Harris Texas Assignment of Note and Deed of Trust as Security for Debt of Third Party is a legal document that allows the transfer of rights and obligations from one party to another in relation to a debt secured by a property. This assignment is commonly used in real estate transactions and mortgage lending in Harris County, Texas. The Assignment of Note and Deed of Trust as Security for Debt of Third Party involves three key parties: the assignor (original creditor or lender), the assignee (new creditor or lender), and the obliged (borrower or debtor). It is an agreement where the assignor transfers their rights to collect payments from the obliged to the assignee while keeping the underlying property as collateral. The purpose of this assignment is to enable the assignee to assume all the rights and responsibilities of the assignor in relation to the debt. The assignee becomes the new creditor and has the authority to collect future payments, modify the terms of the debt, or take legal actions in case of default. In Harris County, Texas, there are different types of Assignment of Note and Deed of Trust as Security for Debt of Third Party, including: 1. Absolute Assignment: This type of assignment transfers all the rights and obligations related to the debt to the assignee. The assignor has no further involvement or interest in the debt after the assignment. 2. Collateral Assignment: In this type of assignment, the assignor transfers only a portion of their rights to the assignee. It is often used when there are multiple debts secured by the same property, and the assignee wants to acquire a specific debt or portion of it. 3. Subordinated Assignment: This assignment places the assignee in a secondary position in terms of debt repayment. It means that the assignee agrees to be paid after the assignor's existing creditors in case of default. 4. Partial Assignment: In a partial assignment, the assignor transfers only a fraction of their rights and obligations to the assignee. It allows the assignor to retain some control over the debt while sharing the responsibility with the assignee. It is important to consult with a legal professional or a real estate attorney familiar with Harris County, Texas laws and regulations to ensure the Assignment of Note and Deed of Trust as Security for Debt of Third Party is executed correctly. This document plays a significant role in facilitating debt transfers and protecting the interests of all involved parties.

Harris Texas Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

How to fill out Harris Texas Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Harris Assignment of Note and Deed of Trust as Security for Debt of Third Party without professional assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Assignment of Note and Deed of Trust as Security for Debt of Third Party by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Harris Assignment of Note and Deed of Trust as Security for Debt of Third Party:

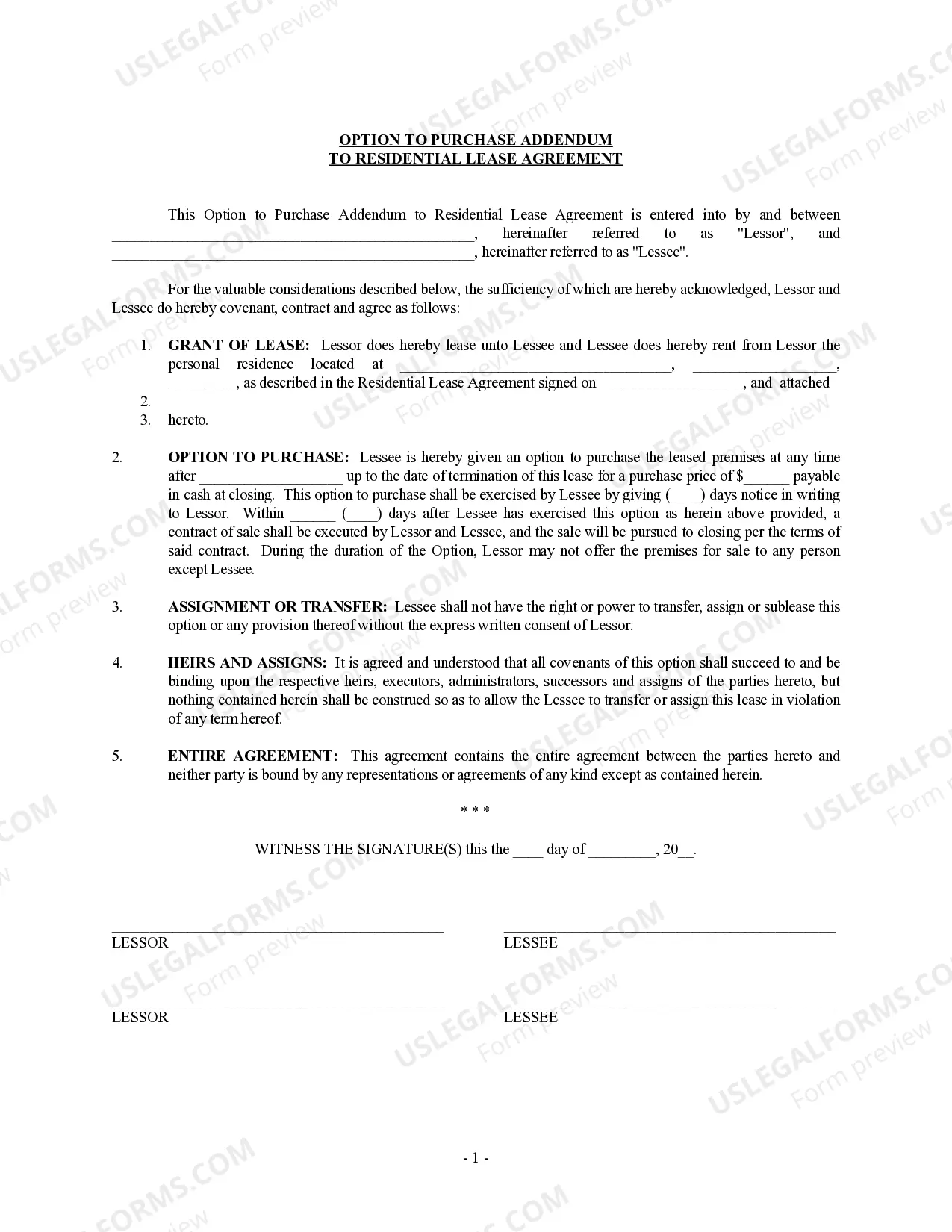

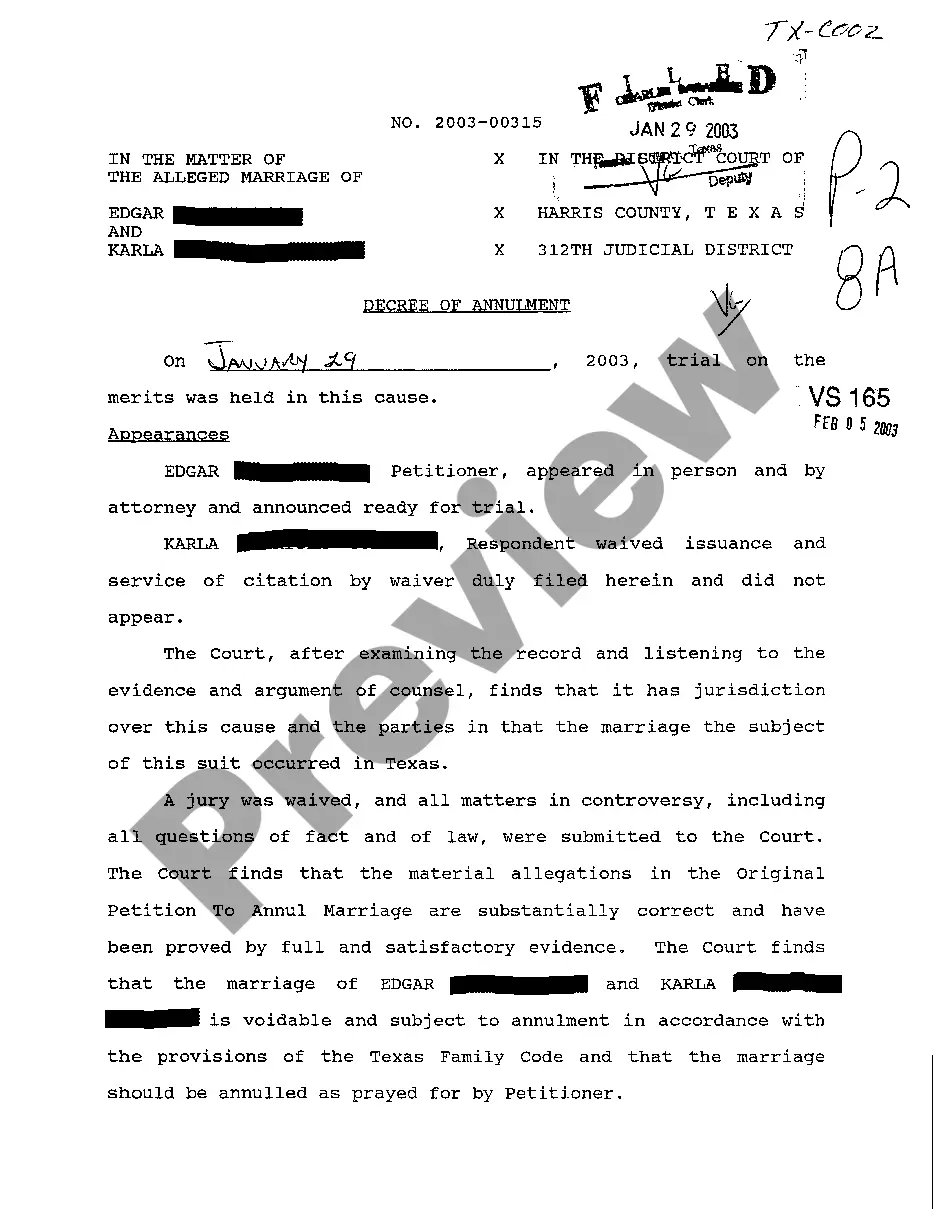

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!