Kings New York Credit and Term Loan Agreement refers to a comprehensive financial agreement offered by Kings New York, a reputable financial institution operating in the state of New York. This agreement serves as a legal document outlining the terms and conditions for obtaining credit or a term loan from the institution. The Kings New York Credit and Term Loan Agreement aims to provide individuals, businesses, and organizations with the necessary funds to meet various financial requirements. Whether it be for personal expenses, business expansions, debt consolidation, or other financial needs, this agreement offers a structured framework to access the required funds. There are different types of Kings New York Credit and Term Loan Agreements tailored to suit diverse financial requirements. Some of these variations may include: 1. Personal Credit and Term Loan Agreement: This agreement caters to individuals seeking funds for personal use, such as home renovations, education expenses, medical bills, or weddings. It outlines the borrowing limits, repayment terms, interest rates, and other conditions set by Kings New York to ensure responsible borrowing. 2. Small Business Credit and Term Loan Agreement: This type of agreement is designed specifically for small businesses in need of capital for operational expenditures, equipment purchases, inventory management, or expansion plans. Kings New York sets specific terms and requirements for this loan, considering the unique needs and risks associated with small-scale enterprises. 3. Mortgage Credit and Term Loan Agreement: This agreement is targeted towards individuals or businesses looking to secure long-term financing for real estate investments, property purchases, or refinancing existing mortgages. It outlines the terms of borrowing, including interest rates, repayment periods, and any collateral requirements. 4. Line of Credit Agreement: Kings New York may offer a line of credit enabling access to fund as needed up to a predetermined credit limit. This agreement details the terms, interest rates, repayment conditions, and any stipulations for using the revolving credit facility. The Kings New York Credit and Term Loan Agreement typically covers essential aspects such as principal amount, interest rates, repayment schedules, penalties for late payments or defaults, collateral requirements, and any associated fees or charges. It is crucial to thoroughly review and understand the agreement before signing, ensuring that all parties involved are aware of their rights and obligations. Overall, Kings New York Credit and Term Loan Agreement provides a transparent and reliable approach to accessing credit or term loans for various purposes, supporting financial stability and growth in the dynamic economic landscape of New York.

Kings New York Credit and Term Loan Agreement

Description

How to fill out Kings New York Credit And Term Loan Agreement?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Kings Credit and Term Loan Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Kings Credit and Term Loan Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Kings Credit and Term Loan Agreement:

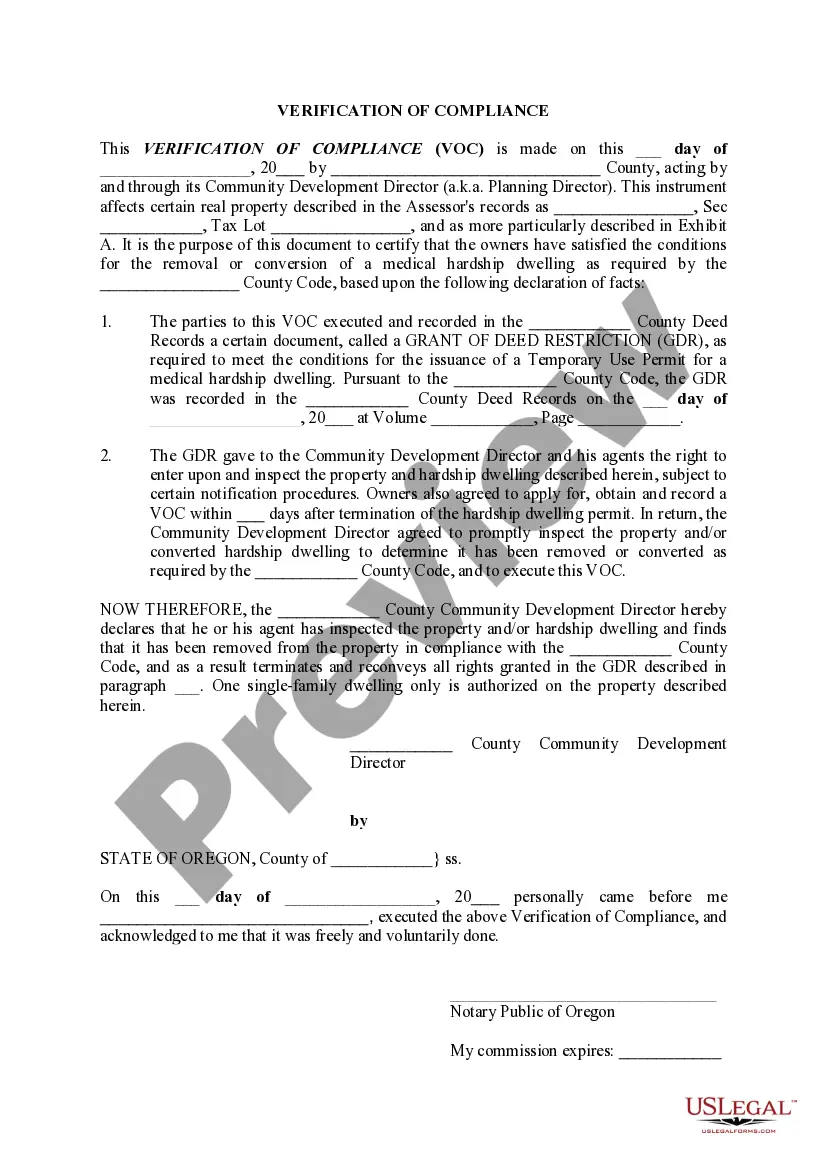

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!