The Nassau New York Term Loan Agreement refers to a legal document that outlines the terms and conditions for borrowing funds for a specified period in Nassau County, New York. This agreement is typically used in a business context where a borrower requires a substantial amount of capital over an extended period for various purposes, such as expanding operations, funding acquisitions, or meeting working capital needs. The Nassau New York Term Loan Agreement outlines the specifics of the loan, including the loan amount, interest rate, repayment schedule, and any collateral or security requirements. It also includes provisions regarding loan default, prepayment penalties, and any other terms and conditions agreed upon by the borrower and the lender. There may be different types of Nassau New York Term Loan Agreements, each tailored to the specific needs and circumstances of the borrower. Some of these variations may include: 1. Fixed-Rate Term Loan Agreement: This type of loan agreement establishes a fixed interest rate for the entire loan term, ensuring stable and predictable monthly payments over the agreed-upon period. 2. Floating-Rate Term Loan Agreement: In contrast to fixed-rate loans, floating-rate term loan agreements have variable interest rates that fluctuate based on a reference rate, such as the prime rate or LIBOR. This type of loan may be advantageous if interest rates are expected to decrease over time. 3. Secured Term Loan Agreement: This agreement requires the borrower to provide collateral, such as real estate, equipment, or inventory, as security for the loan. If the borrower defaults on the loan, the lender has the right to seize the collateral as a form of repayment. 4. Unsecured Term Loan Agreement: Unlike secured loans, unsecured term loan agreements do not require collateral. These agreements, however, may involve higher interest rates and stricter eligibility criteria to compensate for the increased risk taken by the lender. 5. Revolving Term Loan Agreement: A revolving term loan agreement allows the borrower to draw, repay, and redraw funds within a specified credit limit throughout the term of the loan. This type of agreement is commonly used to manage short-term financing needs, providing flexibility and immediate access to funds. When entering into a Nassau New York Term Loan Agreement, it is crucial for both the borrower and the lender to thoroughly review and understand the terms, obligations, and potential risks associated with the loan. Seeking legal and financial advice is highly recommended before signing such an agreement to ensure compliance with applicable laws and to protect the interests of all parties involved.

Nassau New York Term Loan Agreement

Description

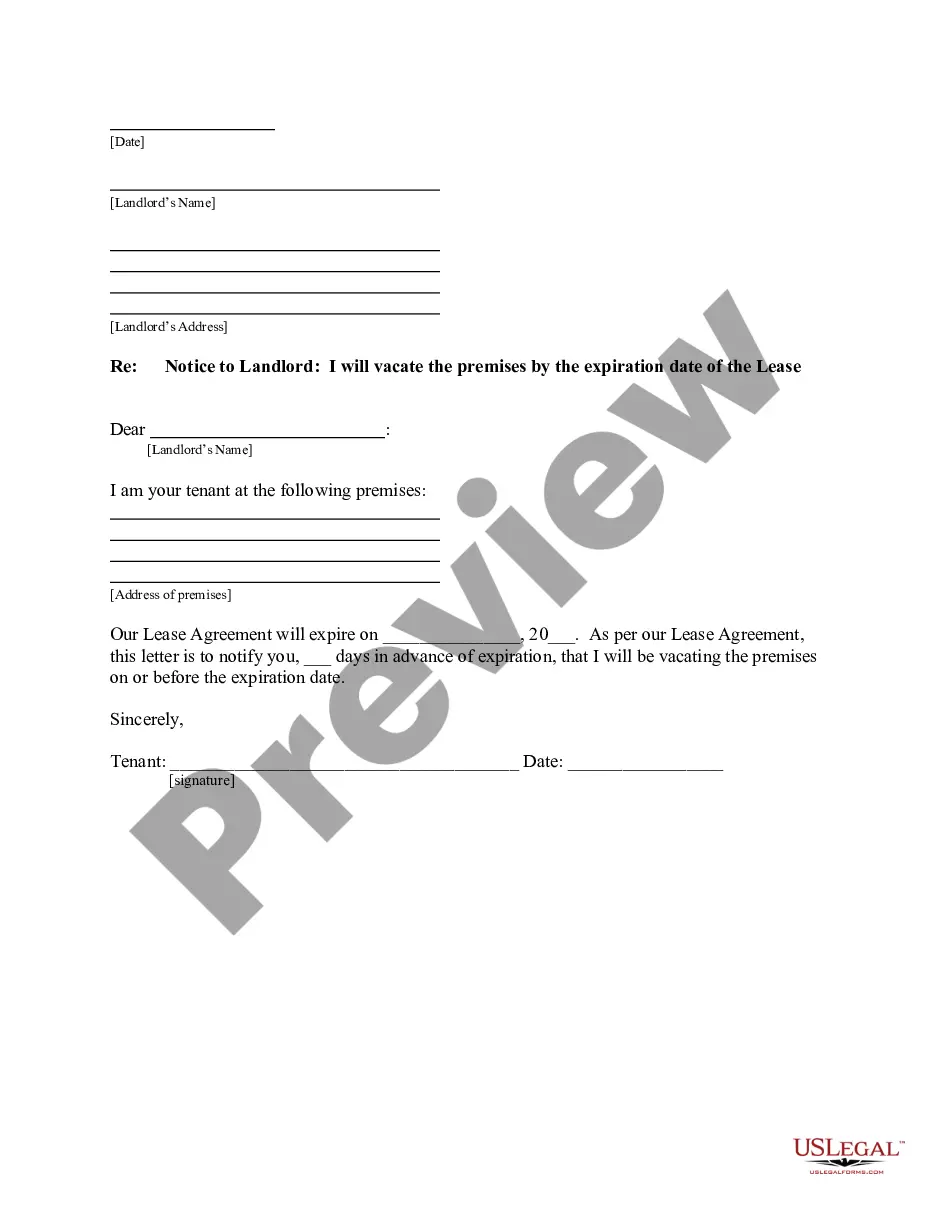

How to fill out Nassau New York Term Loan Agreement?

Are you looking to quickly create a legally-binding Nassau Term Loan Agreement or probably any other document to manage your own or corporate matters? You can go with two options: hire a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant document templates, including Nassau Term Loan Agreement and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, double-check if the Nassau Term Loan Agreement is adapted to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were looking for by using the search box in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Nassau Term Loan Agreement template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Classification or Types of Term Loan There are three main classification found in Term Loans: short-term term loan, intermediate term loan, and long-term term loan.

Key Takeaways. A term loan provides borrowers with a lump sum of cash upfront in exchange for specific borrowing terms. Borrowers agree to pay their lenders a fixed amount over a certain repayment schedule with either a fixed or floating interest rate.

How to Write a Loan Agreement Step 1 Loan Amount, Borrower, and Lender.Step 2 Payment.Step 3 Interest.Step 4 Expenses.Step 5 Governing Law.Step 6 Signing.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Loan Term Example Let's say you have a 15-year fixed-rate mortgage. The loan term will then be 15 years. During this time, the loan must be paid off or refinanced during the term. Your loan can last for any length of time it just needs to be agreed upon by the lender and you as the borrower.

The Pro Note is valid for only 3 years from the date of execution. There is no limitation or ceiling with respect to the AMOUNT. If the borrower pays a part repayment then limitation of 3 years can be from either the date of execution or the last date of payment/acknowledgement whichever is later.

Key Takeaways A loan may be secured by collateral such as a mortgage or it may be unsecured such as a credit card. Revolving loans or lines can be spent, repaid, and spent again, while term loans are fixed-rate, fixed-payment loans.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.