Description: Hennepin Minnesota Credit and Term Loan Agreement is a legally binding contract that outlines the terms and conditions between a borrower and a lender in Hennepin County, Minnesota. This agreement establishes the guidelines for the borrower to receive credit or a loan from the lender, with specific terms and conditions to be adhered to throughout the borrowing period. Keywords: Hennepin Minnesota, Credit and Term Loan Agreement, borrower, lender, contract, terms and conditions, credit, loan, borrowing period. Hennepin Minnesota Credit and Term Loan Agreements can come in various forms depending on the specific borrowing needs and circumstances of the parties involved. Some common types of Hennepin Minnesota Credit and Term Loan Agreements include: 1. Personal Credit and Term Loan Agreement: This type of agreement is designed for individuals who are seeking a loan for personal use, such as financing a vehicle, funding education, or covering unexpected expenses. It establishes the terms and conditions for repayment, interest rates, and any additional fees or penalties. 2. Business Credit and Term Loan Agreement: This agreement is specifically tailored for businesses looking to secure credit or a loan to support their operations, expansion, or other financial needs. It outlines the borrowing terms, repayment schedules, interest rates, collateral requirements, and any other relevant provisions. 3. Real Estate Credit and Term Loan Agreement: This type of agreement pertains to loans specifically intended for real estate transactions, such as purchasing a new property, renovating an existing one, or refinancing an existing mortgage. It establishes the terms and conditions regarding loan amounts, interest rates, repayment terms, and any applicable restrictions or conditions related to the property. 4. Agricultural Credit and Term Loan Agreement: Designed for farmers and agricultural businesses, this agreement sets out the terms and conditions for loans relating to agricultural activities. It includes provisions for the purchase of equipment, land, livestock, or other farming necessities, as well as repayment terms, interest rates, and any collateral requirements. 5. Construction Credit and Term Loan Agreement: This agreement is tailored for individuals or businesses involved in the construction industry. It lays out the terms and conditions specific to loans for construction projects, such as funding for materials, labor costs, or equipment purchases. The agreement may include provisions related to progress payments, project milestones, and any hold backs or performance guarantees. In all Hennepin Minnesota Credit and Term Loan Agreements, it is essential for both parties to carefully review and understand the terms and conditions before signing. The agreement should clearly outline the rights and obligations of both the borrower and the lender to ensure a smooth lending process and to protect the interests of both parties involved.

Hennepin Minnesota Credit and Term Loan Agreement

Description

How to fill out Hennepin Minnesota Credit And Term Loan Agreement?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Hennepin Credit and Term Loan Agreement meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Hennepin Credit and Term Loan Agreement, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Hennepin Credit and Term Loan Agreement:

- Check the content of the page you’re on.

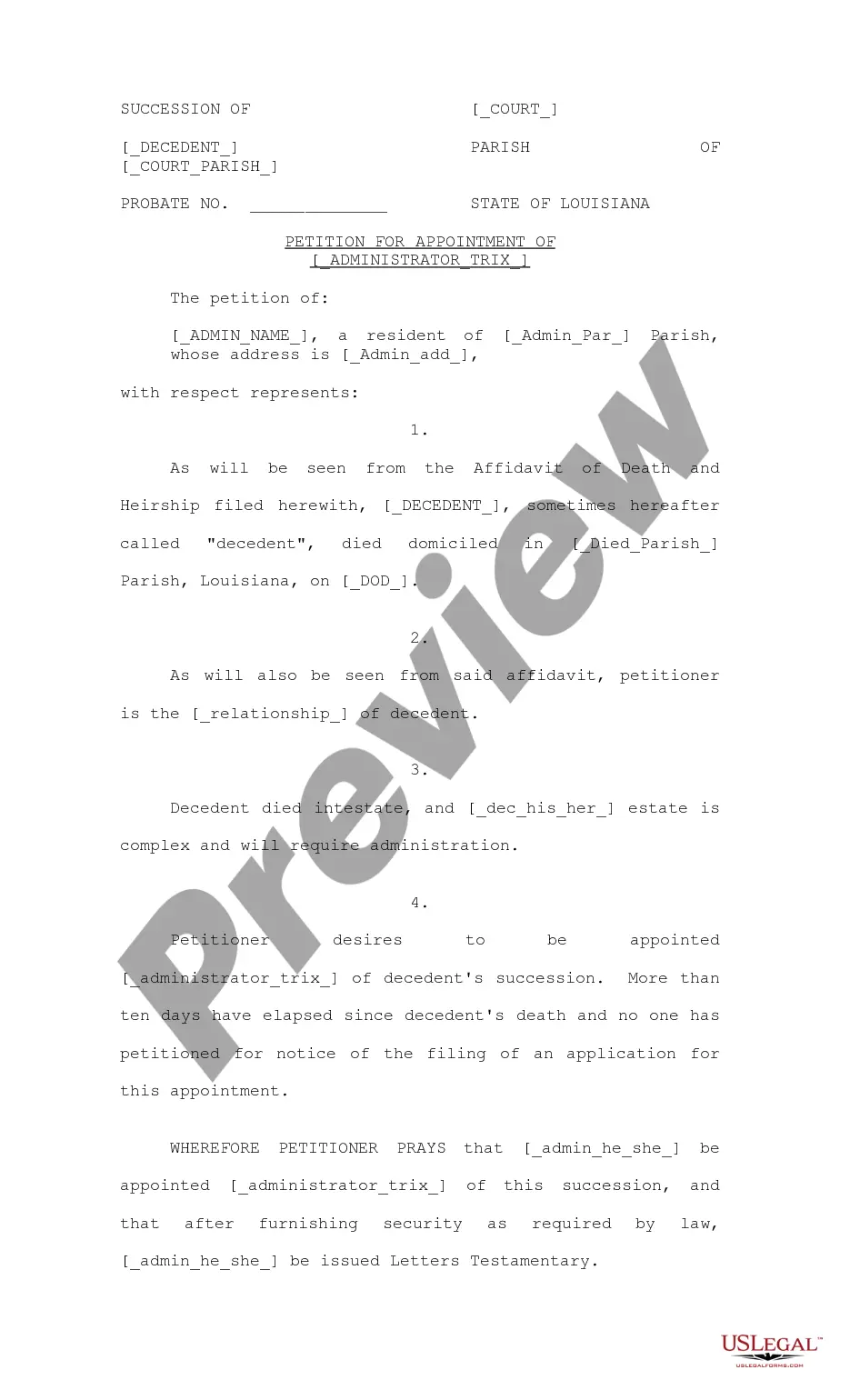

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Hennepin Credit and Term Loan Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!