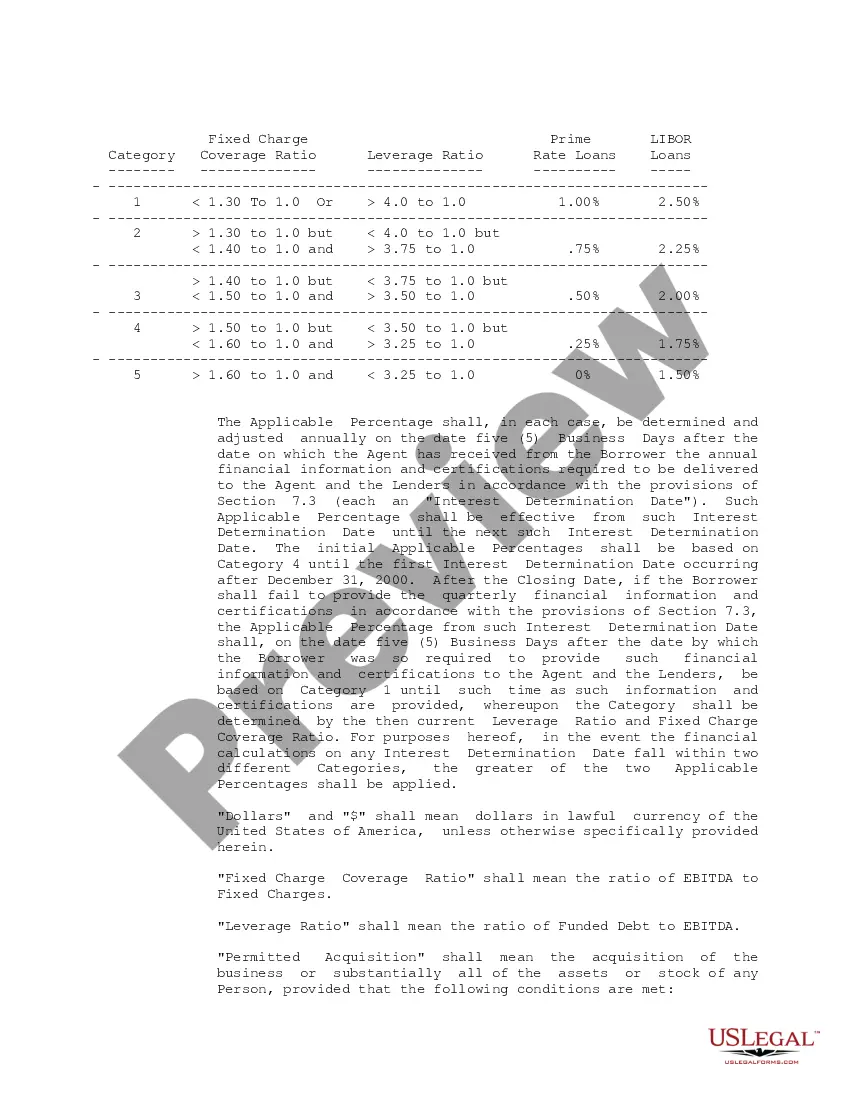

The Middlesex Massachusetts Revolving Credit Loan and Security Agreement is a legal document that establishes the terms and conditions for a revolving credit loan between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. This agreement outlines the rights, obligations, and responsibilities of both parties involved in the loan transaction. The primary purpose of the Middlesex Massachusetts Revolving Credit Loan and Security Agreement is to provide Dixon Ticonderoga Co. with access to a revolving line of credit, allowing them to borrow funds as needed for various business purposes. The loan is secured by collateral, which ensures that if Dixon Ticonderoga Co. fails to repay the borrowed amount, Dixon Ticonderoga, Inc. has the right to seize and sell the collateral to recover the outstanding debt. Within this agreement, several key terms and conditions are specified. These may include the loan principal amount, interest rates, repayment terms, fees, and charges associated with the credit facility. The agreement also outlines the events of default, such as missed payments or violation of any specified conditions, and the resulting consequences, which could include acceleration of the loan or legal action. There could be different types of Middlesex Massachusetts Revolving Credit Loan and Security Agreements offered by Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc., tailored to specific financial requirements or business needs. Some possible variations may include: 1. Middlesex Massachusetts Revolving Credit Loan and Security Agreement with Fixed Interest Rate: This type of agreement includes a predetermined interest rate that remains constant throughout the loan tenure, providing stability and predictability in interest expenses for the borrowing party. 2. Middlesex Massachusetts Revolving Credit Loan and Security Agreement with Variable Interest Rate: In this case, the interest rate may vary periodically based on an agreed-upon reference rate or index. Changes in the interest rate can impact the borrowing costs, providing potential advantages or disadvantages based on market conditions. 3. Middlesex Massachusetts Revolving Credit Loan and Security Agreement with Line of Credit Increase Option: This agreement allows Dixon Ticonderoga Co. to request an increase in the approved credit limit. The terms and conditions for this option, such as required financial statements or collateral valuation, would be outlined within the agreement. 4. Middlesex Massachusetts Revolving Credit Loan and Security Agreement with Guarantor: Dixon Ticonderoga Co. may require a third-party individual or entity to serve as a guarantor for the loan, providing an additional layer of security for Dixon Ticonderoga, Inc. in case of default. It is important to note that the specific terms and conditions of the Middlesex Massachusetts Revolving Credit Loan and Security Agreement may vary depending on the negotiations between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. It is recommended that both parties carefully review and understand the agreement before signing to ensure mutual understanding and compliance with all obligations.

Middlesex Massachusetts Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

How to fill out Middlesex Massachusetts Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Middlesex Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Middlesex Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Middlesex Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.:

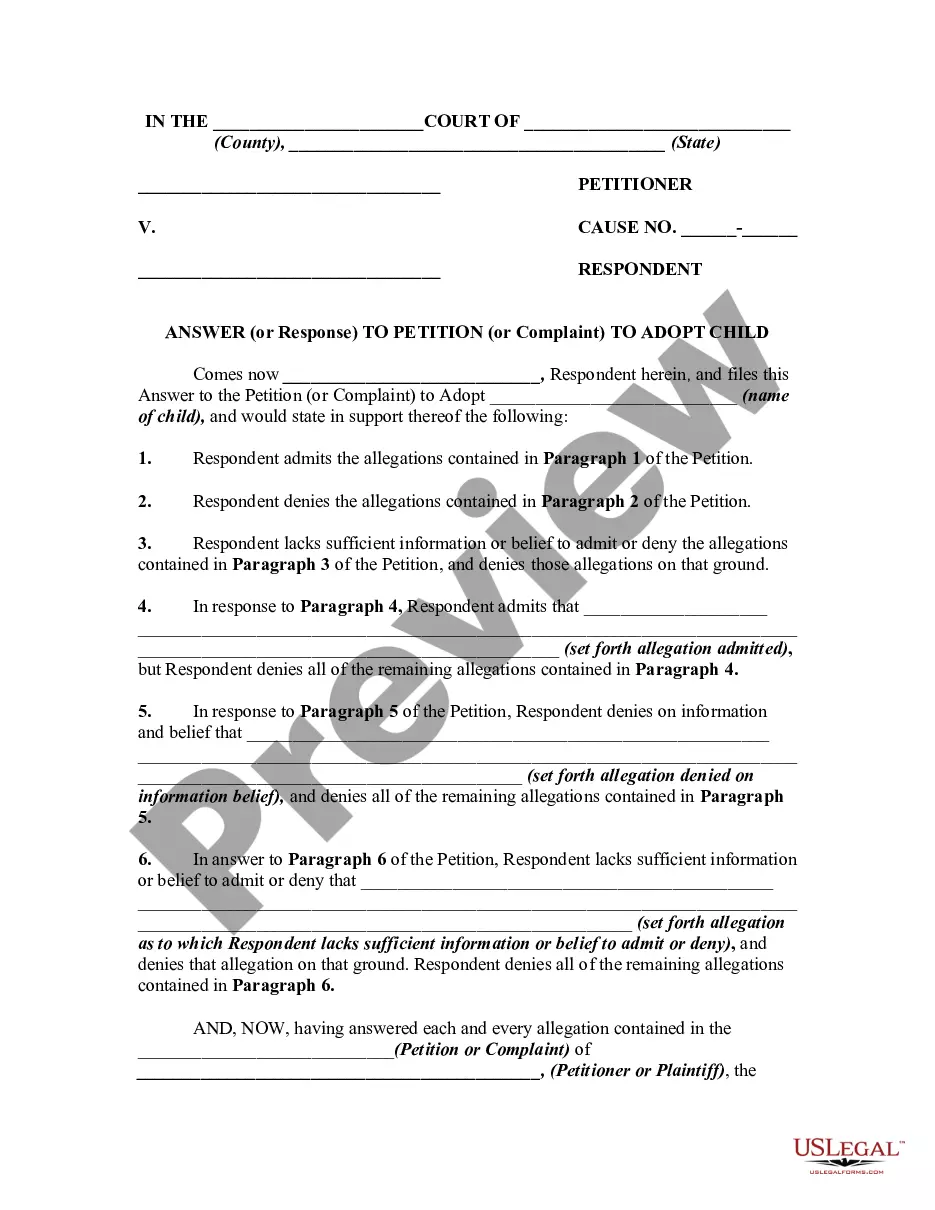

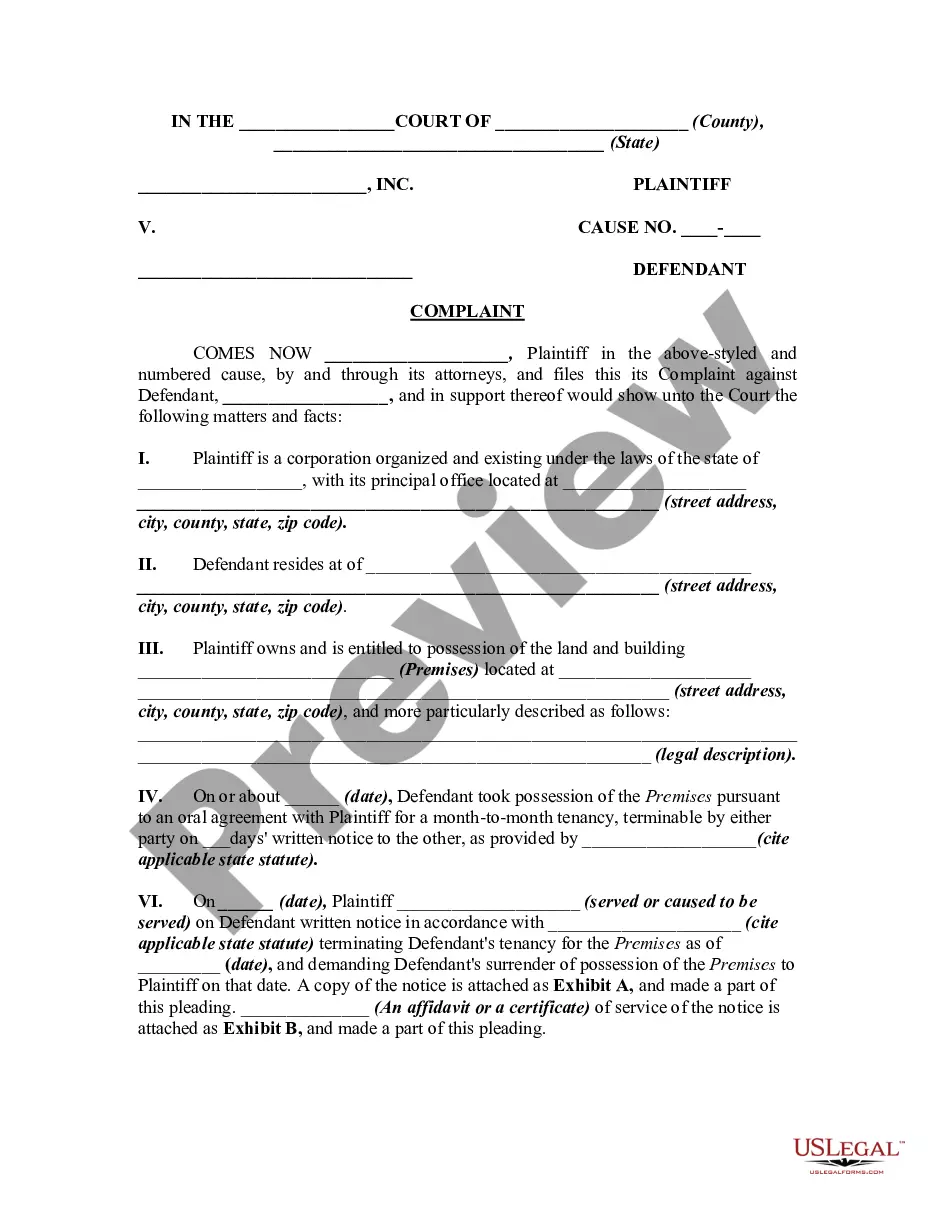

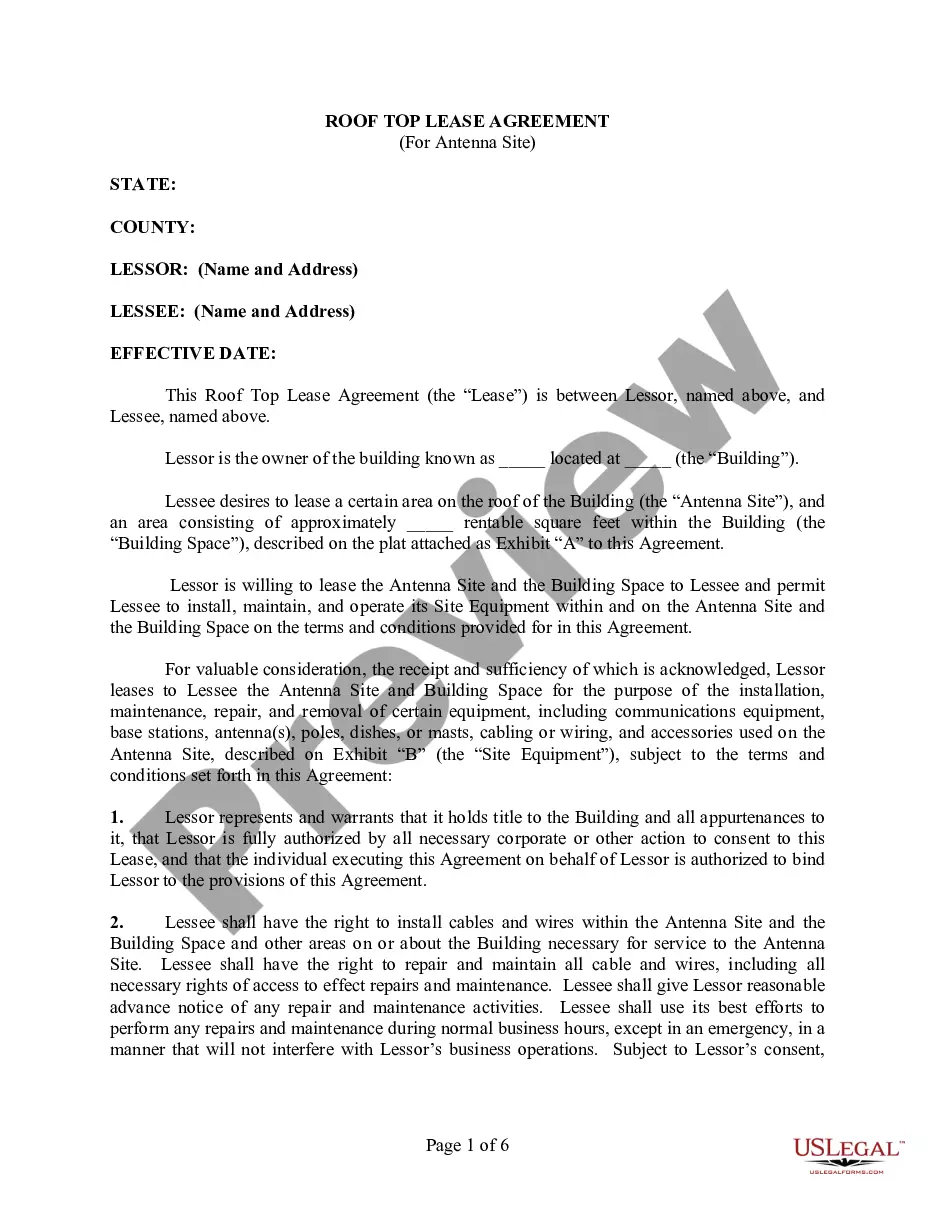

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!