Fulton Georgia Sample Stock Purchase and Investor Rights Agreement of Soft, Inc. is a legal document that outlines the terms and conditions involved in the purchase of stock by investors in Soft, Inc., a company based in Fulton, Georgia. This agreement is specifically designed to protect the rights and interests of both the company and the investors. The Fulton Georgia Sample Stock Purchase and Investor Rights Agreement of Soft, Inc. covers various important aspects, including the purchase price, number of shares being acquired, and the agreed-upon valuation of the company. It also addresses the rights and obligations of the investors, such as information rights, voting rights, and any restrictions on transfer of the purchased shares. The agreement ensures transparency and provides guidelines for the management of Soft, Inc., including provisions regarding corporate governance, board composition, and decision-making processes. It establishes the rights of investors to receive financial and operational reports, as well as to access company information. In addition to standard provisions, there may be different types or variations of the Fulton Georgia Sample Stock Purchase and Investor Rights Agreement of Soft, Inc., based on specific circumstances. These include: 1. Series A Stock Purchase and Investor Rights Agreement: This agreement specifically applies to the first round of equity financing (Series A) received by Soft, Inc. It outlines the terms of investment and subsequent rights for the initial investors, setting the foundation for future rounds of funding. 2. Series B Stock Purchase and Investor Rights Agreement: This agreement applies to subsequent rounds of investment (Series B) in Soft, Inc. It builds upon the terms established in the Series A agreement and includes any new rights or provisions negotiated for the new investors. 3. Preferred Stock Purchase and Investor Rights Agreement: This type of agreement concerns the purchase of preferred stock by investors in Soft, Inc. Preferred stock typically carries additional rights and privileges compared to common stock, and this agreement outlines the specific terms and conditions associated with such stock purchases. Overall, the Fulton Georgia Sample Stock Purchase and Investor Rights Agreement of Soft, Inc. serves as a crucial legal framework for investors to protect their rights, while providing Soft, Inc. with the necessary capital to grow and expand its operations in Fulton, Georgia.

Fulton Georgia Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc.

Description

How to fill out Fulton Georgia Sample Stock Purchase And Investor Rights Agreement Of Esoft, Inc.?

Drafting documents for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Fulton Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc. without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Fulton Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc. by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Fulton Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc.:

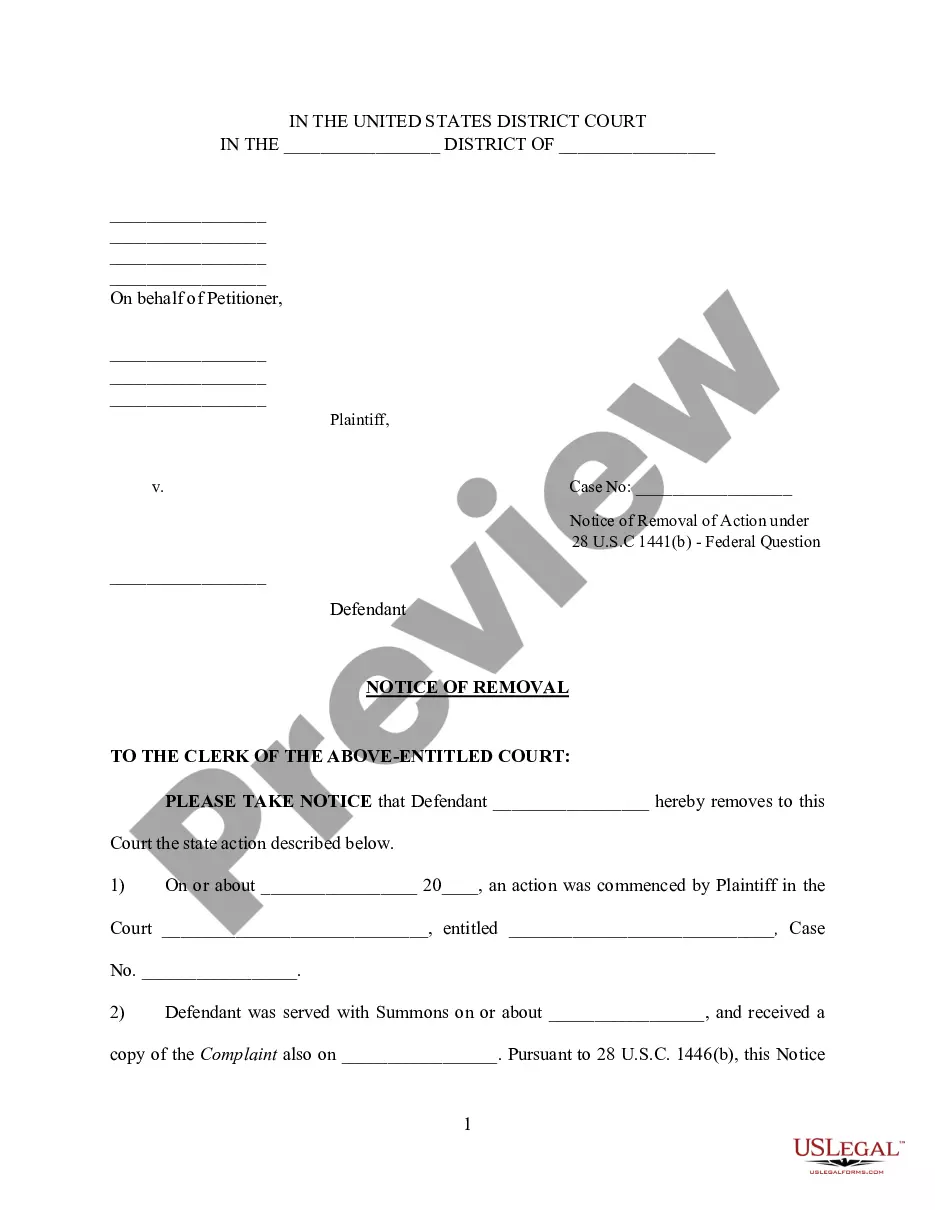

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

Purchased Assets and Excluded Assets This can manifest in the agreement in one of two ways - the agreement can list only the assets that the buyer will choose to purchase, or an agreement can state that the buyer will purchase all the assets of the business, excluding certain listed assets.

The Stock Purchase Agreement generally includes the following key provisions, the parties, the agreement to sell, consideration, representations, warranties, and indemnities, pre-closing covenants, conditions precedent to closing, and restrictive covenants.

What is included in a stock purchase agreement? Your company's name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing. The transaction's date, time and location.

?When you invest, you have the right to: Ask for and receive information from a firm about the work history and background of the person handling your account, as well as information about the firm itself. Receive complete information about the risks, obligations, and costs of any investment before investing.

Buyers and sellers use stock purchase agreements when they want to buy or sell stocks. They use asset purchase agreements when purchasing company assets, not through a merger or acquisition. Stock acquisitions, by nature, are also less expensive than asset purchases since they are not subject to additional taxes.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

You only have to fill up a simple application form and provide copies of KYC documents such as Aadhar card, PAN card, and Form-16. Additionally, you would be required to link your bank account with your share market Demat account so that you can use the funds in your linked bank account to purchase shares.

forstock merger is when shareholders trade the shares of a target company for shares in the acquiring firm's company. This type of merger is cheaper and more efficient because the acquiring company does not have to raise additional capital for the transaction.

Investor agreements generally cover any transaction that gives other people or businesses ownership interest in the company. This could be of interest now or into the future and could be in exchange for anything of value such as cash, labor, an asset, and more.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.