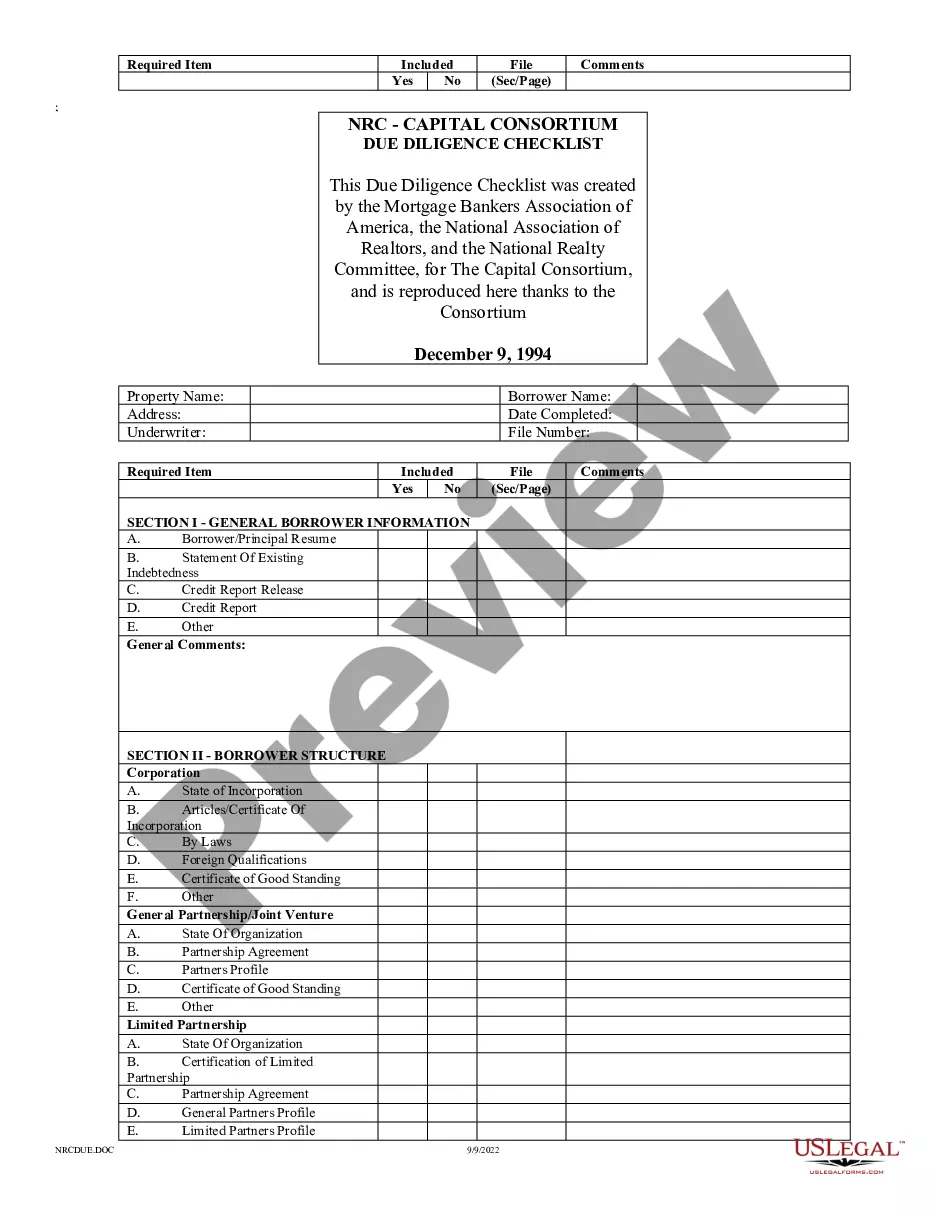

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

Wake North Carolina Capital Consortium Due Diligence Checklist is a comprehensive document that outlines the necessary steps and requirements for conducting a thorough investigation and assessment of potential capital consortium opportunities in the Wake County region of North Carolina. This meticulous checklist serves as a guiding tool for individuals, organizations, or investors who are interested in participating in or evaluating capital consortium proposals. The due diligence checklist ensures that all crucial aspects of the potential opportunity are thoroughly analyzed, providing a structured approach to minimizing risks and maximizing opportunities. It covers a broad range of areas and key factors that need to be considered during the due diligence process. The Wake North Carolina Capital Consortium Due Diligence Checklist includes the following sections: 1. Legal and Regulatory Compliance: This section focuses on assessing the compliance of the proposed capital consortium with all applicable laws, regulations, and governance requirements in the Wake County region. 2. Financial Analysis: This section involves a comprehensive assessment of the financial aspects of the proposed opportunity, including analyzing financial statements, assessing cash flow projections, and evaluating the financial stability of the consortium. 3. Market Analysis: This section delves into evaluating the market potential and demand for the proposed consortium, conducting competitor analysis, and identifying potential market risks and opportunities. 4. Operational Due Diligence: This section aims to assess the operational aspects of the capital consortium, including evaluating the management team's experience and track record, analyzing the operational processes and efficiency, and identifying any operational risks. 5. Risk Assessment: This section involves identifying and evaluating all potential risks associated with the proposed opportunity, such as market risks, regulatory risks, legal risks, financial risks, and operational risks. 6. Due Diligence on Consortium Members: This section focuses on conducting background checks on all consortium members, assessing their qualifications, reputations, and previous business experiences. 7. Exit Strategies and Return on Investment: This section deals with identifying potential exit strategies available to investors and evaluating the expected return on investment. 8. Documentation Review: This section involves a thorough examination of all relevant legal, financial, and contractual documents related to the capital consortium. It is important to note that there can be various types of Wake North Carolina Capital Consortium Due Diligence Checklists tailored to specific industries or types of investments. For instance, there may be separate checklists designed for real estate capital consortium projects, technology startup investments, or infrastructure development opportunities. Each of these specialized checklists would take into account the unique considerations and risks associated with the specific type of investment.