Cuyahoga Ohio Escrow Agreement Public Offering is a legal agreement between Lorelei Corporation and Chase Manhattan Bank, wherein Lorelei Corporation intends to raise funds by offering its securities to the public. The agreement establishes an escrow account and outlines the terms and conditions for the investment, ensuring transparency and protection for both parties involved. Keywords: Cuyahoga Ohio, Escrow Agreement, Public Offering, Lorelei Corporation, Chase Manhattan Bank, securities, funds, escrow account, terms and conditions, investment, transparency, protection. Types of Cuyahoga Ohio Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank may include: 1. Corporate Bond Offering: In this type of public offering, Lorelei Corporation issues bonds to the public in exchange for funds. These bonds represent a loan from the investors to the corporation and carry an agreed-upon interest rate and maturity date. 2. Initial Public Offering (IPO): An IPO refers to the first sale of Lorelei Corporation's common shares to the public. This type of public offering allows the corporation to raise capital by offering ownership stakes to investors. 3. Secondary Offering: A secondary offering occurs when Lorelei Corporation, after its IPO, offers additional shares to the public. This type of offering aims to raise additional funds for the corporation's growth, expansion, or other financial needs. 4. Rights Offering: In a rights offering, existing shareholders of Lorelei Corporation are given the opportunity to purchase additional shares at a discounted price. This allows shareholders to maintain their proportional ownership in the corporation while providing a means for the corporation to raise capital. 5. Convertible Bond Offering: This type of public offering involves issuing bonds that can be converted into shares of Lorelei Corporation's common stock. Investors have the option to convert their bond investments into equity, providing them with potential future ownership in the corporation. These are some possible variations of Cuyahoga Ohio Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank, each tailored to meet specific financial objectives and goals.

Cuyahoga Ohio Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank

Description

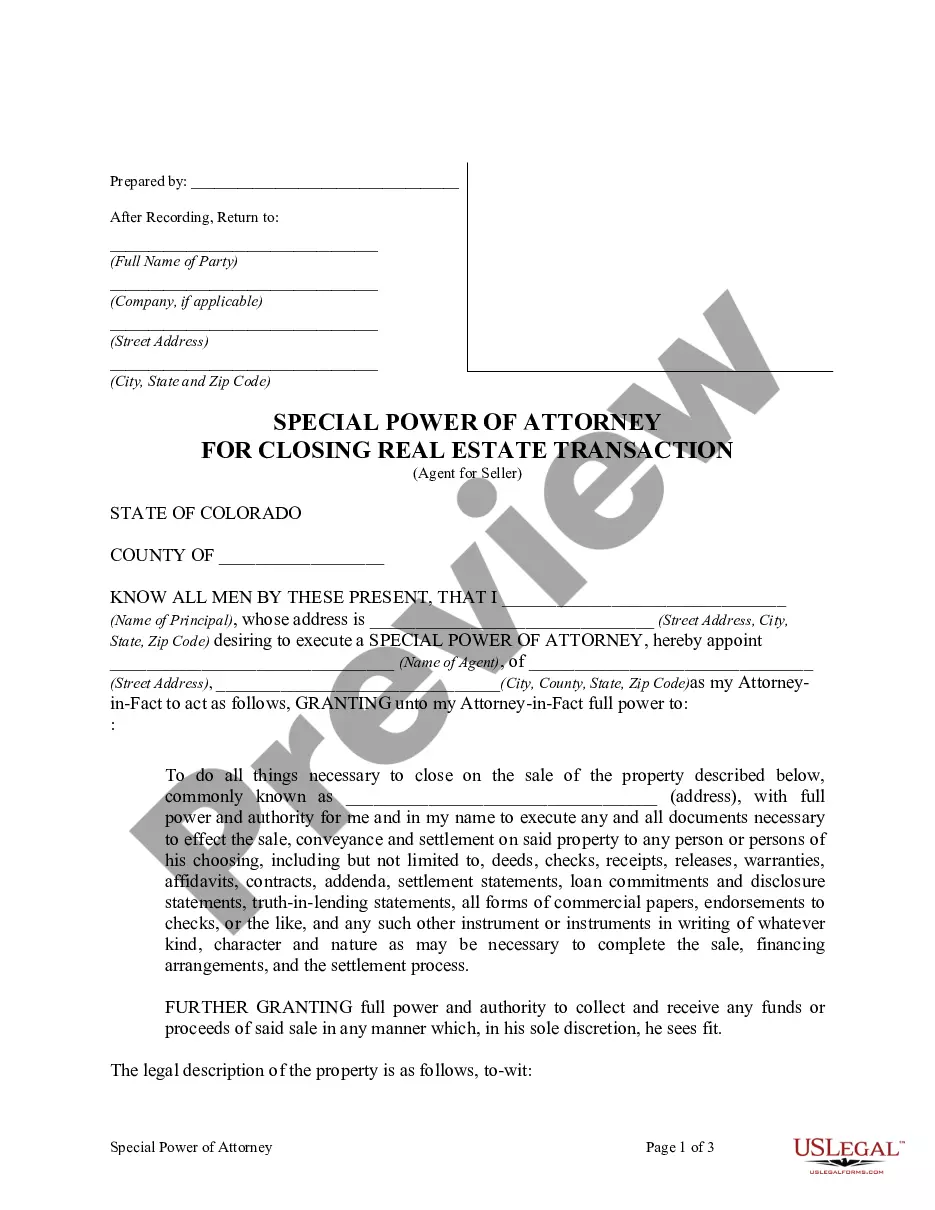

How to fill out Cuyahoga Ohio Escrow Agreement Public Offering Between Lorelei Corporation And Chase Manhattan Bank?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Cuyahoga Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Cuyahoga Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Cuyahoga Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Cuyahoga Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!