Orange California Nonqualified Defined Benefit Deferred Compensation Agreement is a financial arrangement that allows employers in Orange, California, to offer their employees a nonqualified retirement plan with defined benefits. This agreement serves as a means for employees to accumulate additional retirement savings beyond qualified plans like 401(k) or pension plans. One type of Orange California Nonqualified Defined Benefit Deferred Compensation Agreement is the Nonqualified Supplemental Executive Retirement Plan (SERP). This specific plan is designed to provide additional retirement benefits to key executives within an organization. It is a valuable tool for attracting and retaining top-level talent by offering them enhanced retirement benefits. Another type of Orange California Nonqualified Defined Benefit Deferred Compensation Agreement is the Nonqualified Deferred Compensation Plan (NDC). This plan allows employees to defer a portion of their income, which is contributed to the plan and grows tax-deferred until retirement. Upon retirement, employees receive a fixed monthly benefit for a predetermined period, providing them with a stable income stream during their retirement years. The Orange California Nonqualified Defined Benefit Deferred Compensation Agreement offers several advantages to both employers and employees. For employers, it enables them to design a customized retirement plan tailored to their specific needs and objectives. It provides a competitive advantage in attracting and retaining talented individuals and offers flexibility in structuring benefits. For employees, this agreement offers an opportunity to accumulate additional retirement savings beyond the limits of traditional qualified plans. It allows for tax-deferred growth on contributions and potentially provides higher benefits compared to other retirement savings alternatives. The fixed monthly benefit received during retirement ensures a reliable income stream to support their post-employment lifestyle. In summary, the Orange California Nonqualified Defined Benefit Deferred Compensation Agreement encompasses various types, including the Nonqualified Supplemental Executive Retirement Plan (SERP) and Nonqualified Deferred Compensation Plan (NDC). These agreements offer advantages for both employers and employees, providing flexibility, competitive benefits, and additional retirement savings opportunities.

Orange California Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Orange California Nonqualified Defined Benefit Deferred Compensation Agreement?

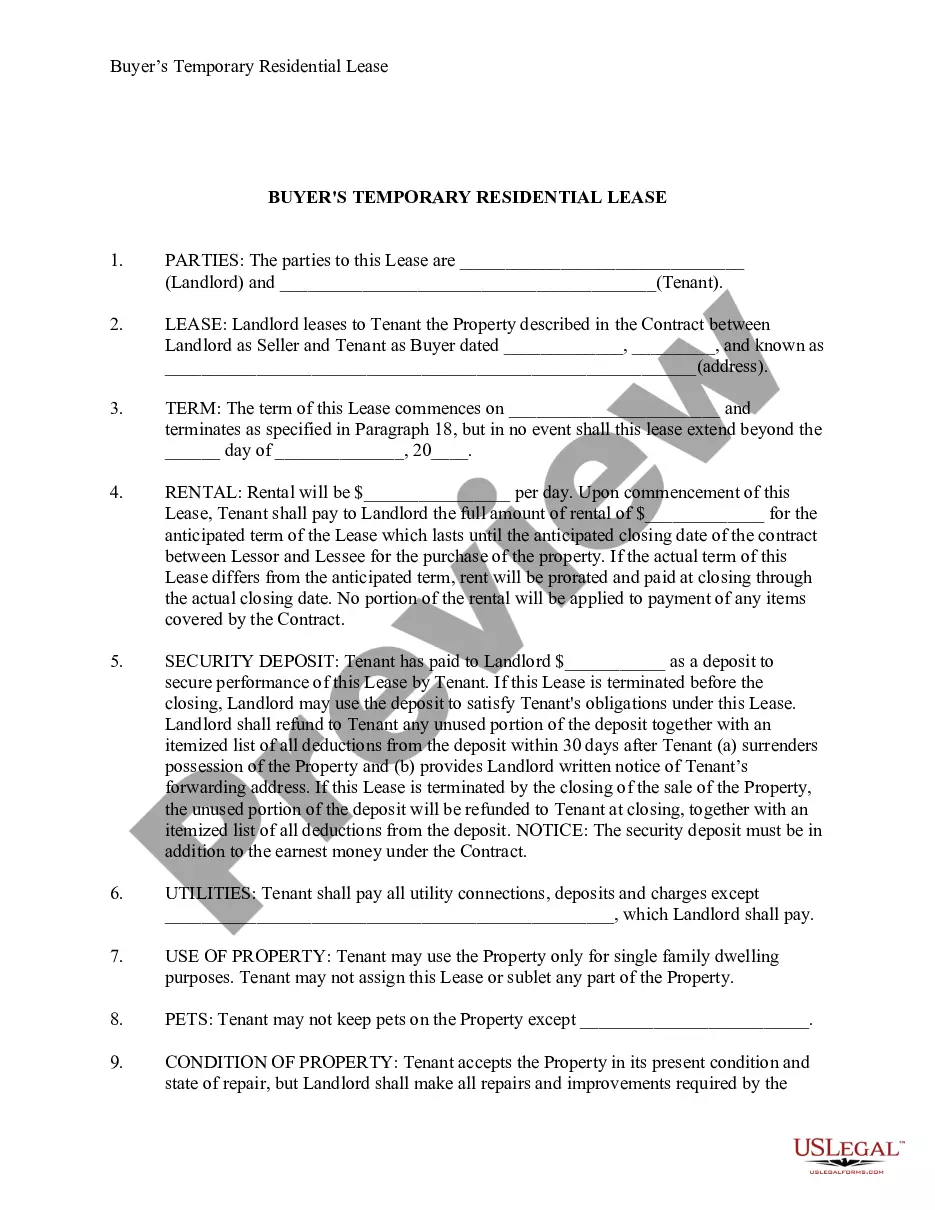

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Orange Nonqualified Defined Benefit Deferred Compensation Agreement, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any activities related to document completion simple.

Here's how you can locate and download Orange Nonqualified Defined Benefit Deferred Compensation Agreement.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the similar document templates or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Orange Nonqualified Defined Benefit Deferred Compensation Agreement.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Orange Nonqualified Defined Benefit Deferred Compensation Agreement, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to deal with an exceptionally complicated situation, we advise using the services of an attorney to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

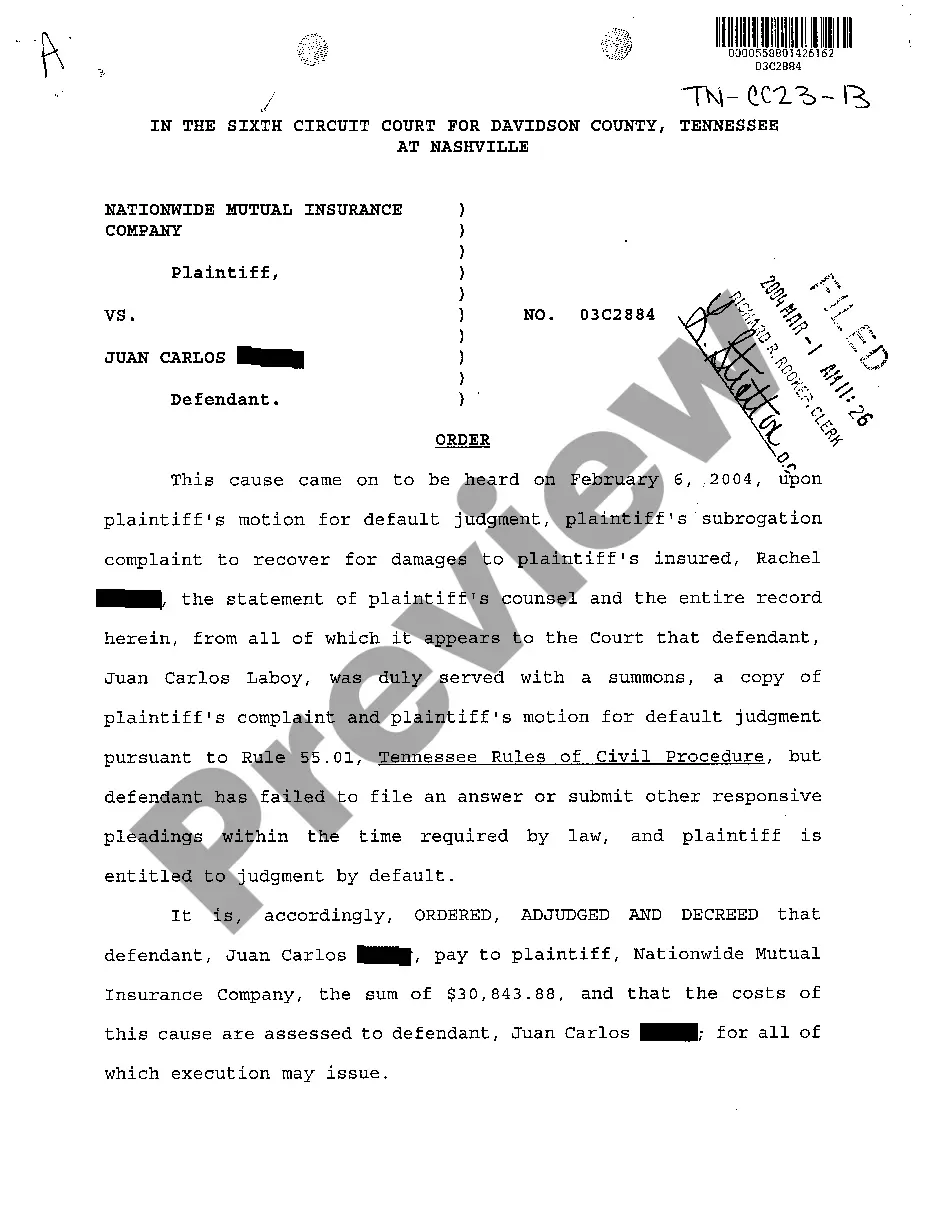

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

Under a NQDC plan, employers can only deduct the benefit as the employee includes the benefit in taxable income. The deduction amount is the total amount included in the employee's taxable compensation, which includes any earnings on the employer contributions.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).

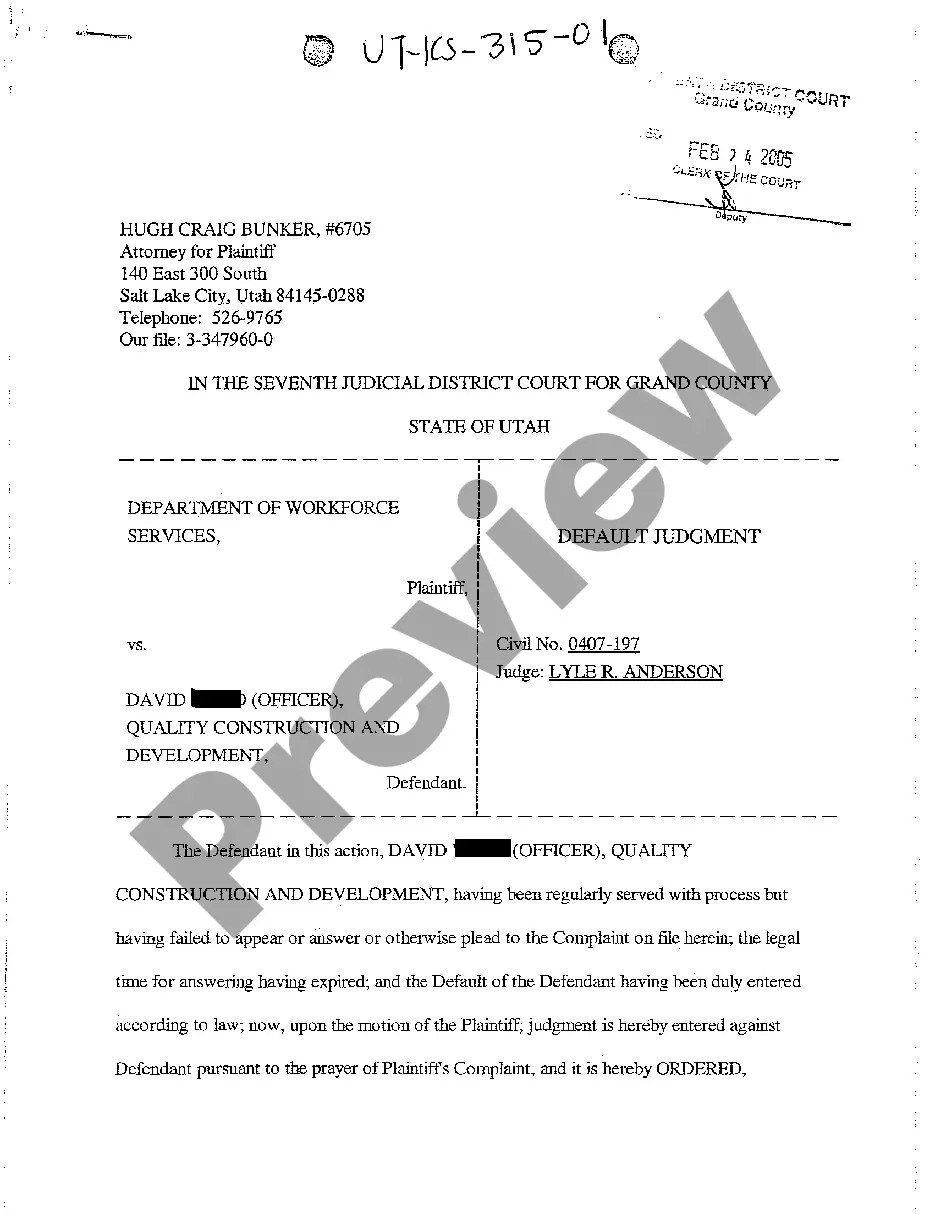

There are two main types of nonqualified deferred compensation plans from which small business owners may choose: supplemental executive retirement plans (SERPs) and deferred savings plans. These two options share several common characteristics, but there are also important differences between the two.

NQDC Cons. The deferred compensation account is subject to creditors of the business. You may not access your deferred compensation until the distribution date, meaning you can't take out a loan or take distributions before that date under any circumstances.

Advantages of Nonqualified Deferred Compensation Plans For employers like you, a NQDC plan offers: Flexibility: You can choose which executive or highly compensated employees can participate. Because there aren't any non-discriminatory rules, you don't have to offer this plan to every employee.

Nonqualified deferred compensation provides an excellent way to offer executives additional benefits beyond what's provided for the general employee base. Putting these plans into play may increase your ability to attract and retain top employee talent.