San Bernardino, California Loan Agreement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston A San Bernardino, California Loan Agreement is a legally-binding contract that outlines the terms and conditions of a loan transaction between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston. This agreement defines the responsibilities and obligations of both the borrower and the lenders involved in the loan transaction. The San Bernardino Loan Agreement typically includes key information such as the loan amount, interest rate, repayment terms, collateral, and any additional fees or charges associated with the loan. It serves as a vital document to ensure clarity and transparency between all parties involved. Different types of San Bernardino Loan Agreements may include: 1. Term Loan Agreement: This type of loan agreement establishes a fixed term for the loan, specifying the repayment schedule and interest rate for the agreed-upon period. It is commonly used for financing large projects or capital investments. 2. Revolving Line of Credit Agreement: A revolving line of credit agreement allows the borrower to access funds up to a predetermined limit, with the ability to borrow, repay, and re-borrow within the specified period. This type of loan agreement is often used for working capital needs or short-term financing. 3. Construction Loan Agreement: Construction loan agreements are designed specifically for funding construction projects. They outline the disbursement schedule, milestones, and conditions for releasing funds throughout the construction process. 4. Syndicated Loan Agreement: In a syndicated loan agreement, multiple lenders collectively provide funds to a borrower. This type of loan agreement is more complex and involves a lead lender coordinating with other participating lenders. Syndicated loans are often utilized for large-scale projects or acquisitions. Regardless of the type of loan agreement, the primary purpose is to establish a legally binding document that protects the interests of all parties involved. By clearly defining the terms and conditions, a San Bernardino Loan Agreement ensures a smooth borrowing process, reduces the risk of disputes, and establishes a framework for repayment.

San Bernardino California Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston

Description

How to fill out San Bernardino California Loan Agreement Between Laclede Gas Co., Mercantile Bank National Assoc., Bank Of America And Credit Suisse First Boston?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a San Bernardino Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the San Bernardino Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your San Bernardino Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston:

- Examine the content of the page you’re on.

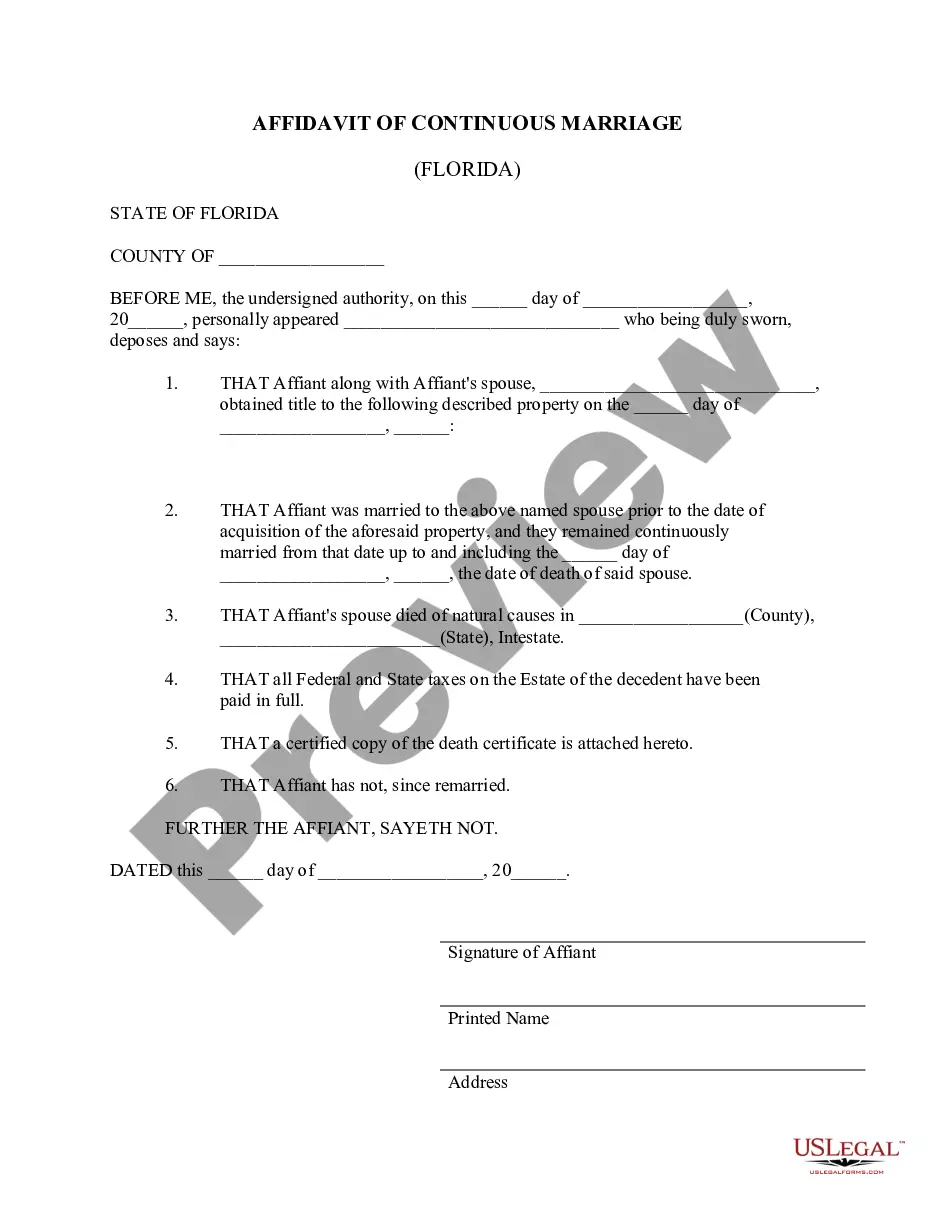

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Bernardino Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!