Maricopa Arizona Loan Modification Agreement — Multistate is a legal document that outlines the terms and conditions for modifying an existing loan in the state of Arizona. This agreement is designed to facilitate a mutually beneficial arrangement between the lender and the borrower, allowing for adjustments to the loan terms that can help the borrower meet their financial obligations. The primary purpose of this loan modification agreement is to provide a framework for restructuring the loan, typically through a reduction in interest rates, extending the loan term, or even principal reduction in some cases. By modifying the loan terms, both parties aim to avoid foreclosure and find a more sustainable payment plan. The Maricopa Arizona Loan Modification Agreement — Multistate ensures that all parties involved are aware of their rights and obligations throughout the modification process. It includes detailed provisions regarding the modified terms, payment schedules, and any additional fees or costs incurred as part of the loan modification. Different types of Maricopa Arizona Loan Modification Agreement — Multistate may include: 1. Interest Rate Modification: This type of agreement focuses on reducing the interest rate charged on the loan. Lowering the interest rate can help borrowers manage their monthly payments more comfortably. 2. Loan Term Extension: In cases where borrowers are struggling with high monthly payments, extending the loan term may be an option. This modification allows borrowers to spread their payments over a longer period, resulting in lower monthly installments. 3. Principal Reduction: In some instances, lenders may agree to reduce the principal amount owed on the loan. This method helps borrowers who owe more than the property's current value, providing them with a more manageable and realistic loan balance. 4. Hybrid Modification: This type of modification combines various elements, such as interest rate reduction and principal forgiveness, to create a customized solution based on the borrower's unique circumstances. It is important for borrowers considering a Maricopa Arizona Loan Modification Agreement — Multistate to carefully review the terms and seek legal advice if needed. This agreement offers the opportunity for struggling homeowners to avoid foreclosure and regain control of their finances by creating a more affordable loan repayment plan.

Maricopa Arizona Loan Modification Agreement - Multistate

Description

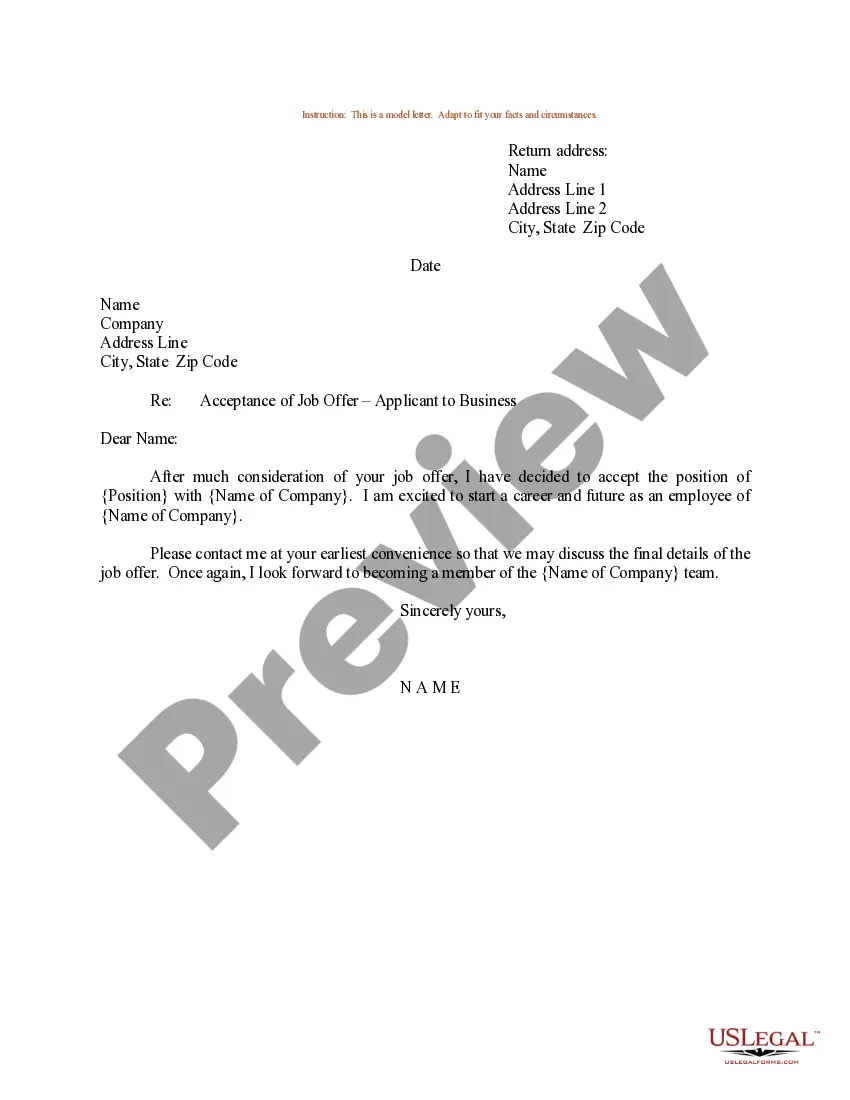

How to fill out Maricopa Arizona Loan Modification Agreement - Multistate?

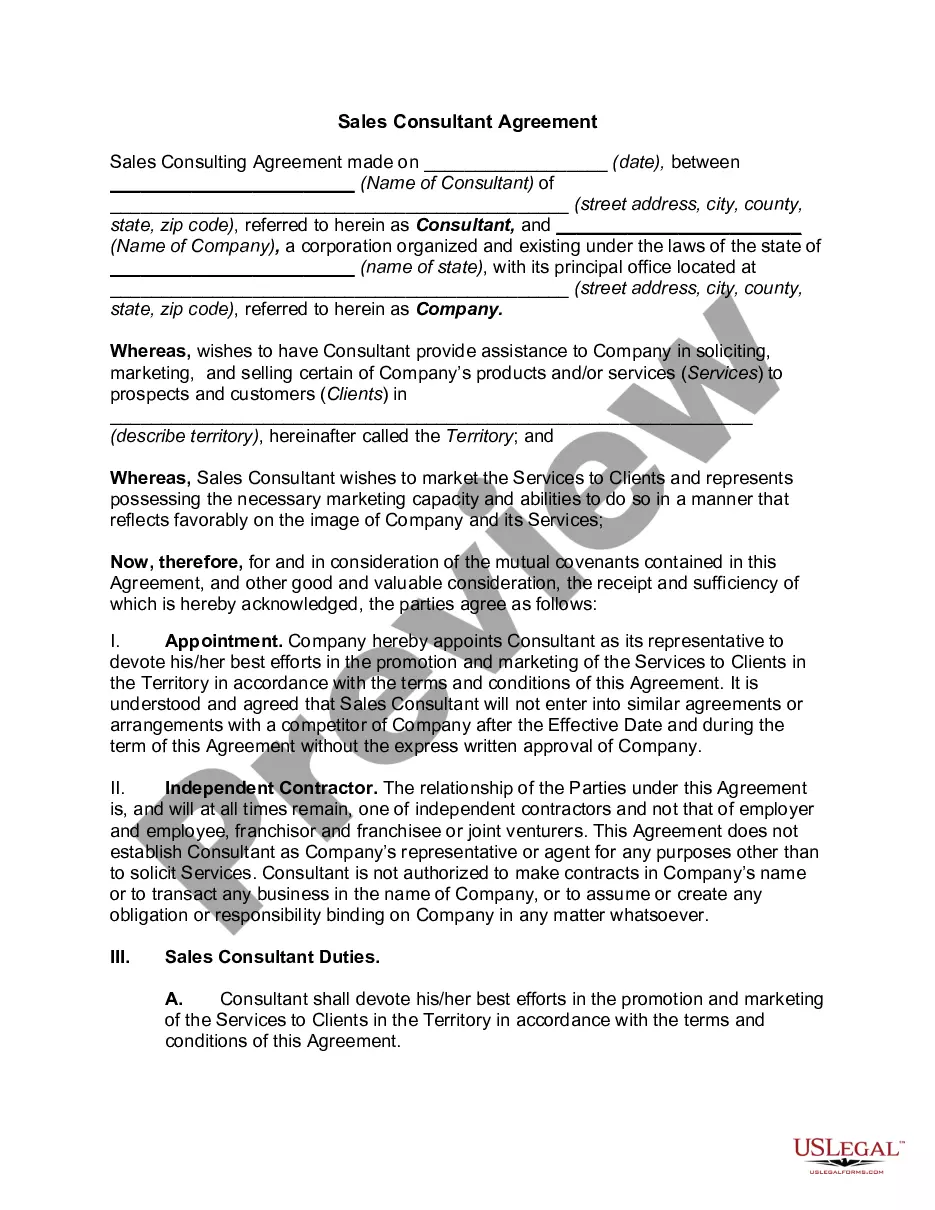

Are you looking to quickly draft a legally-binding Maricopa Loan Modification Agreement - Multistate or probably any other document to manage your personal or corporate affairs? You can select one of the two options: contact a professional to draft a legal paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant document templates, including Maricopa Loan Modification Agreement - Multistate and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Maricopa Loan Modification Agreement - Multistate is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Maricopa Loan Modification Agreement - Multistate template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the paperwork we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

How to Negotiate a Loan Modification Do Not Ignore Your Lender. When facing foreclosure, your lender will likely contact you regularly.Stay in the Home.Collect Evidence.Contact a Foreclosure Defense Attorney.Contact Your Lender.Be Patient.Let Our Florida Foreclosure Defense Lawyers Help With Your Loan Modification.

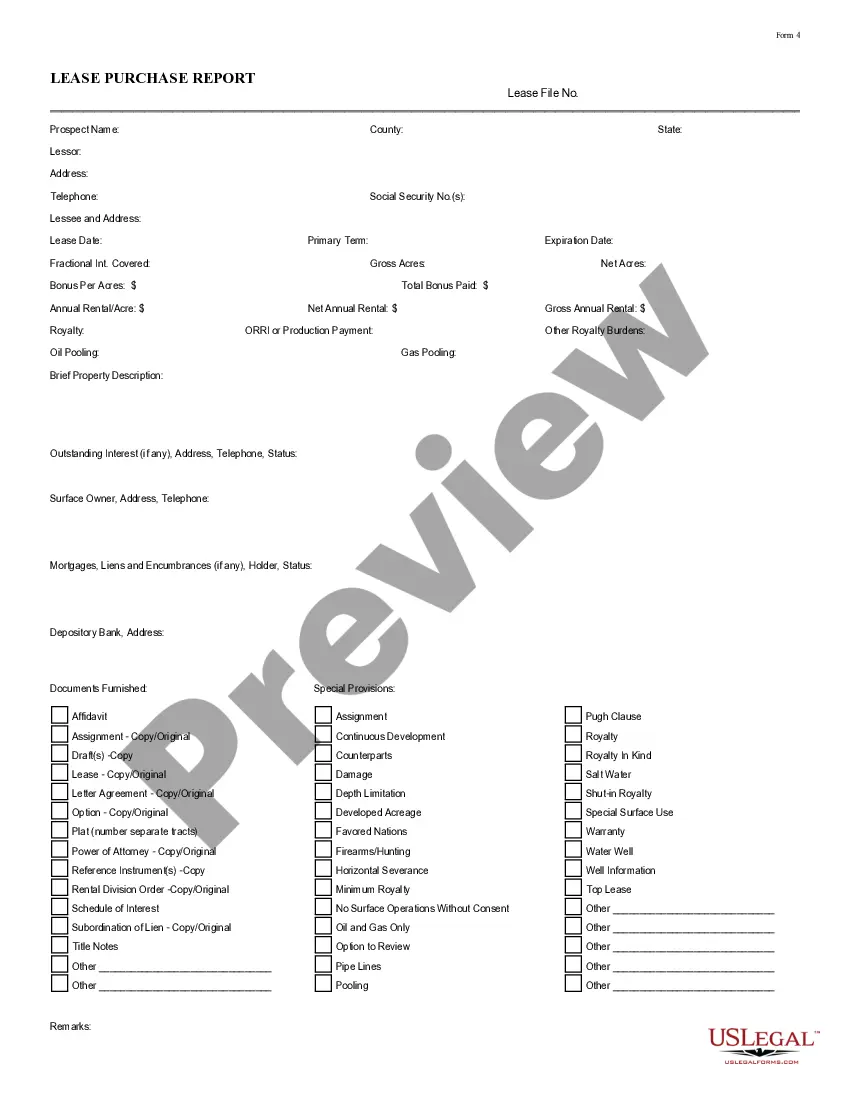

Required Paperwork Application. The first thing you'll need to complete a loan modification is your mortgage lenders application.Paystubs.Signed IRS form 4506-T or 4506-EZ.Two Most Recent Bank Statements.Investment Statements.Monthly Bills.Divorce Decree or Separation Agreement (if applicable)Hardship Letter.

The loan modification process Talk to your servicer. Communicate with your servicer.Utilize the 90-day right to cure If a servicer or lender claims you are in default, they must give you a written notice.Organize your documents.Understand what a modification can and cannot do.Reporting issues with mortgage servicers.

To qualify for a loan modification under federal laws, the borrower's surplus income must total at least $300 and must constitute at least 15 percent of his or her monthly income.

A loan modification changes the underlying terms of your existing deed of trust. In almost all cases, it does not cost any money to receive a loan modification with your lender.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

In most instances, a recorded modification will not be necessary. However, in some circumstances, a recorded modification may be required to ensure that the lender is protected.

The loan modification process typically takes 6 to 9 months, depending on your lender.

May be reported as a debt settlement Lenders will often report a loan modification to credit bureaus as a type of settlement or adjustment to the terms of the loan. If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.