The Hennepin Minnesota Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund is a comprehensive strategy aimed at restructuring and aligning the operations and resources of these two entities. This plan seeks to optimize the utilization of their assets, enhance investor returns, and streamline their business operations in Hennepin County, Minnesota. As part of the Hennepin Minnesota Plan of Reorganization, several key aspects are addressed. First and foremost, the plan involves a thorough assessment of the current financial standing and investment portfolio of both Franklin Gold Fund and Franklin Gold and Precious Metals Fund. This evaluation lays the groundwork for identifying areas of synergies, weaknesses, and opportunities for growth. Upon analysis, the plan may involve reorganizing the investment holdings within the funds, potentially merging certain assets or reallocating resources to maximize overall performance. The objective is to achieve a more diversified portfolio, actively managed to respond to market dynamics and fluctuations in precious metals prices. The Hennepin Minnesota Plan of Reorganization also focuses on implementing efficient cost management practices and identifying potential cost-saving measures. By reducing unnecessary expenditures and optimizing operational efficiencies, both funds can enhance their competitive position and generate higher returns for their investors. Furthermore, the plan may include a revised marketing strategy to promote the funds and attract new investors. This could involve targeting specific geographical regions, investor profiles, or demographic segments to expand the investor base and increase the funds' visibility in the market. It is important to note that there might be different types or variations of the Hennepin Minnesota Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund. These variations could include specific sub-strategies catered to different market conditions or investment goals. For example, a variant of the plan might be focused on capital preservation during economic downturns, while another variant could be designed to maximize growth during periods of economic stability or positive market trends. In conclusion, the Hennepin Minnesota Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund is a comprehensive and proactive approach to revitalize the funds, optimize their portfolios, and enhance investor returns. By leveraging synergies, implementing cost-effective practices, and adapting to market conditions, this plan aims to position both funds as leaders in the precious metals' investment landscape.

Hennepin Minnesota Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund

Description

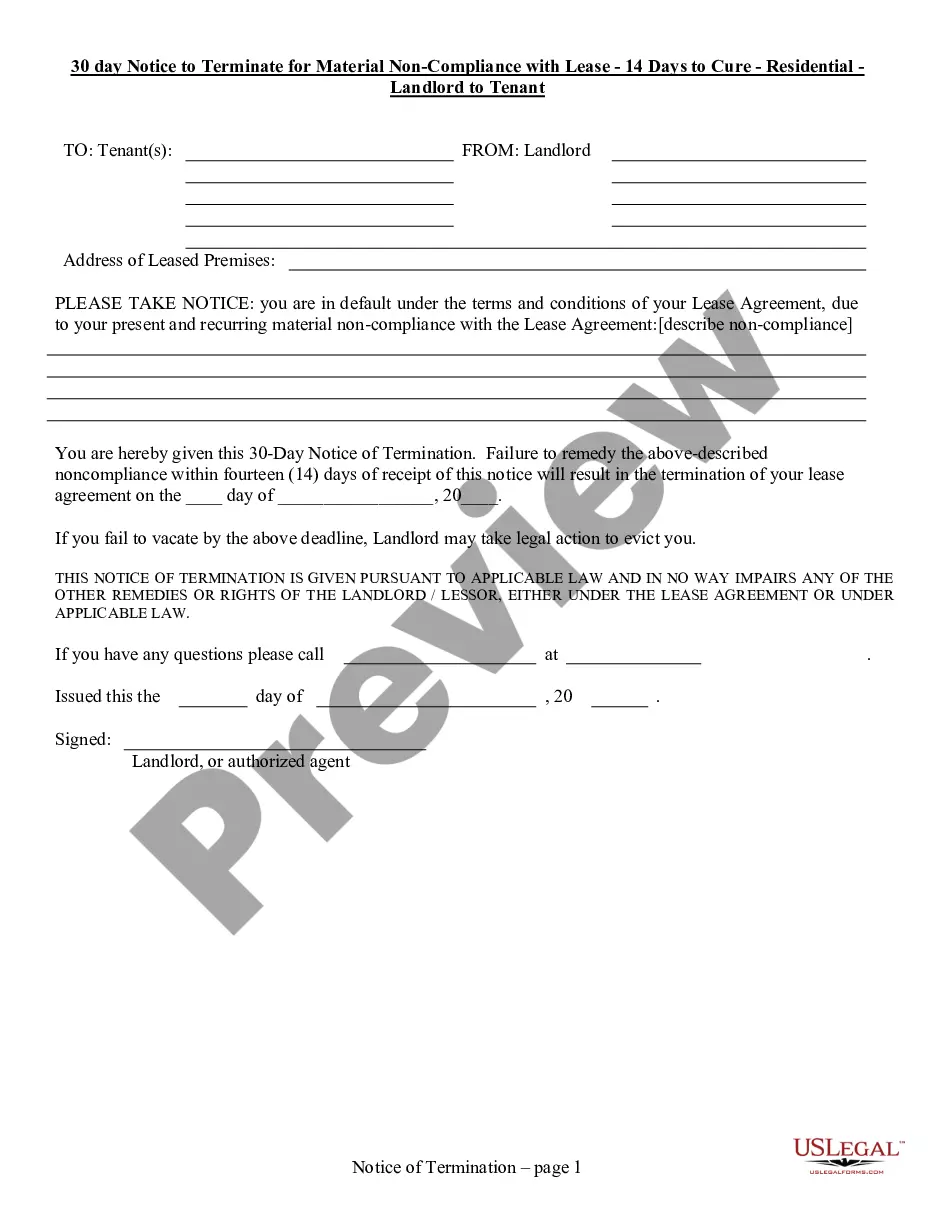

How to fill out Hennepin Minnesota Plan Of Reorganization Between Franklin Gold Fund And Franklin Gold And Precious Metals Fund?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Hennepin Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Hennepin Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Although Vanguard does not offer a pure gold fund, it does offer a fund that invests around one-quarter of its portfolio in precious metals and mining companies, providing indirect exposure to this market: The Vanguard Global Capital Cycles Fund (VGPMX).

Fidelity offers ETFs and stocks for gold and silver mining companies, as well as other investment vehicles to help you gain exposure to the metals market. In addition, it also offers physical direct investment into gold, silver, or platinum.

Fidelity® Select Gold PortfolioFSAGX.

How Much of Your IRA Should Include Precious Metals? If you decide to invest in a precious metal IRA, you should do so conservatively. Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals.

The Fidelity Select Gold Portfolio fund falls in Morningstar's equity precious metals category. Funds in this category typically invest in stocks related to gold and other precious metals, which might include companies that mine, explore for, market or process these precious metals.

There are 15 precious metals ETFs that trade in the United States, excluding inverse and leveraged ETFs as well as funds with less than $50 million in assets under management (AUM). These ETFs are invested in physical precious metals rather than in shares of precious metals mining companies.

The fund seeks capital appreciation by investing at least 80% of its net assets in the securities of companies around the world that mine, process or deal in gold or other precious metals such as silver, platinum and palladium. The fund has a secondary goal of current income.

Franklin Templeton Investments Headquarters in San Mateo, CaliforniaKey peopleJennifer M. Johnson (President and CEO) Gregory E. Johnson (Executive Chairman of the Board) Rupert H. Johnson Jr. (Vice ChairmanProductsMutual funds Retirement PlanningRevenueUS$8.43 billion (2021)Operating incomeUS$1.88 billion (2021)14 more rows

Overall, Franklin Gold & Precious Metals A ( FKRCX ) has a high Zacks Mutual Fund rank, and in conjunction with its comparatively strong performance, worse downside risk, and lower fees, this fund looks like a good potential choice for investors right now.

Definition: Precious Metals ETFs invest in gold, silver, platinum, and palladium. Depending on preference, the funds in this category offer futures-based exposure as well as physical exposure.