In Salt Lake City, Utah, an Assignment of Note and Deed of Trust as Security for Debt of a Third Party is an important legal document used in real estate transactions. This document serves to protect the interests of a lender when a borrower provides a third party with a mortgage or a loan secured by a property. A detailed description of this assignment and deed of trust involves the transfer of both the promissory note and the deed of trust from the original lender (assignor) to a designated third party (assignee). This transfer is executed as a security arrangement for a debt owed by the borrower to the third party. The borrower is typically the owner of the property in question. The Assignment of Note refers to the transfer of the legal right to collect payments from the borrower on the loan. The assignor effectively transfers this right to the assignee, thereby allowing the third party to receive the loan payments directly from the borrower. The Deed of Trust as Security for Debt of a Third Party is an agreement that allows the assignee to hold a security interest in the property as collateral for the loan. This means that if the borrower fails to repay the debt, the assignee can potentially foreclose on the property and satisfy the debt owed to them by selling it. It is essential to understand that there can be different types of Assignment of Note and Deed of Trust as Security for Debt of Third Party in Salt Lake City, Utah, depending on the specific circumstances and parties involved. Some variations might include: 1. Assignee Nominee Trust: This type of assignment involves designating a trustee as the assignee. The trustee then holds the note and deed of trust on behalf of a beneficiary. 2. Partial Assignment: In some cases, not the entire loan amount is assigned to the third party. Instead, only a portion of the debt is transferred to the assignee, while the original lender retains ownership of the remaining balance. 3. Subordination Agreement: This type of assignment occurs when a subsequent lender agrees to have their lien or security interest in the property ranked lower than the original lender's interest. It allows the third party to still secure their loan while acknowledging the first position of the original lender. In conclusion, a Salt Lake City, Utah Assignment of Note and Deed of Trust as Security for Debt of Third Party is a legal mechanism designed to safeguard the interests of lenders. It involves the transfer of the promissory note and the deed of trust to a third party who becomes the assignee. Different variations of this assignment may exist, such as assignee nominee trust, partial assignment, or subordination agreement, depending on the specific circumstances of the transaction.

Salt Lake Utah Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

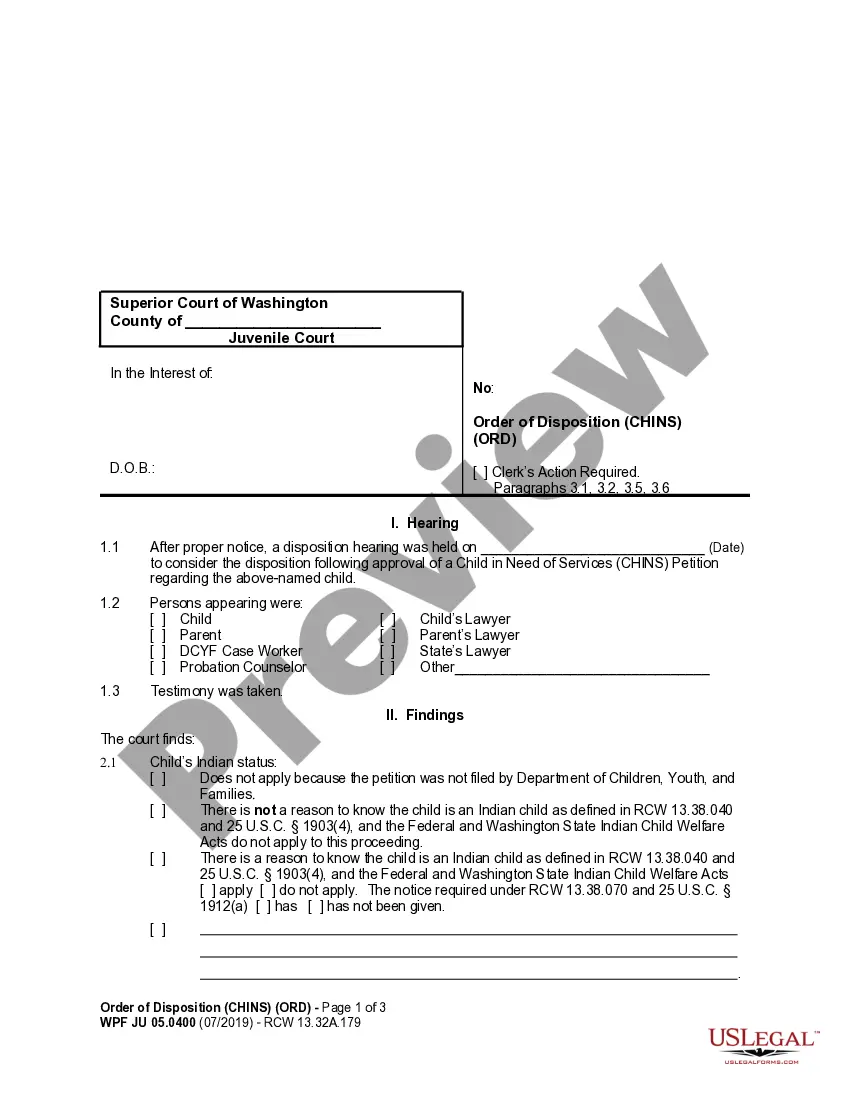

How to fill out Salt Lake Utah Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Salt Lake Assignment of Note and Deed of Trust as Security for Debt of Third Party is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Salt Lake Assignment of Note and Deed of Trust as Security for Debt of Third Party. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Salt Lake Assignment of Note and Deed of Trust as Security for Debt of Third Party in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

The lender holds the promissory note and the security instrument until the loan is repaid. a documentmortgage, deed of trust, security deed, or land contractthat is the evidence of the pledge of real estate as collateral for the loan. You just studied 107 terms!

When a deed of trust is used as a security instrument, who holds the deed and the note? The trustee holds the deed, and the lender holds the note. Olivia took out a 15-year loan secured with a deed of trust.

A deed of trust often requires a promissory note, but the promissory note is a specific document type. While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

When a borrower pays off a mortgage, the note holder gives the note to the borrower. This means that the home is theirs, free and clear. If a borrower refinances a mortgage, the new mortgage pays off the original lender and a new note is created, to be held by that lender until the new mortgage is paid in full.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a trustee. The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

A deed of trust often requires a promissory note, but the promissory note is a specific document type. While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt.

In California, the most common method of securing a loan on real property is for the lender to record a deed of trust against the property. If the borrower defaults on the loan, the lender may then foreclose on the real property.

The trustee's primary function is to hold and maintain a property title for the borrower and the lender for the duration of the loan. Therefore, it is the trustee who retains factual ownership and control of the property in question, not the lender.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.