A Suffolk New York Joint Filing of Rule 13d-1(f)(1) Agreement is a legal agreement that involves multiple parties joining together to file a joint report with the Securities and Exchange Commission (SEC) in accordance with Rule 13d-1(f)(1). This agreement is typically used when two or more individuals or entities collectively have beneficial ownership of more than 5% of a class of equity securities. The purpose of this agreement is to ensure compliance with SEC regulations and to provide transparency regarding the collective ownership and intentions of the parties involved. By filing a joint report, the parties can consolidate their respective ownership stakes and voting rights, as well as disclose any shared plans or intentions they may have in regard to the securities in question. The Suffolk New York Joint Filing of Rule 13d-1(f)(1) Agreement serves to streamline the reporting process and reduce duplicate filings. It allows the parties to present a unified front and present a clear and concise picture of their combined interests. This is particularly useful when the parties are acting in concert or have a common investment strategy. Different types of Suffolk New York Joint Filing of Rule 13d-1(f)(1) Agreements can include agreements between hedge funds, institutional investors, or activist investors who have collectively acquired a substantial stake in a company. These agreements can be strategic in nature, as they allow the parties to leverage their combined influence and negotiate with the company in question or influence its management and policies. By utilizing relevant keywords such as "Suffolk New York," "joint filing," "Rule 13d-1(f)(1) Agreement," "SEC compliance," "equity securities," "beneficial ownership," "voting rights," "transparency," "aggregate ownership," "investment strategy," "hedge funds," "activist investors," and "institutional investors," this detailed description provides an understanding of the nature, purpose, and importance of the Suffolk New York Joint Filing of Rule 13d-1(f)(1) Agreement and its different variations.

Suffolk New York Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Suffolk New York Joint Filing Of Rule 13d-1(f)(1) Agreement?

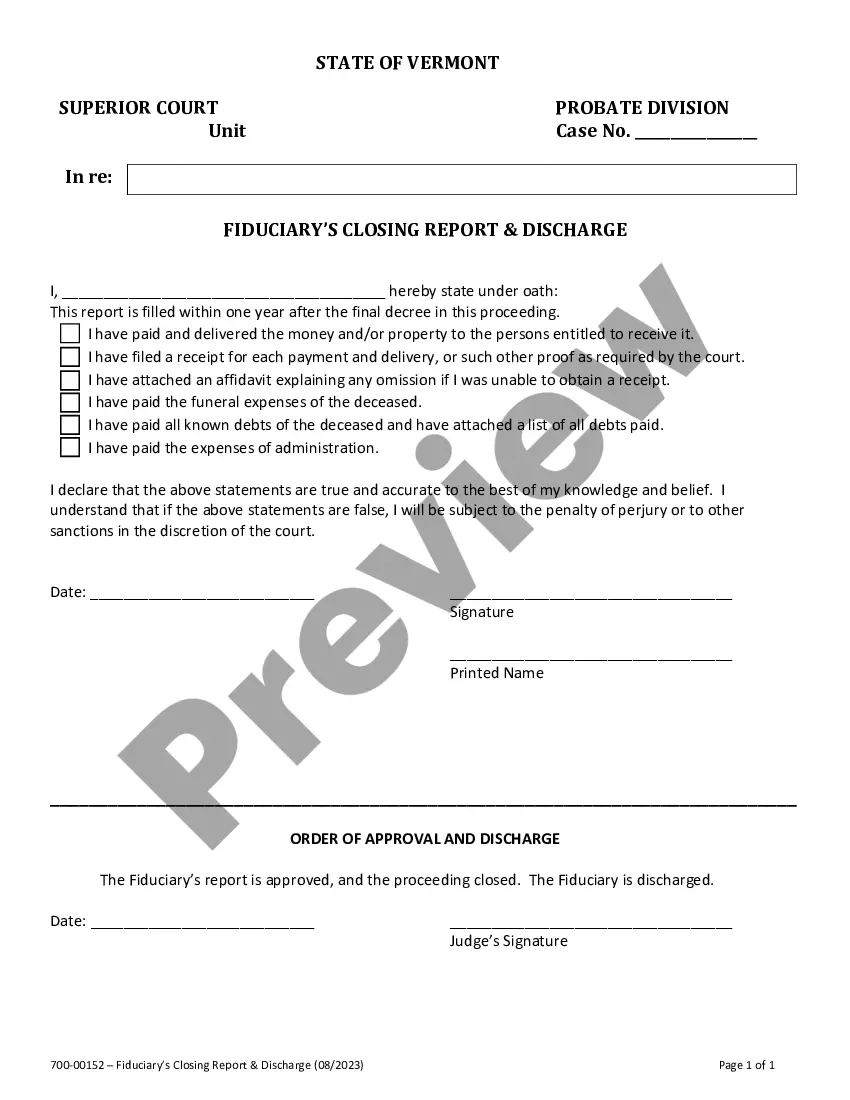

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Suffolk Joint Filing of Rule 13d-1(f)(1) Agreement is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Suffolk Joint Filing of Rule 13d-1(f)(1) Agreement. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Joint Filing of Rule 13d-1(f)(1) Agreement in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Key Takeaways. Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

Schedule 13G is available to specified institutional investors (Qualified Institutional Investors) that acquired or hold the securities in the ordinary course of business and without a purpose or effect or in connection with a transaction having a purpose or effect, of changing or influencing control of the issuer.

Securities and Exchange Commission (SEC) Schedule 13G form is used to report a party's ownership of stock which exceeds 5% of a company's total stock issue. 3feff Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements.

Amendments. Under existing Rule 13d-2(b), a Passive Investor that has a Schedule 13G on file must file an annual amendment within 45 days after the end of each calendar year if, as of year-end, there are any changes in the information disclosed in the previous filing.

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

The initial Schedule 13G is due within 45 calendar days after the calendar year in which the person becomes obligated to file and amendments are due within 45 calendar days after the end of each calendar year thereafter to report any change in the information contained in the Schedule 13G.

Section 13(f)(6)(A) of the Exchange Act defines the term institutional investment manager to include any person (other than a natural person) investing in, or buying and selling, securities for its own account, and any person (including a natural person) exercising investment discretion with respect to the account of

A material change includes any material increase or decrease in the percentage of the class of securities you are deemed to "beneficially own." For instance, if you manage more than 5% in the shares of an issuer and the percentage managed increases or decrease by more than 1% (whether through a transaction or other

Insofar as Schedule 13D amendments are concerned, the current requirement is that an amendment must be filed promptly after a material change in any facts previously reported. The Proposing Release would require that a Schedule 13D amendment be filed on the first business day after a material change.