San Diego, located in Southern California, is a vibrant city known for its beautiful beaches, idyllic climate, and diverse cultural scene. It is home to several major companies and financial institutions, such as Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston. A loan agreement is a legal contract between a borrower and a lender that outlines the terms and conditions of a loan. In the case of San Diego, there are various types of loan agreements that can occur between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston. Some common loan agreements include: 1. Business Loan Agreement: This type of loan agreement is designed for businesses, such as Lacked Gas Co., seeking financial assistance for their operations, expansion, or other business-related needs. The agreement includes details about the loan amount, interest rate, repayment terms, and any collateral or guarantees required. 2. Real Estate Loan Agreement: Real estate loan agreements are used when individuals or companies, like Lacked Gas Co., are looking to purchase or develop properties in San Diego. The agreement outlines the loan amount, interest rate, repayment terms, responsibilities of the borrower, and details of the property being financed. 3. Equipment Financing Agreement: In this type of loan agreement, businesses like Lacked Gas Co. can secure funds to purchase or lease equipment necessary for their operations. The agreement specifies the loan amount, interest rate, repayment terms, and the equipment being financed. 4. Construction Loan Agreement: This agreement is commonly used in the real estate sector, particularly for construction projects. Lacked Gas Co. may require funding for constructing new facilities or improving existing ones. The loan agreement details the loan amount, interest rate, disbursement schedule, construction timeline, and other project-specific clauses. 5. Line of Credit Agreement: A line of credit is a flexible borrowing arrangement where Lacked Gas Co. can access funds as needed, up to a predetermined credit limit. The agreement stipulates the terms for accessing and repaying the borrowed amount and may require collateral or personal guarantees. These are just a few examples of the potential loan agreements that may exist between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston in San Diego, California. Each agreement will be tailored to meet the specific needs of the borrower and lender, ensuring transparency and legal protection for all parties involved.

San Diego California Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston

Description

How to fill out San Diego California Loan Agreement Between Laclede Gas Co., Mercantile Bank National Assoc., Bank Of America And Credit Suisse First Boston?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate San Diego Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid San Diego Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the San Diego Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston:

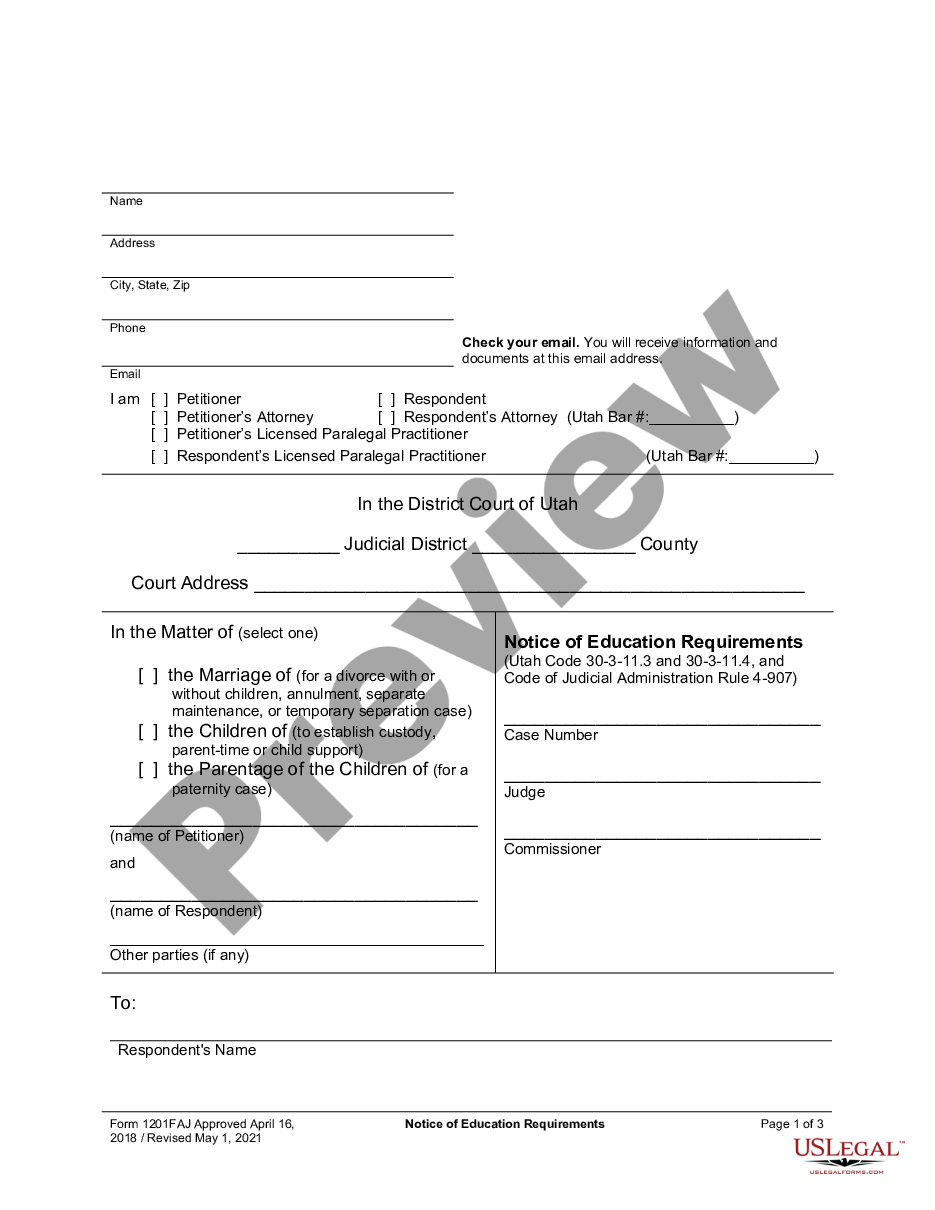

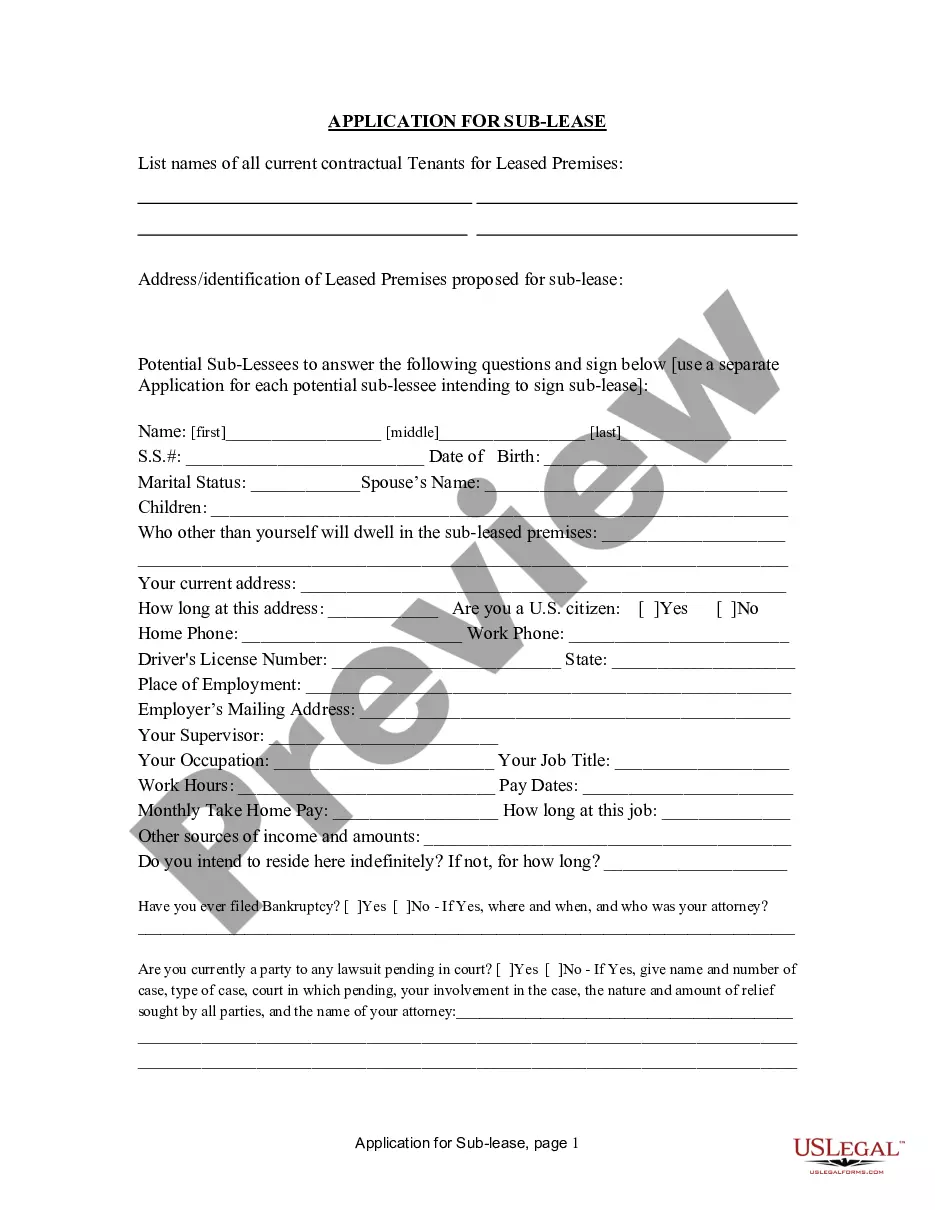

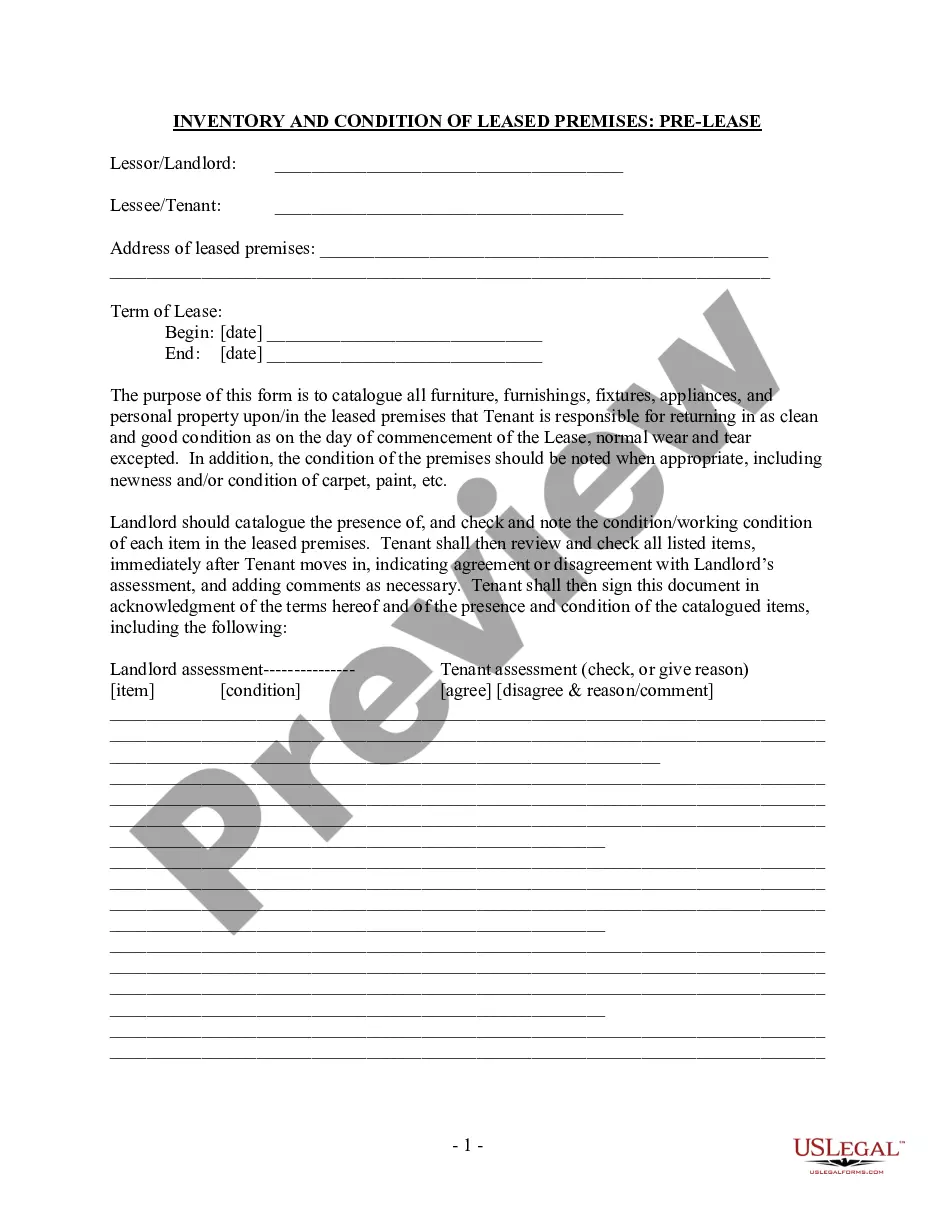

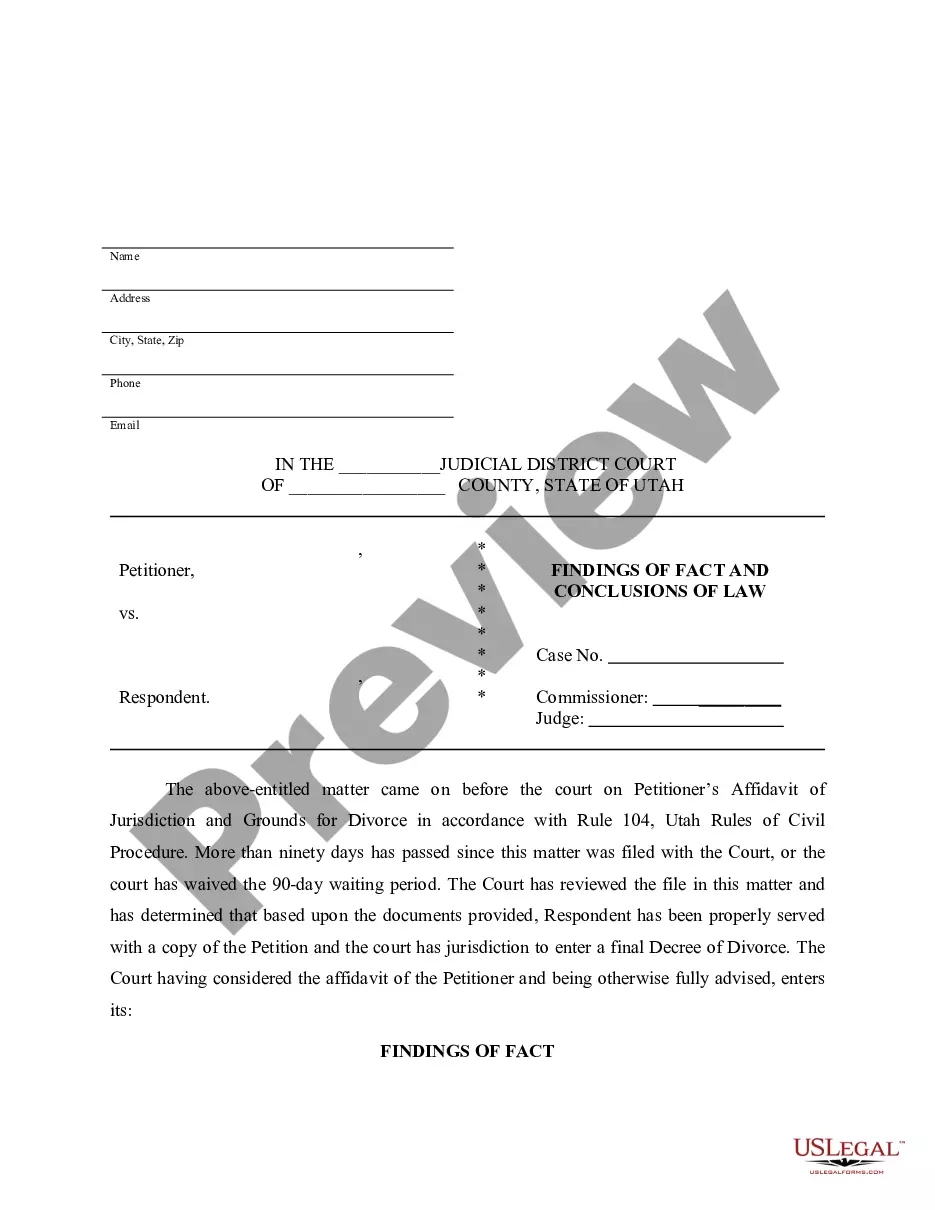

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!