Dallas, Texas Joint Filing of Rule 13d-1(f)(1) Agreement: An Overview In Dallas, Texas, the Joint Filing of Rule 13d-1(f)(1) Agreement refers to a legally binding contract between two or more parties who collectively file a joint statement on Schedule 13D or Schedule 13G with the United States Securities and Exchange Commission (SEC). This agreement is an essential requirement for certain shareholders or investor groups holding more than 5% of a publicly traded company's outstanding shares. When multiple parties join forces to jointly acquire, sell, or manage a significant ownership stake in a company, they must file a joint statement with the SEC. This filing aims to bring transparency and safeguard the interests of both the company and its other shareholders. The Joint Filing of Rule 13d-1(f)(1) Agreement includes crucial information such as the names and addresses of the filing parties, the nature of their business or relationship, the purpose of their joint ownership, the details of the securities being acquired, and any additional relevant information required by the SEC. Keywords to Consider: Dallas, Texas, Joint Filing, Rule 13d-1(f)(1), Agreement, SEC, Schedule 13D, Schedule 13G, shareholders, investor groups, ownership stake, filing parties, transparency. Different Types of Dallas, Texas Joint Filing of Rule 13d-1(f)(1) Agreement: 1. Acquisition Agreement: This type of agreement is made when multiple parties decide to jointly acquire a significant ownership stake in a company. It outlines the terms and conditions of the joint ownership, including financial contributions, voting rights, decision-making processes, and any specific objectives or goals the parties aim to achieve together. 2. Sale Agreement: In some cases, joint filing occurs when parties collectively sell their holdings in a publicly traded company. This agreement governs the terms of the sale, including share pricing, distribution of proceeds, and any post-sale obligations or restrictions. 3. Management Agreement: Joint filings can also occur when parties collectively seek to influence or manage the operations of a company. This type of agreement includes provisions related to the appointment of representatives, decision-making authority, governance structures, and long-term strategic plans. 4. Voting Agreement: Shareholders or investor groups may enter into a joint filing agreement specifically to consolidate their voting power on certain matters concerning the company. This agreement outlines the terms and conditions of the collective voting rights, alignment of voting preferences, and coordination of actions during shareholder meetings. Note: While these categories highlight different objectives of joint filings, it is essential to consult legal counsel or refer to specific agreements to understand the intricacies and details unique to each arrangement.

Dallas Texas Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Dallas Texas Joint Filing Of Rule 13d-1(f)(1) Agreement?

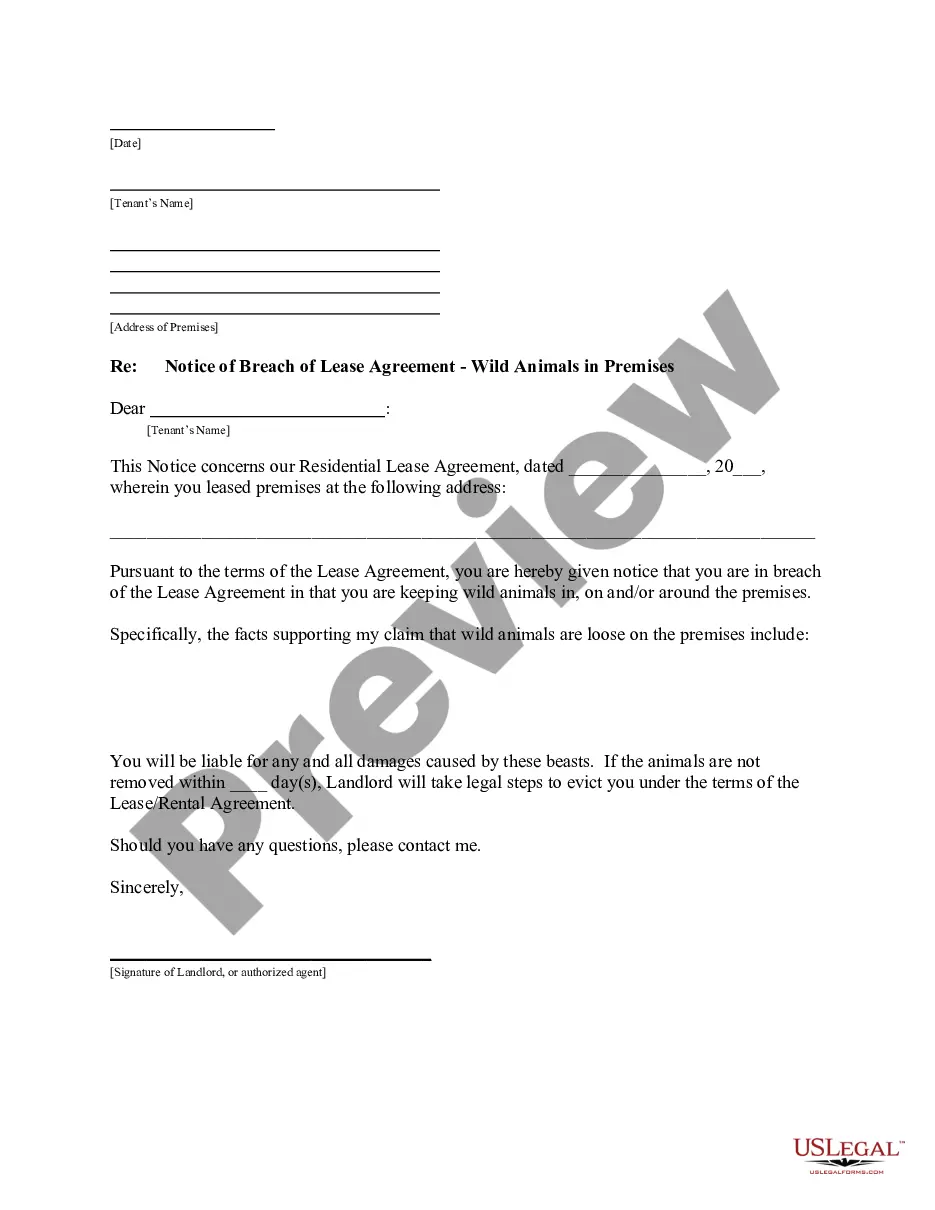

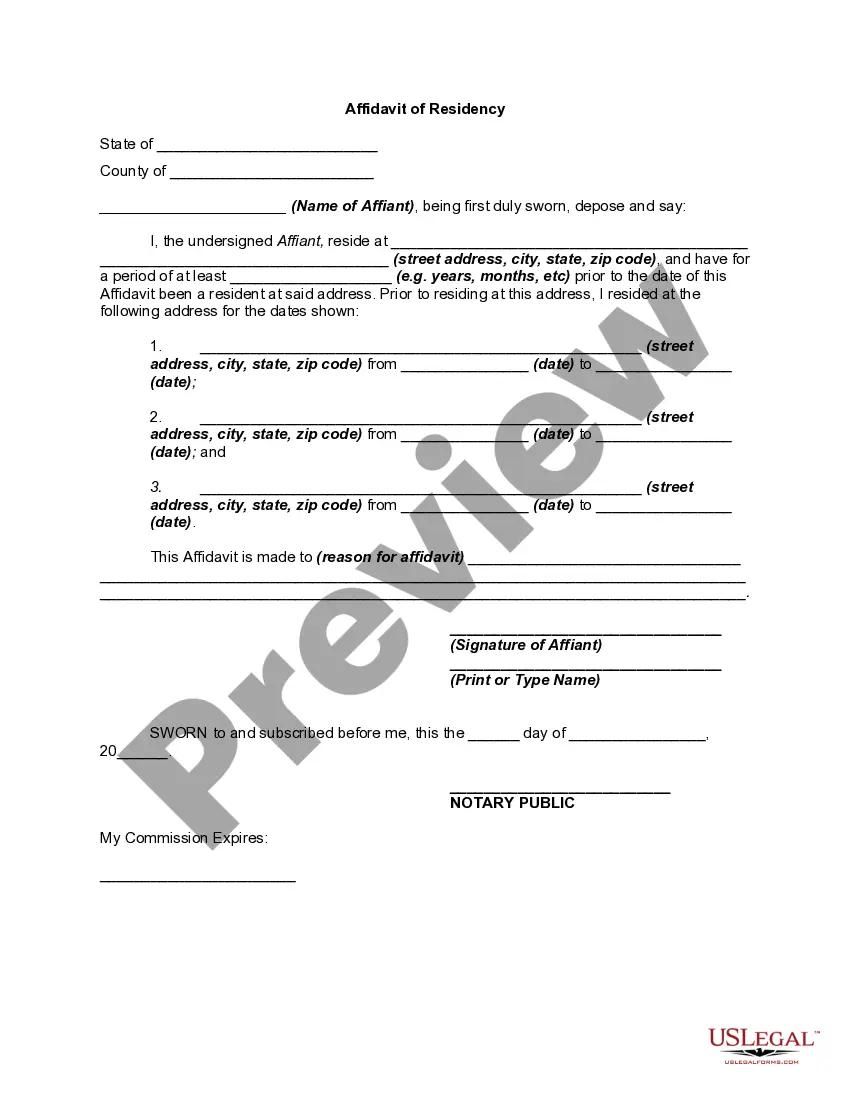

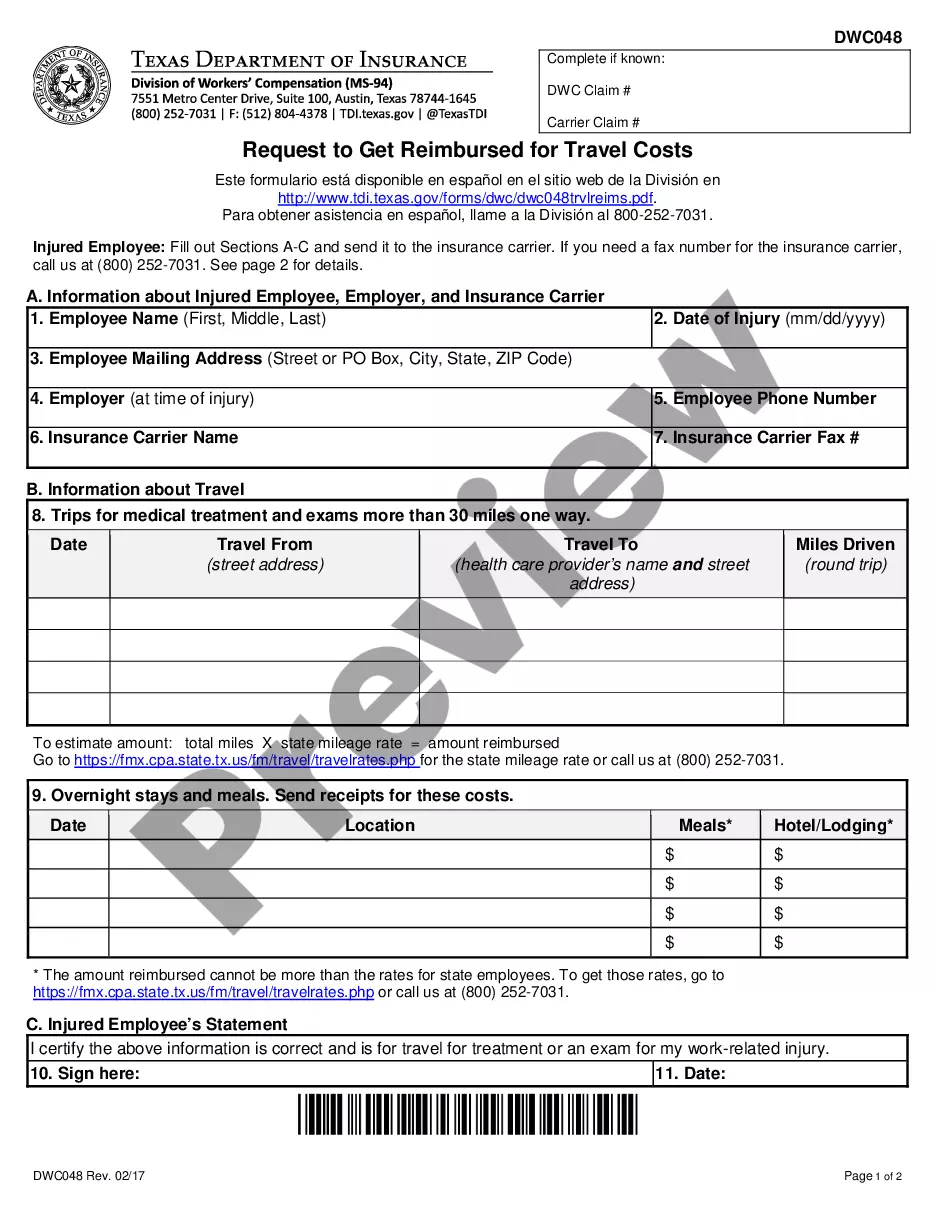

If you need to get a trustworthy legal form supplier to get the Dallas Joint Filing of Rule 13d-1(f)(1) Agreement, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to locate and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Dallas Joint Filing of Rule 13d-1(f)(1) Agreement, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Dallas Joint Filing of Rule 13d-1(f)(1) Agreement template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Dallas Joint Filing of Rule 13d-1(f)(1) Agreement - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Rule 13d-2(b) amendments to Schedule 13G would need to be filed five business days after the month in which a reportable change occurs instead of 45 days after calendar year-end (but the Proposed Amendments raise the threshold for what constitutes a reportable change from any change to a material change);

The Schedule 13D Filing is required under Rule 13D of the U.S. Securities and Exchange Commission (SEC). Anyone who purchases more than 5% of a company's publicly traded securities. The securities are either equity or debt-based. must submit the form to the SEC.

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Insofar as Schedule 13D amendments are concerned, the current requirement is that an amendment must be filed promptly after a material change in any facts previously reported. The Proposing Release would require that a Schedule 13D amendment be filed on the first business day after a material change.

The initial Schedule 13G is due within 45 calendar days after the calendar year in which the person becomes obligated to file and amendments are due within 45 calendar days after the end of each calendar year thereafter to report any change in the information contained in the Schedule 13G.

Section 13(d)(3) of the Exchange Act provides that when two or more persons act as a group for the purpose of acquiring, holding, or disposing of securities of an issuer, the group is deemed a person. This means that if the group members collectively exceed 5 percent beneficial ownership, the group will have a

Under Section 13 of the Exchange Act, an investment manager may have an obligation to file reports with the U.S. Securities and Exchange Commission (the SEC) on Schedule 13D, Schedule 13G, Form 13F, and/or Form 13H, each of which is discussed in more detail below.

A material change includes any material increase or decrease in the percentage of the class of securities you are deemed to "beneficially own." For instance, if you manage more than 5% in the shares of an issuer and the percentage managed increases or decrease by more than 1% (whether through a transaction or other

Section 13(f)(6)(A) of the Exchange Act defines the term institutional investment manager to include any person (other than a natural person) investing in, or buying and selling, securities for its own account, and any person (including a natural person) exercising investment discretion with respect to the account of