The King Washington Nonqualified Defined Benefit Deferred Compensation Agreement is an important financial agreement that provides individuals with a comprehensive retirement benefits plan. This agreement allows employees to defer a portion of their income, excluding any applicable FICA taxes, into a nonqualified account, thereby offering significant tax advantages. Under this agreement, employees can receive a defined benefit payout at a later date, typically at retirement, ensuring a consistent income stream throughout their golden years. The agreement is specifically designed for highly compensated employees who have maxed out their contributions to traditional retirement plans, such as 401(k)s or IRAs. One type of King Washington Nonqualified Defined Benefit Deferred Compensation Agreement is the Supplemental Executive Retirement Plan (SERP). This plan is typically offered to key executives and provides additional retirement benefits beyond what is offered through a traditional qualified employee retirement plan. By implementing a SERP, companies can attract and retain top talent while helping executives achieve their retirement goals. Another variation of this agreement is the Top Hat Plan (also known as an excess benefit plan). This plan caters to a select group of highly compensated individuals and allows them to defer a substantial portion of their income into a nonqualified account to supplement their retirement savings. The Top Hat Plan provides flexibility in benefit design and can be tailored to meet the specific needs of these key employees. In summary, the King Washington Nonqualified Defined Benefit Deferred Compensation Agreement is a powerful tool that enables highly compensated employees to secure a comfortable retirement by deferring a portion of their income into a nonqualified account. The agreement offers various types, such as SERP and Top Hat Plans, to cater to different groups or levels of employees. By taking advantage of this arrangement, individuals can strategically plan for their financial future while taking advantage of valuable tax benefits.

King Washington Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out King Washington Nonqualified Defined Benefit Deferred Compensation Agreement?

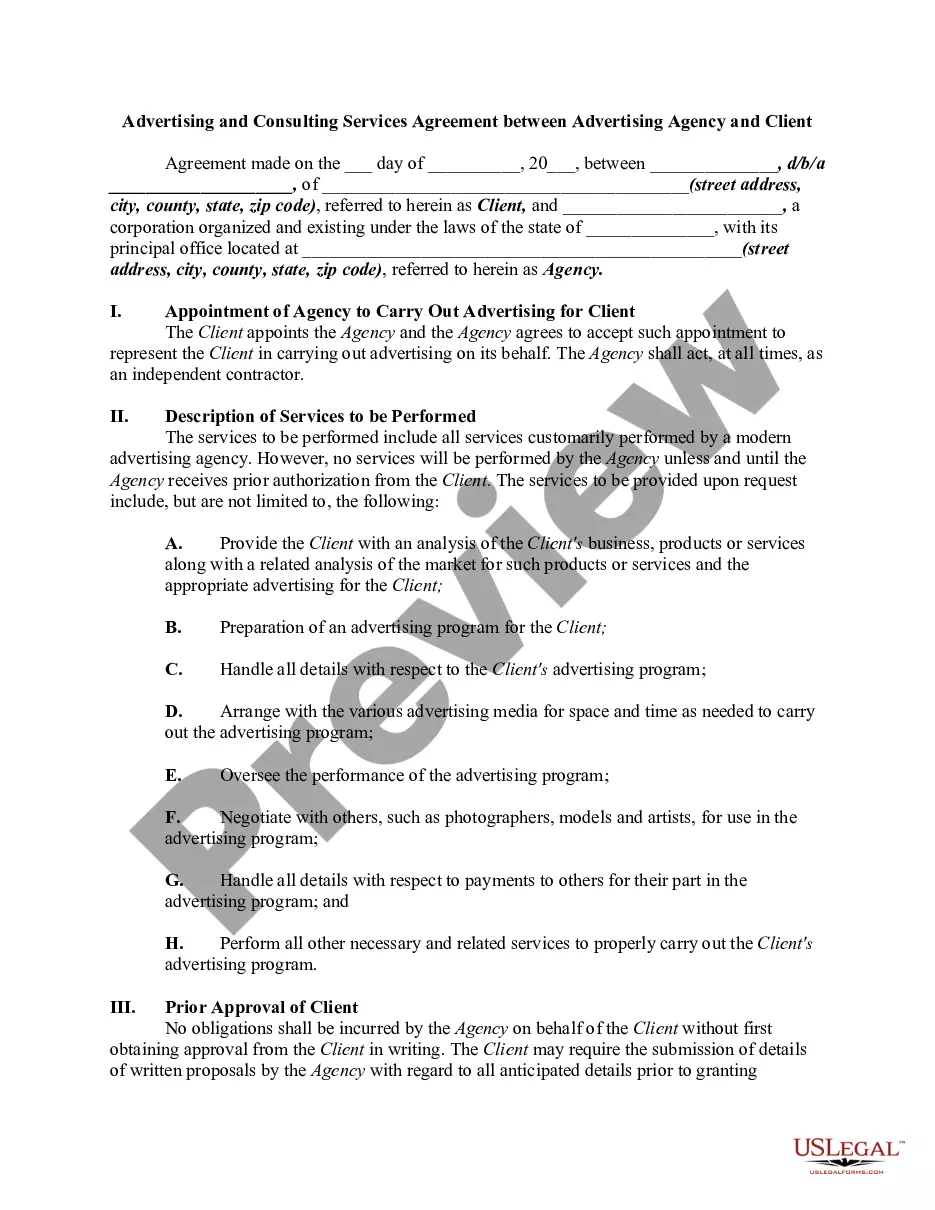

Do you need to quickly draft a legally-binding King Nonqualified Defined Benefit Deferred Compensation Agreement or probably any other form to handle your own or corporate matters? You can go with two options: hire a professional to draft a legal document for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including King Nonqualified Defined Benefit Deferred Compensation Agreement and form packages. We provide templates for an array of use cases: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the King Nonqualified Defined Benefit Deferred Compensation Agreement is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the King Nonqualified Defined Benefit Deferred Compensation Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!