Nassau New York Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased — Specific Property refers to the legal process by which an individual voluntarily gives up their right to inherit a specific property or assets from a deceased person in Nassau County, New York. When a person passes away, their assets and properties are typically distributed among their heirs or beneficiaries according to their will or the state's laws of intestacy if no will exists. However, there may be situations where an individual named as an heir or beneficiary does not wish to accept the inheritance, specifically a particular property. A Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased allows the individual to formally disclaim their claim to a specific property or assets, thus preventing them from being legally obligated to accept it. In Nassau County, New York, there might be different types or variations of Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased — Specific Property, depending on the specific circumstances and nature of the property. Some possible variations may include: 1. Renunciation and Disclaimer of Right to Inherit Real Estate: This type of renunciation is specific to disclaiming one's right to inherit real estate properties like houses, lands, or commercial buildings. 2. Renunciation and Disclaimer of Right to Inherit Personal Property: This variation refers to disclaiming one's right to inherit personal or movable properties such as money, jewelry, vehicles, or artworks. 3. Renunciation and Disclaimer of Right to Inherit Business Assets: If the deceased person owned a business, this type of disclaimer would allow an individual to renounce their right to inherit business assets, shares, or ownership interests. 4. Renunciation and Disclaimer of Right to Inherit Debts: In some cases, a person might inherit not only assets but also debts. This variation would enable an individual to disclaim their right to inherit the debts associated with the property or estate. It is crucial to consult with an attorney specializing in estate planning or probate law to fully understand the specific requirements and implications of the Nassau New York Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased — Specific Property, as the process can involve legal intricacies that vary depending on the situation.

Nassau New York Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Nassau New York Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

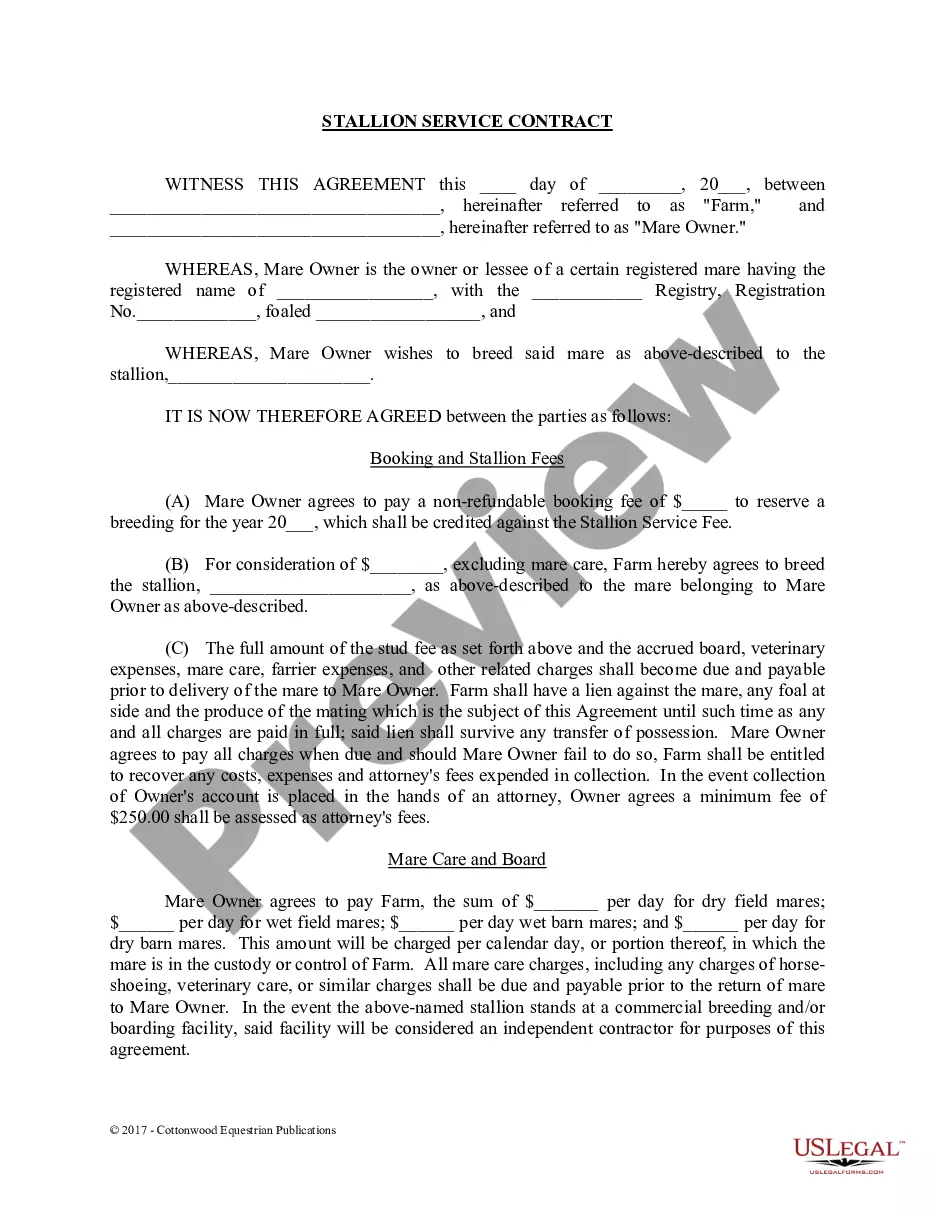

Do you need to quickly create a legally-binding Nassau Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property or maybe any other document to take control of your own or business affairs? You can go with two options: contact a professional to write a legal paper for you or create it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including Nassau Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, double-check if the Nassau Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Nassau Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the templates we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!