Suffolk New York Nonqualified Defined Benefit Deferred Compensation Agreement is a legal contract primarily used by employers in Suffolk County, New York, to provide their employees with supplementary retirement benefits. This agreement allows eligible employees to defer a portion of their salary or compensation into a retirement account, which will then be paid out as a defined benefit at a later date. Keywords: Suffolk New York, nonqualified defined benefit, deferred compensation agreement, retirement benefits, eligible employees, salary deferral, supplementary retirement, retirement account, defined benefit plan. There may be different types or variations of the Suffolk New York Nonqualified Defined Benefit Deferred Compensation Agreement to cater to specific circumstances or employer preferences. Some common variations include: 1. Traditional Nonqualified Defined Benefit Deferred Compensation Agreement: This is the standard arrangement wherein eligible employees agree to defer a percentage of their salary or compensation into a retirement account, which will be paid out as a defined benefit upon retirement. 2. Vesting Nonqualified Defined Benefit Deferred Compensation Agreement: Under this agreement, employees may be subject to a vesting schedule, which determines the extent to which they have ownership of the deferred compensation. This type of arrangement provides greater incentives for employees to remain with the company for a specific duration to fully benefit from the deferred compensation. 3. Matching Contribution Nonqualified Defined Benefit Deferred Compensation Agreement: In this variation, employers may offer to match a certain percentage or dollar amount of the employee's deferred compensation. This serves as an additional incentive for employees to participate in the program and maximize their retirement benefits. 4. Lump Sum Nonqualified Defined Benefit Deferred Compensation Agreement: This agreement provides employees with the option to receive their deferred compensation as a lump-sum payment upon retirement, rather than regular periodic payments. This variation can be beneficial for employees who prefer a one-time payout or have specific financial needs at the time of retirement. It is important for both employers and employees to carefully review and understand the specific terms and conditions outlined in the Suffolk New York Nonqualified Defined Benefit Deferred Compensation Agreement that they are entering into. Consulting with legal and financial professionals can help ensure compliance with applicable laws and maximize the benefits associated with these arrangements.

Suffolk New York Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Suffolk New York Nonqualified Defined Benefit Deferred Compensation Agreement?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Suffolk Nonqualified Defined Benefit Deferred Compensation Agreement meeting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Aside from the Suffolk Nonqualified Defined Benefit Deferred Compensation Agreement, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Suffolk Nonqualified Defined Benefit Deferred Compensation Agreement:

- Check the content of the page you’re on.

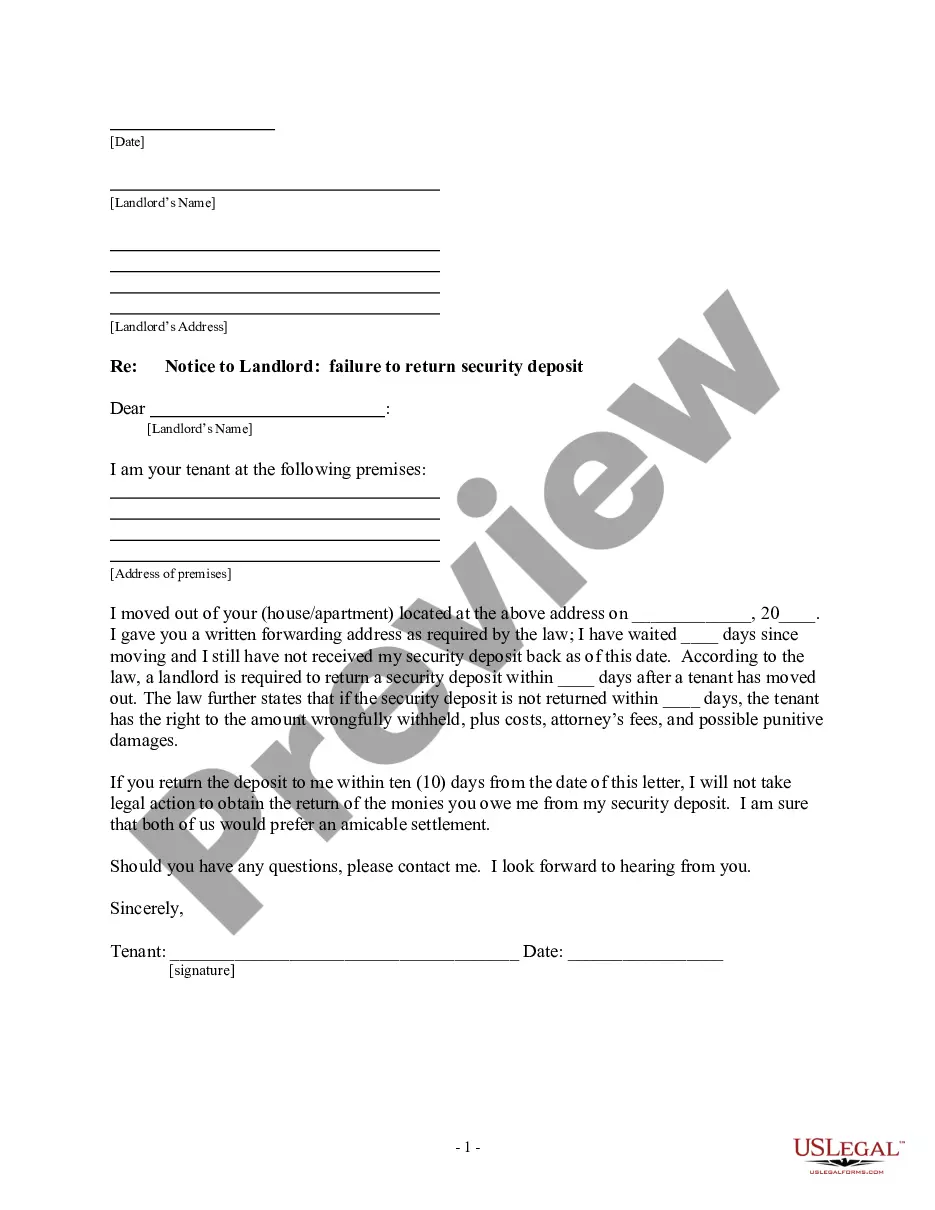

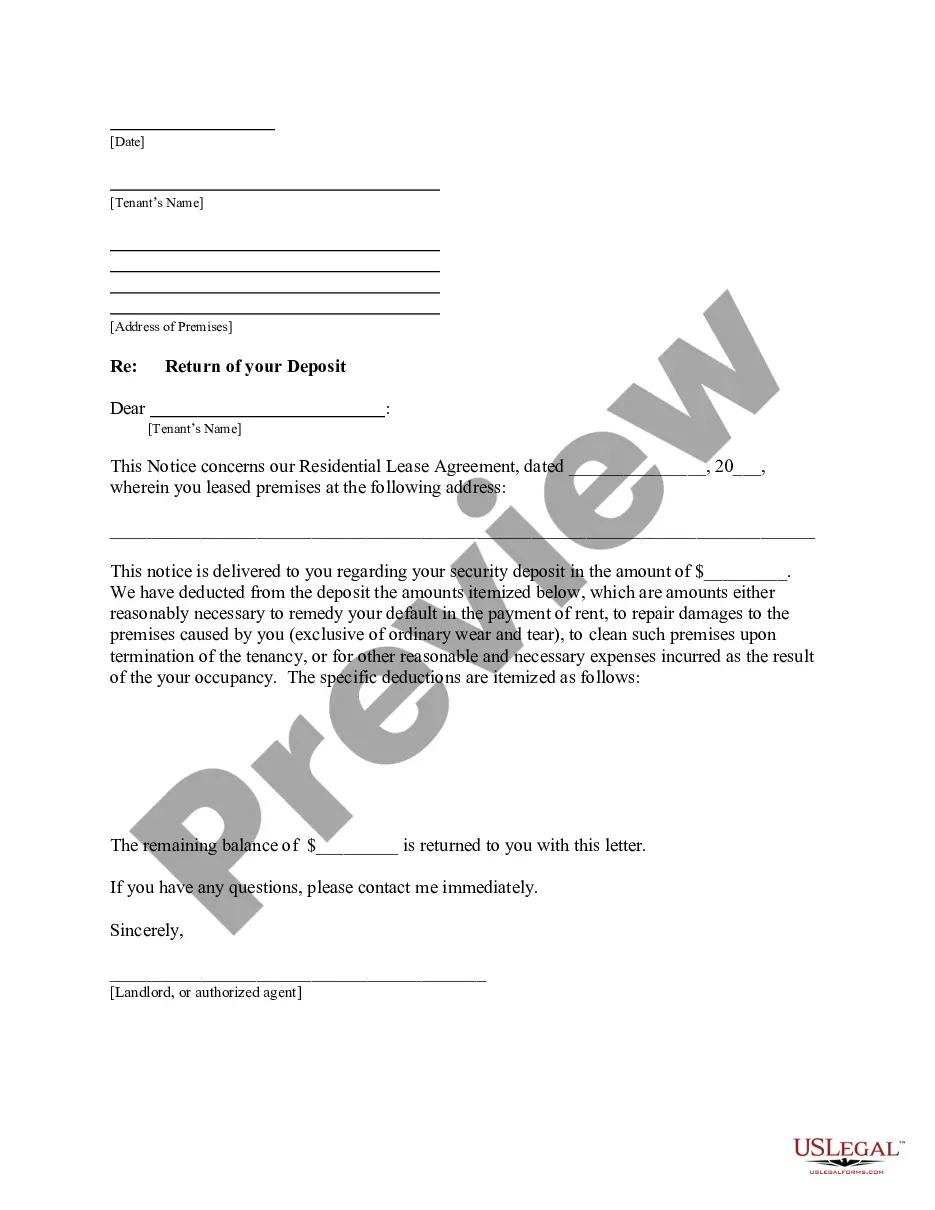

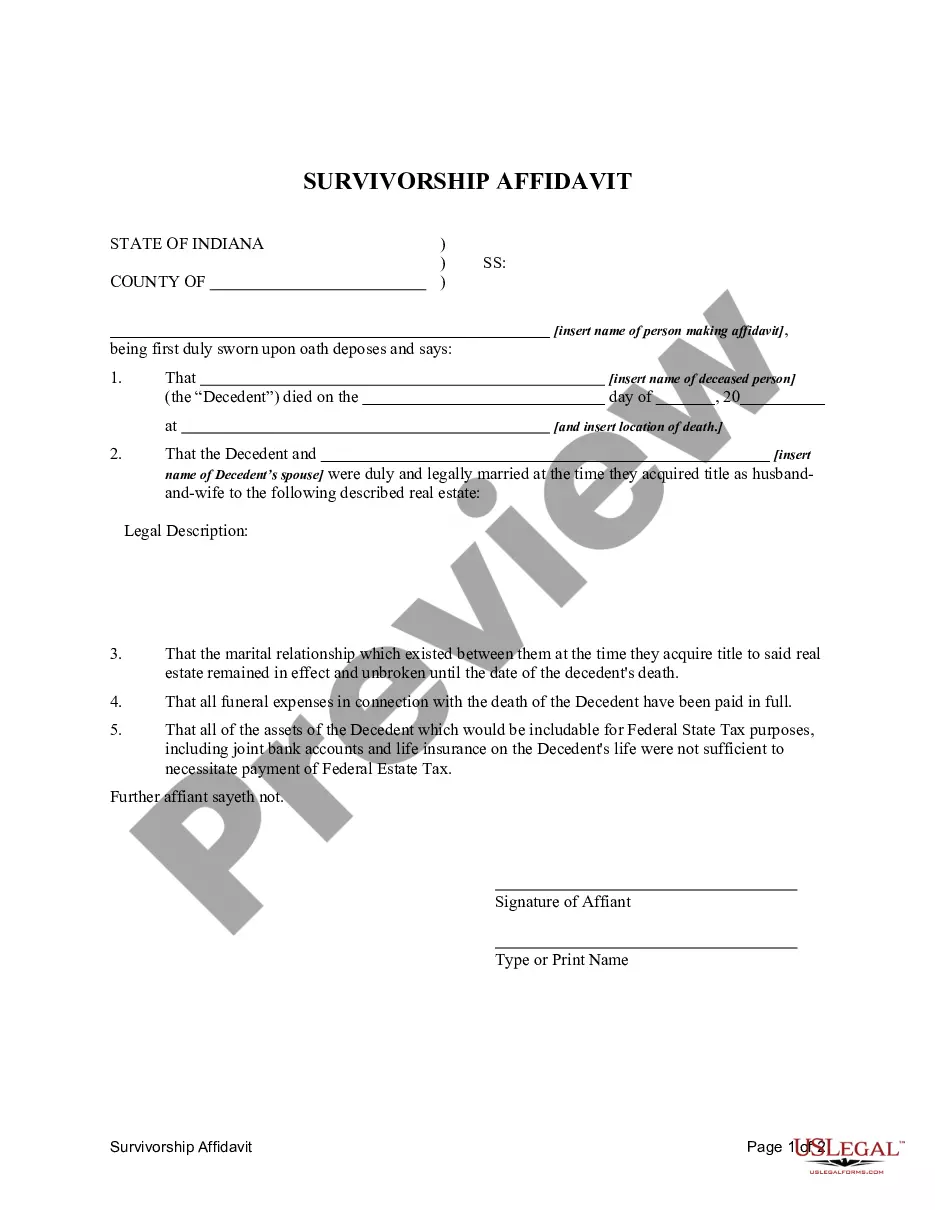

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Suffolk Nonqualified Defined Benefit Deferred Compensation Agreement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!