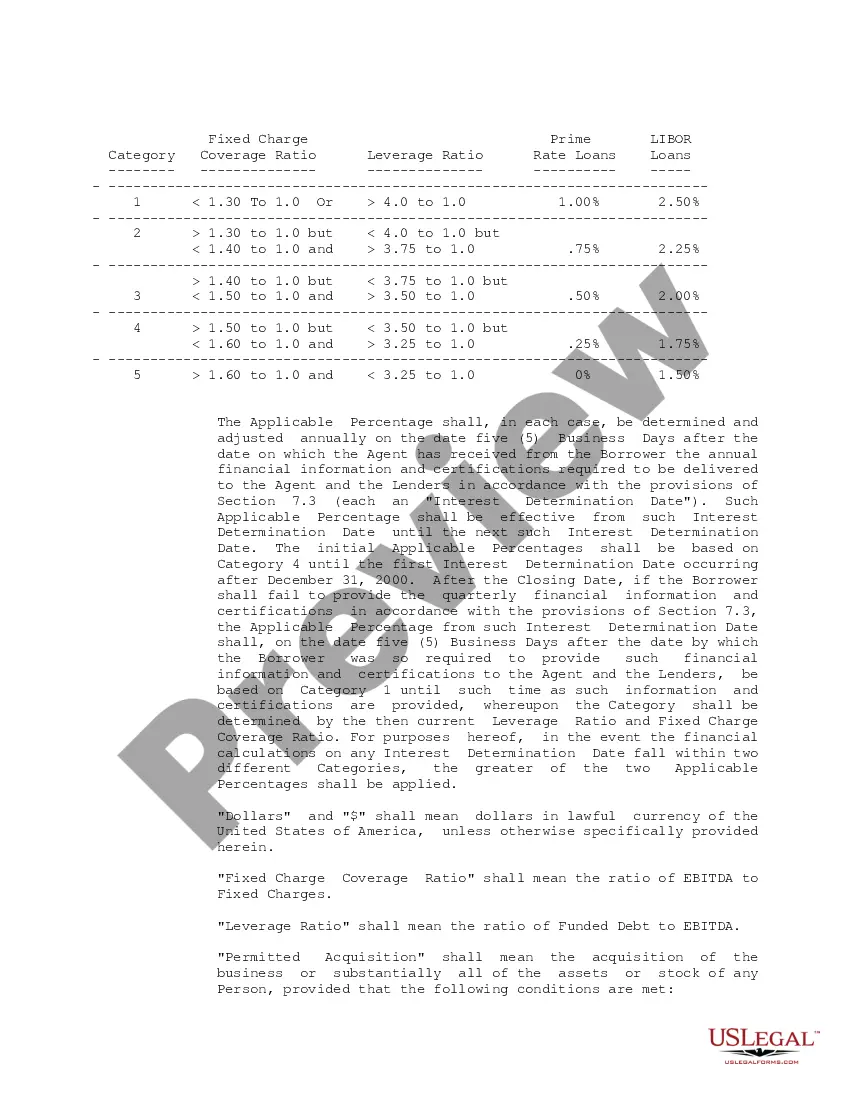

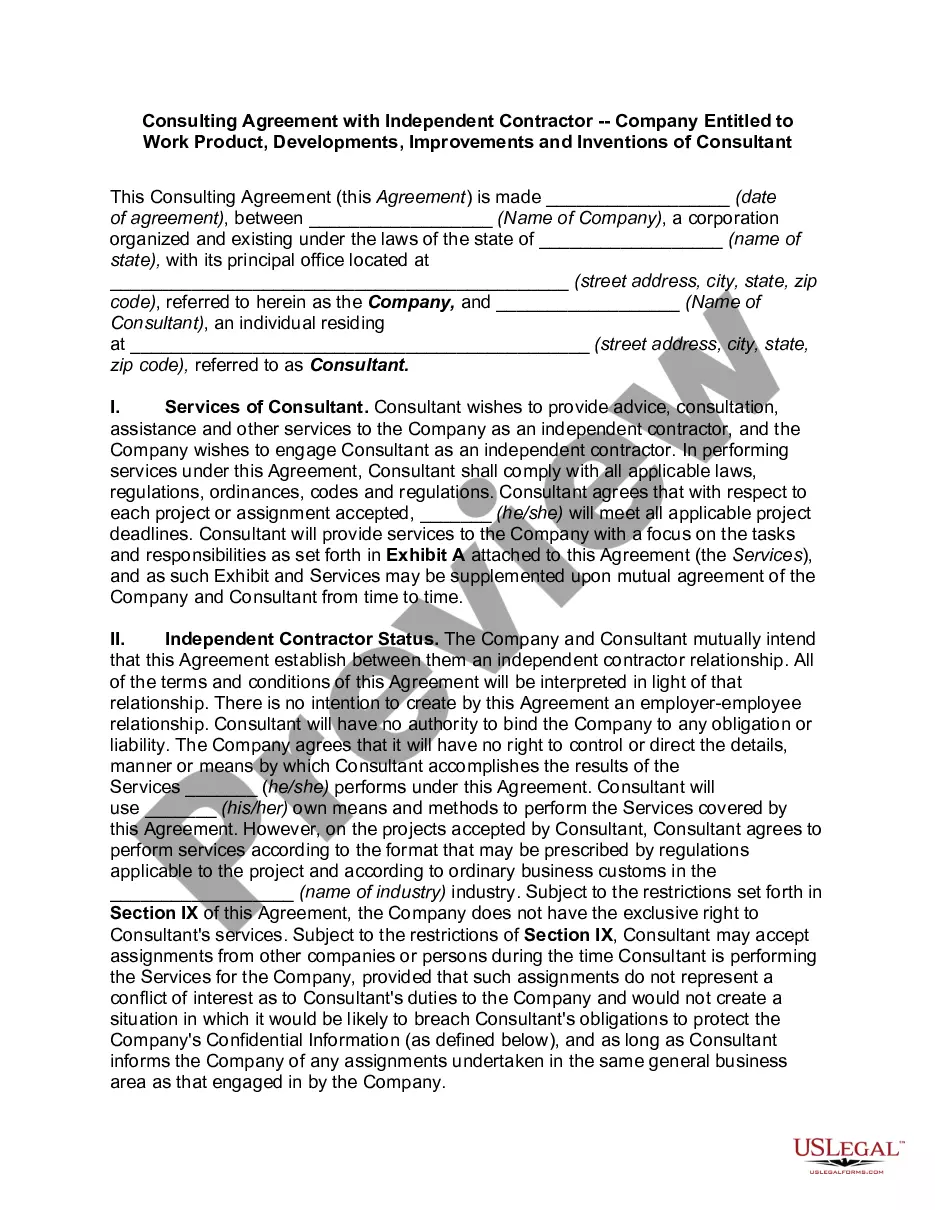

Montgomery Maryland Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.: Introduction: The Montgomery Maryland Revolving Credit Loan and Security Agreement is a legally binding document that outlines the terms and conditions of a loan and establishes a security interest for Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. It provides a framework for the revolving credit facility and protects the interests of both parties involved. This agreement enables Dixon Ticonderoga Co. to borrow funds as needed, while offering collateral to secure the loan. Types of Montgomery Maryland Revolving Credit Loan and Security Agreements: 1. Traditional Revolving Credit Loan Agreement: Under this agreement, Dixon Ticonderoga Co. can borrow funds up to a predefined limit, usually provided by a financial institution, for various business purposes. The terms include interest rates, repayment schedules, and other conditions mutually agreed upon by both parties. The company can borrow, repay, and re-borrow funds within the specified limit without requiring additional documentation. 2. Secured Revolving Credit Loan Agreement: This type of agreement involves providing collateral as security for the loan. By pledging company assets, such as equipment, inventory, or accounts receivable, Dixon Ticonderoga Co. ensures the lender's protection in case of default. Security interest allows the lender to seize and sell the pledged assets to recover their funds if necessary. 3. Personal Guarantee Revolving Credit Loan Agreement: In some instances, the agreement may require a personal guarantee from the shareholders or owners of the company. This guarantee holds them personally liable for the repayment of the loan, ensuring an added layer of security for the lender. In case of default, the lender can seek repayment from the personal assets of the guarantors. Contents of Montgomery Maryland Revolving Credit Loan and Security Agreement: 1. Parties Involved: Clearly identify the parties entering into the agreement — Dixon Ticonderoga Co. as the borrower and Dixon Ticonderoga, Inc. as the lender. Include their legal names, addresses, and contact information. 2. Loan Terms: Specify important loan details such as the principal amount, interest rate, repayment schedules, and any fees associated with the loan. Outline the interest calculation method, payment due dates, and acceptable payment methods. 3. Security Interest: Describe the collateral that Dixon Ticonderoga Co. pledges to secure the loan. This may include detailed information about the assets, their location, and how they will be maintained until the loan is repaid. 4. Conditions Precedent: List any conditions that need to be met before the loan can be accessed, such as providing financial statements, insurance requirements, or maintaining certain financial ratios. 5. Representations and Warranties: Include statements affirming the accuracy of information provided by both parties, ensuring they have the necessary authority to enter into the agreement, and disclosing any potential conflicts of interest. 6. Default and Remedies: Outline the events that would constitute a default, such as missed payments or breach of other obligations, and the remedies available to the lender, including acceleration of the loan or legal actions to recover the outstanding balance. Conclusion: The Montgomery Maryland Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. is a comprehensive and legally binding document that defines the terms and conditions of the revolving credit facility. By setting out the obligations, rights, and responsibilities of both parties, this agreement fosters a mutually beneficial financial relationship.

Montgomery Maryland Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

How to fill out Montgomery Maryland Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

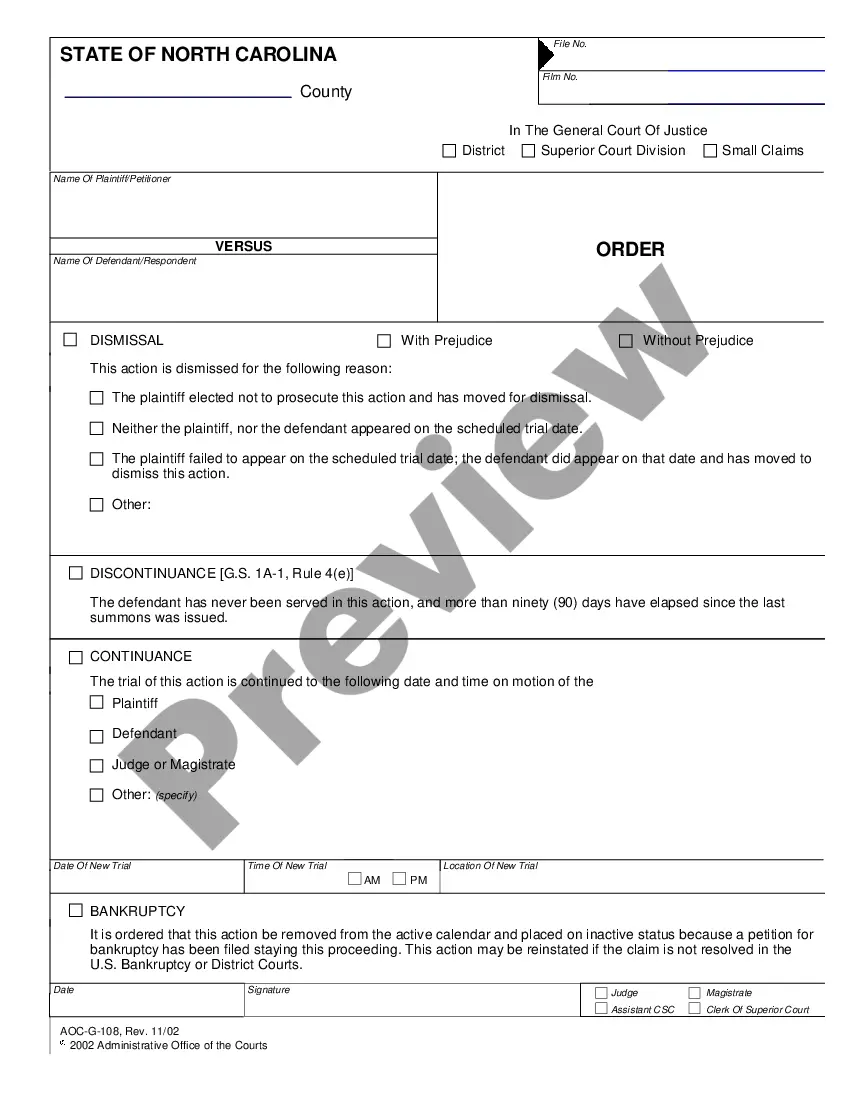

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

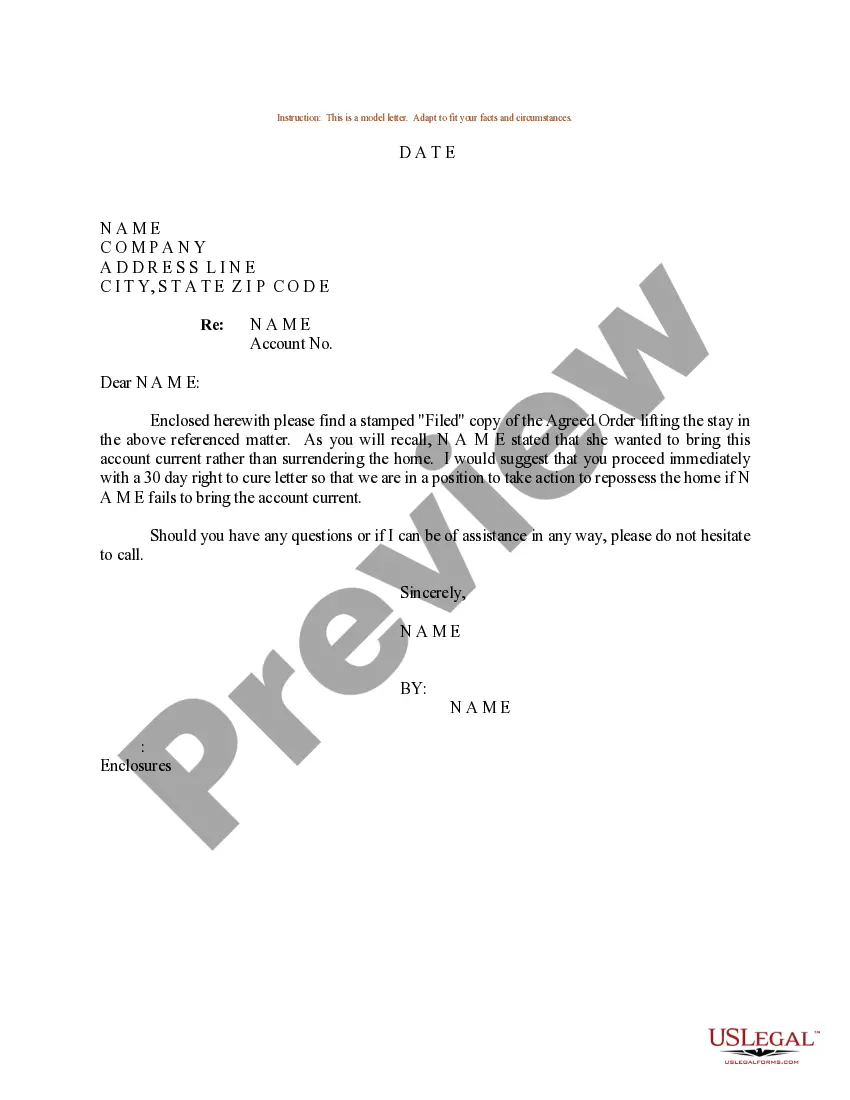

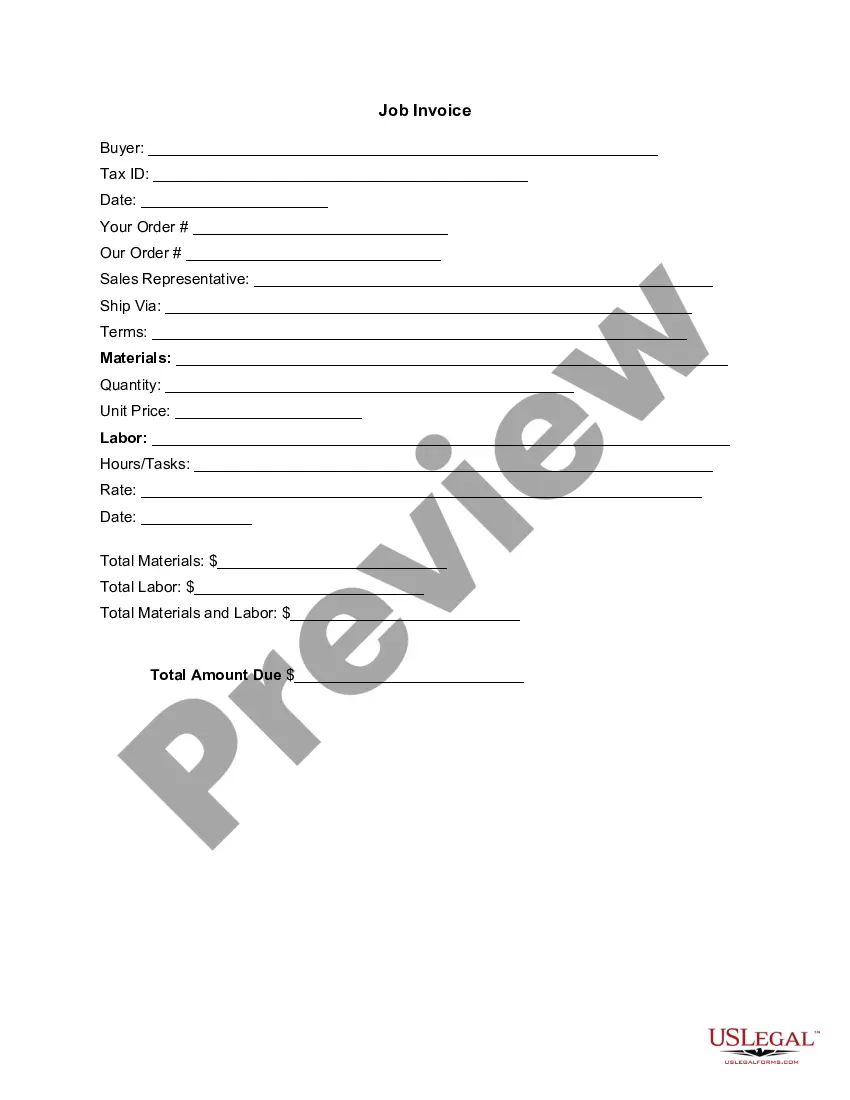

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Montgomery Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Montgomery Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!