The Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement is a specialized financial arrangement designed to provide retirement benefits to eligible individuals in Maricopa, Arizona. This agreement falls under the category of nonqualified retirement plans, which means it does not meet the requirements set by the Internal Revenue Service (IRS) to be considered a qualified plan. Nonqualified Defined Benefit Deferred Compensation Agreements allow employees to defer a portion of their salary and receive the accrued benefits at a later date, usually during retirement. In this case, the agreement is specific to residents or employees in Maricopa, Arizona. There are different types of Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreements tailored to meet the needs of various individuals. One variation might be a "Fixed Formula Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement," wherein the benefit amount is predetermined based on a specific formula that considers factors like years of service and average salary. Another type could be the "Indexed Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement" that incorporates an index, such as the Consumer Price Index (CPI), to ensure the benefit amount keeps pace with inflation and maintains its purchasing power over time. Furthermore, there might be options for a "Vesting Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement," where the benefits gradually become fully owned by the participant over a specific period, incentivizing long-term commitment to the organization or employer. These Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreements provide a valuable retirement planning tool for eligible individuals. They offer flexibility in deferring compensation, optimizing tax benefits, and ensuring a secure financial future. It is important for employees and residents in Maricopa, Arizona, to consult with qualified professionals when considering these agreements to understand the specific terms, options, and implications associated with each type available to them.

Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Maricopa Arizona Nonqualified Defined Benefit Deferred Compensation Agreement?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Maricopa Nonqualified Defined Benefit Deferred Compensation Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Nonqualified Defined Benefit Deferred Compensation Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Maricopa Nonqualified Defined Benefit Deferred Compensation Agreement:

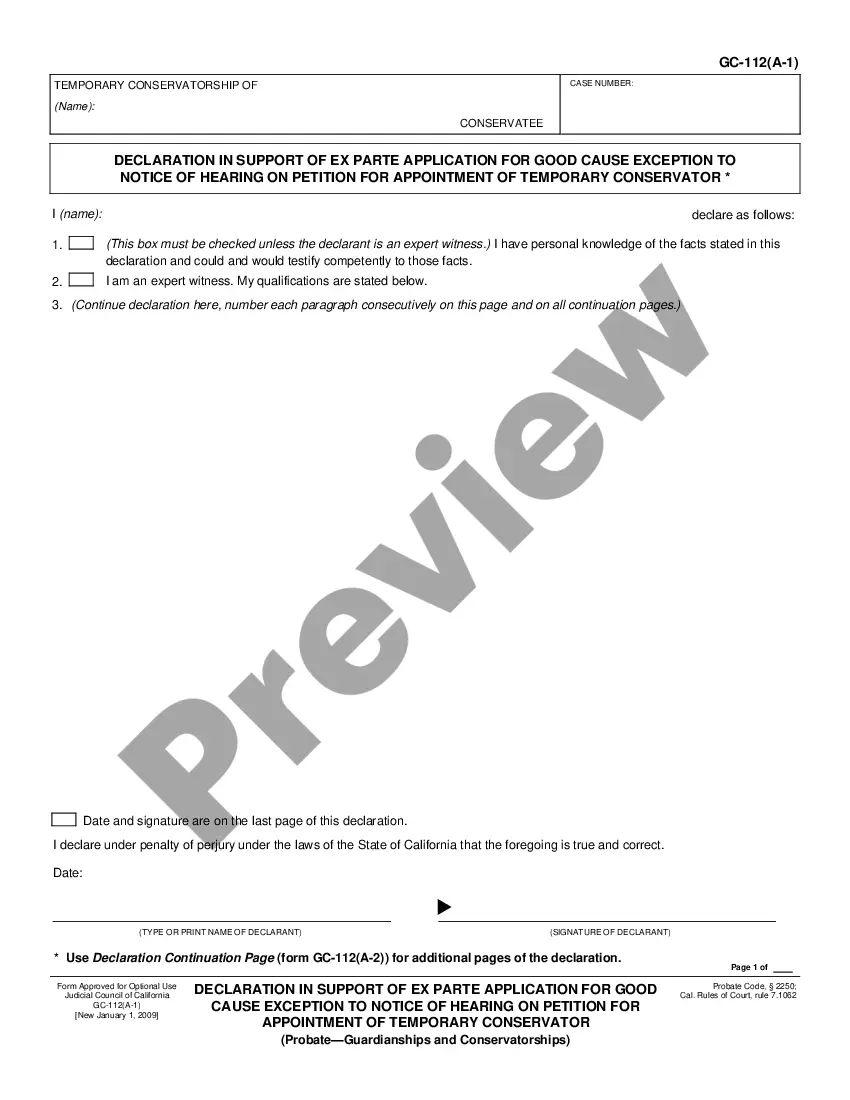

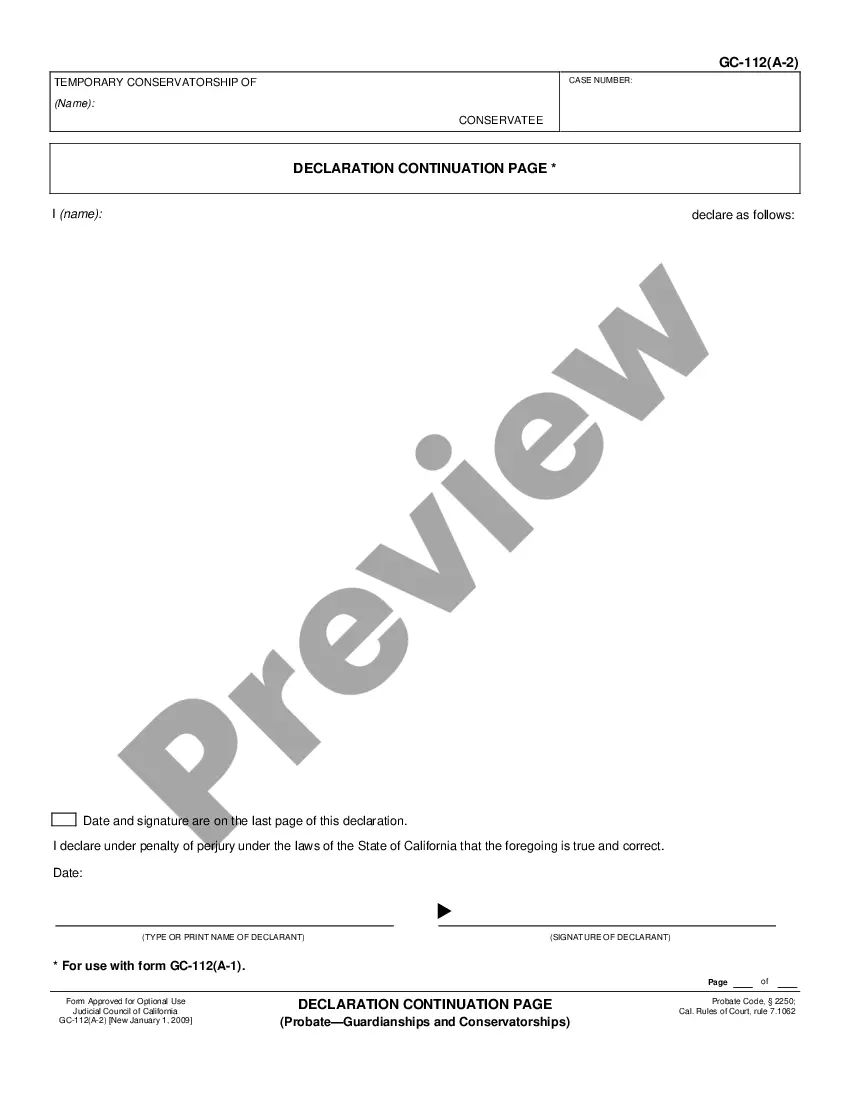

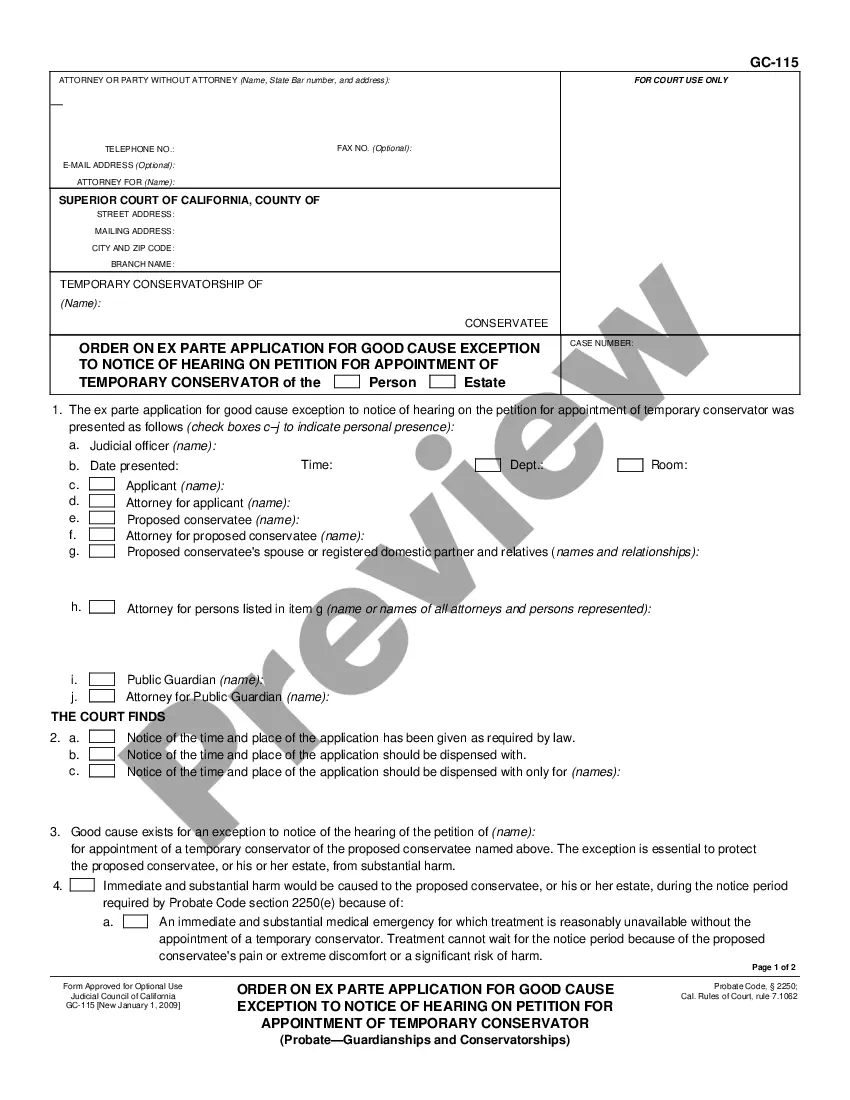

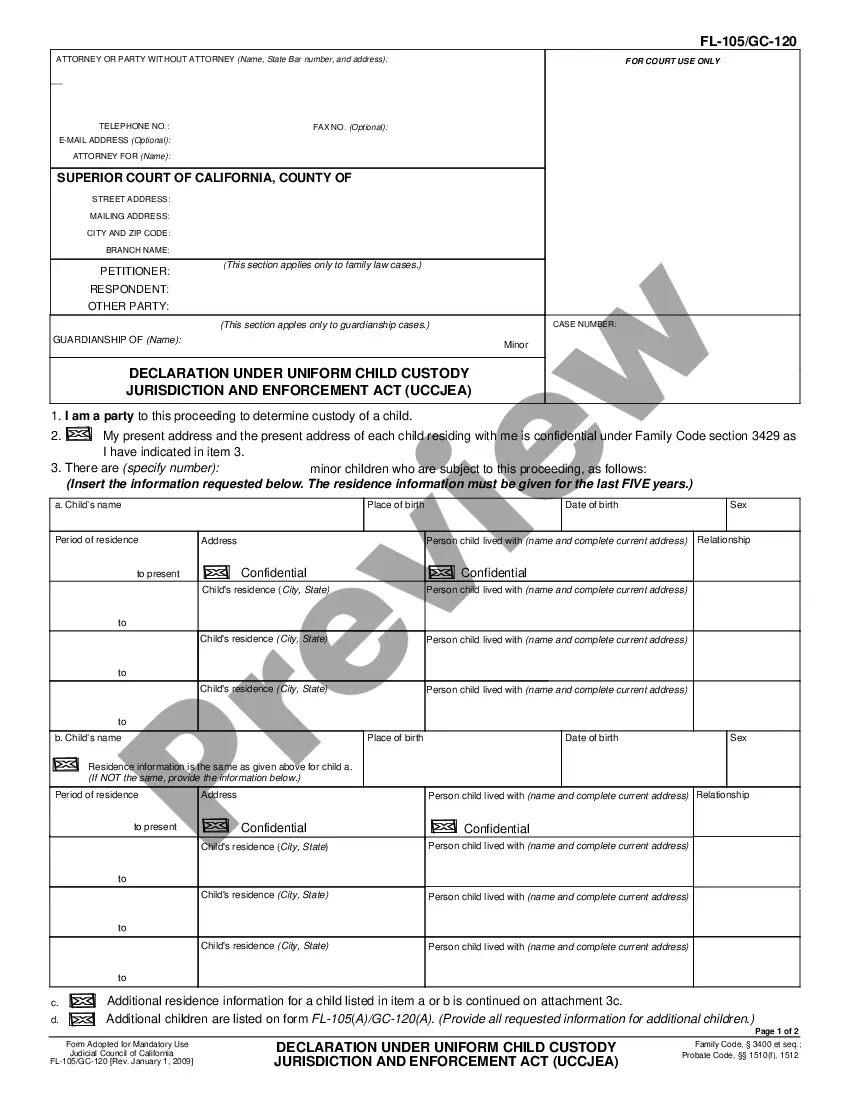

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

Like a 401(k) plan, an NQDC plan allows employees to defer compensation until retirement or some other predetermined date. In addition to avoiding current income taxes on contributions, employees enjoy tax-deferred growth of accumulated earnings.

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

Nonqualified deferred compensation is generally taxed when made available to the recipient without a substantial risk of forfeiture.

Nonqualified plans provide employees additional retirement benefits. These plans do not meet the requirements under ERISA. Nonqualified plans offer the employer a great deal of flexibility when designing the plan. The employer can decide who is to be included in the plan.

Nonqualified deferred compensation provides an excellent way to offer executives additional benefits beyond what's provided for the general employee base. Putting these plans into play may increase your ability to attract and retain top employee talent.

The Pros And Cons Of Using A Deferred Compensation Plan Deferred compensation plans can save a high earner a lot of money in the long run. These plans grow tax-deferred and the contributions can be deducted from taxable income. There are risks to these plans, such as the company declaring bankruptcy.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

"Deferring this income provides one tax advantage: You don't pay federal or state income tax on that portion of your compensation in the year you defer it (you pay only Social Security and Medicare taxes), so it has the potential to grow tax-deferred until you receive it."