Chicago Illinois Assignment of Note and Deed of Trust as Security for Debt of Third Party is a legal agreement used in the state of Illinois to secure a debt owed by a third party through the assignment of a promissory note and lateralization of a property using a deed of trust. This arrangement provides protection for a lender in case the debtor defaults on the loan. The Assignment of Note and Deed of Trust involves three main parties: the lender, the borrower (third party), and the trustee. The trustee holds the legal title of the property until the debt is fully paid off, ensuring that the lender has a security interest in the property. In case of default, the lender can initiate foreclosure proceedings to recover the owed amount. Key terms and elements related to this assignment in Chicago Illinois include: 1. Promissory Note: This is a legal document that outlines the terms and conditions of the loan, including repayment schedule, interest rates, and penalties for default. It is assigned by the borrower to the lender as collateral for the debt. 2. Deed of Trust: This document is used to create a lien on the property being used as collateral. The borrower (third party) grants the lender or a designated trustee the power to sell the property in case of default. It contains specific details about the property, such as its legal description and any encumbrances. 3. Assignment: The borrower assigns their rights, title, and interest in the promissory note to the lender. This ensures that the lender becomes the lawful holder of the debt and can enforce its terms. 4. Foreclosure: In the event of default, the lender may initiate foreclosure proceedings to legally acquire ownership of the property and sell it to recover the outstanding debt. These proceedings must follow the specific legal requirements outlined by the state of Illinois. There are two main types of Assignment of Note and Deed of Trust as Security for Debt of Third Party in Chicago Illinois: 1. Absolute Assignment: In this type, the lender assumes full control and ownership rights of the promissory note and the collateralized property from the borrower once the assignment is executed. The lender can enforce the rights without any further permission or involvement of the borrower. 2. Collateral Assignment: This type allows the lender to take control of the promissory note and, in case of default, step in as the temporary beneficiary of the deed of trust. The collateralized property remains in the borrower's possession until a default occurs. Only then does the lender have the right to initiate foreclosure and sell the property to recover the debt. In summary, the Chicago Illinois Assignment of Note and Deed of Trust as Security for Debt of Third Party is a vital legal tool that protects lenders in loan agreements. It allows lenders to secure their rights to a debt through the assignment of a promissory note and lateralization of a property. It is essential to consult legal professionals for guidance and to ensure compliance with Illinois state laws.

Chicago Illinois Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

How to fill out Chicago Illinois Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

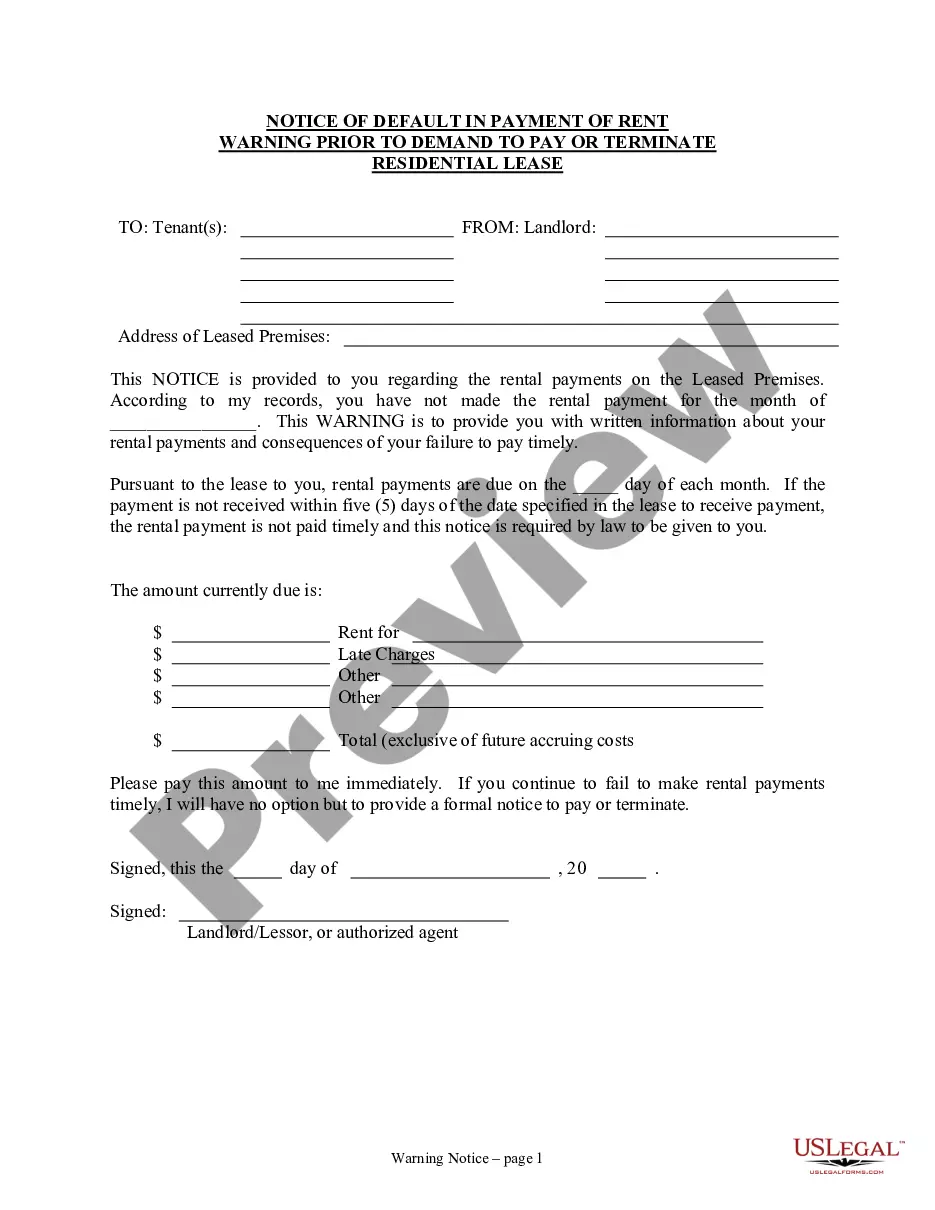

Creating documents, like Chicago Assignment of Note and Deed of Trust as Security for Debt of Third Party, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for various scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Assignment of Note and Deed of Trust as Security for Debt of Third Party form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Chicago Assignment of Note and Deed of Trust as Security for Debt of Third Party:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Chicago Assignment of Note and Deed of Trust as Security for Debt of Third Party isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!