A Riverside California Credit and Term Loan Agreement is a legally binding contract between a borrower and a lender regarding the terms and conditions of a credit or term loan in the Riverside County, California area. This agreement outlines the specific terms and conditions, including the loan amount, interest rate, repayment schedule, and any collateral or security required. Credit and Term Loan Agreements in Riverside, California can vary depending on the specific type of loan being obtained. Some common types include: 1. Personal Loans: These are unsecured loans provided by a lender to an individual borrower for personal use. The borrower must repay the loan amount along with interest within a predetermined time frame as per the agreement. 2. Small Business Loans: These loans are designed to support small businesses in Riverside, California. They can range from working capital loans to equipment financing, and they often require specific documentation outlining the purpose of the loan and a comprehensive business plan. 3. Mortgages: This type of loan is specifically for purchasing a property in Riverside, California. It typically involves a substantial loan amount and a longer-term repayment schedule. The property itself serves as collateral, and the loan is secured by a mortgage lien on the property. 4. Auto Loans: These loans are obtained for purchasing a vehicle in Riverside, California. The loan amount is used to finance the car, which serves as collateral. Repayment terms and interest rates are agreed upon, and failure to make timely payments can potentially result in repossession of the vehicle. 5. Student Loans: These loans are specifically for financing education and are often provided by the federal government or private lenders. They allow Riverside, California students to pursue higher education and must be repaid after the completion of studies or upon leaving school. In summary, a Riverside California Credit and Term Loan Agreement is a crucial document that outlines the terms and conditions of various loan types, including personal loans, small business loans, mortgages, auto loans, and student loans. It protects the rights and obligations of both the borrower and the lender and ensures transparency and legal compliance throughout the loan process.

Riverside California Credit and Term Loan Agreement

Description

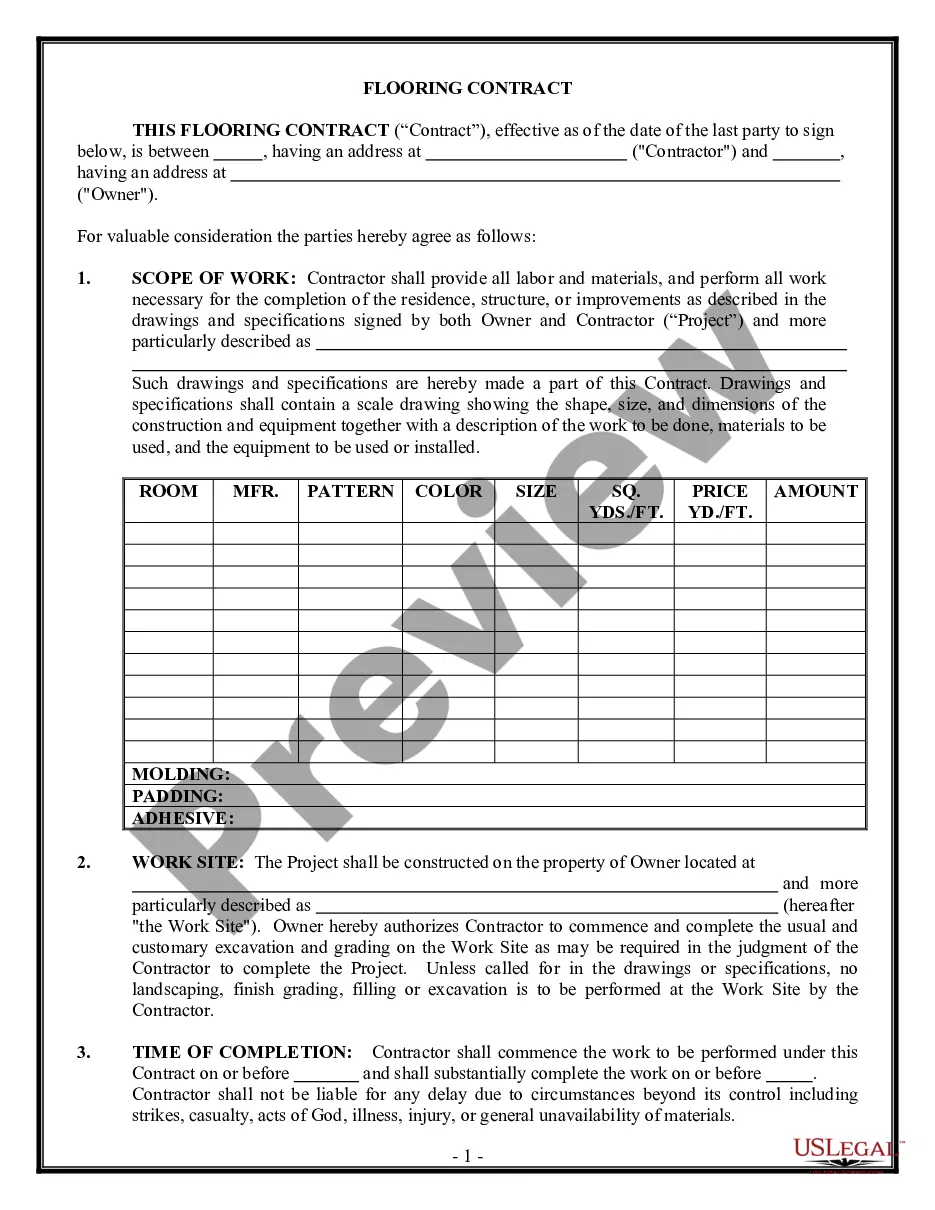

How to fill out Riverside California Credit And Term Loan Agreement?

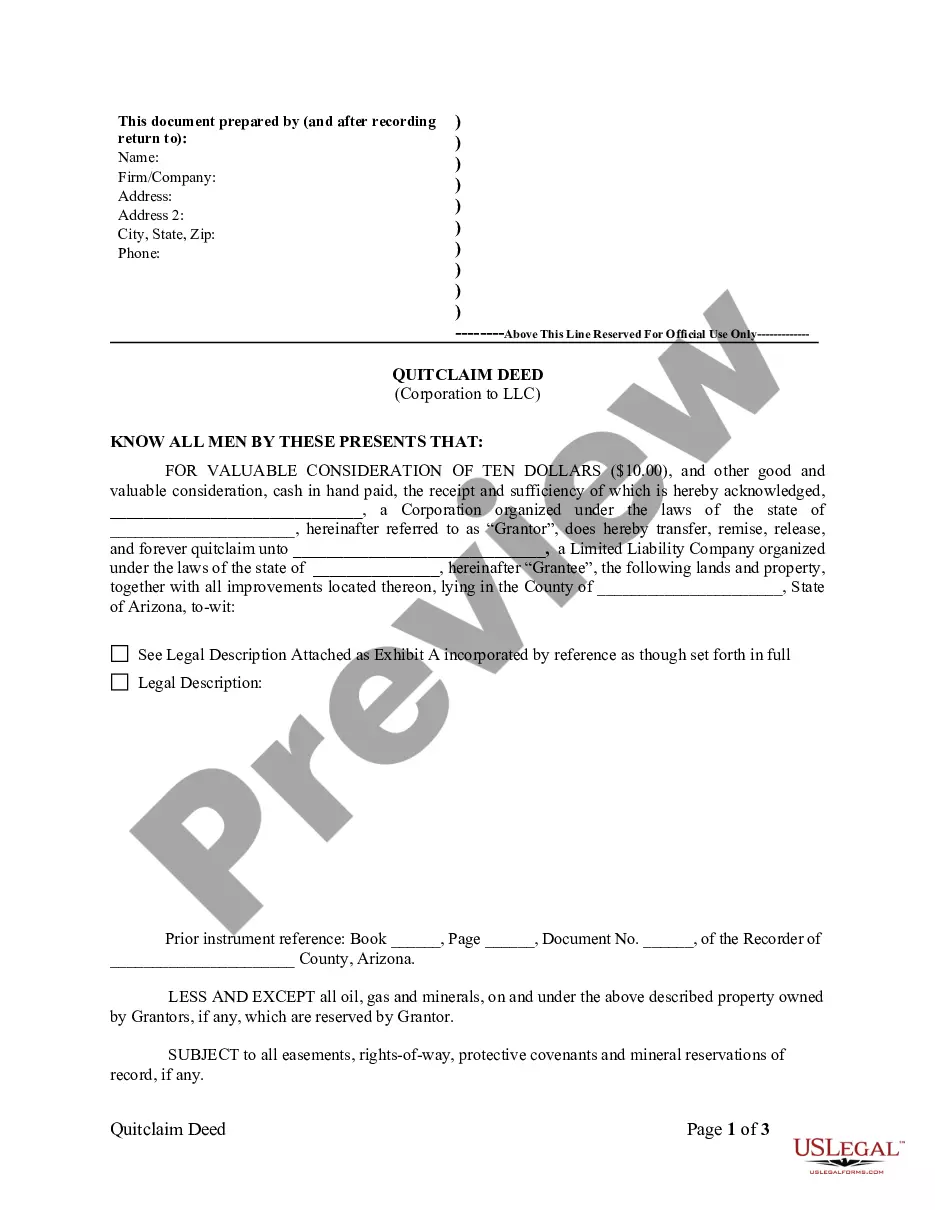

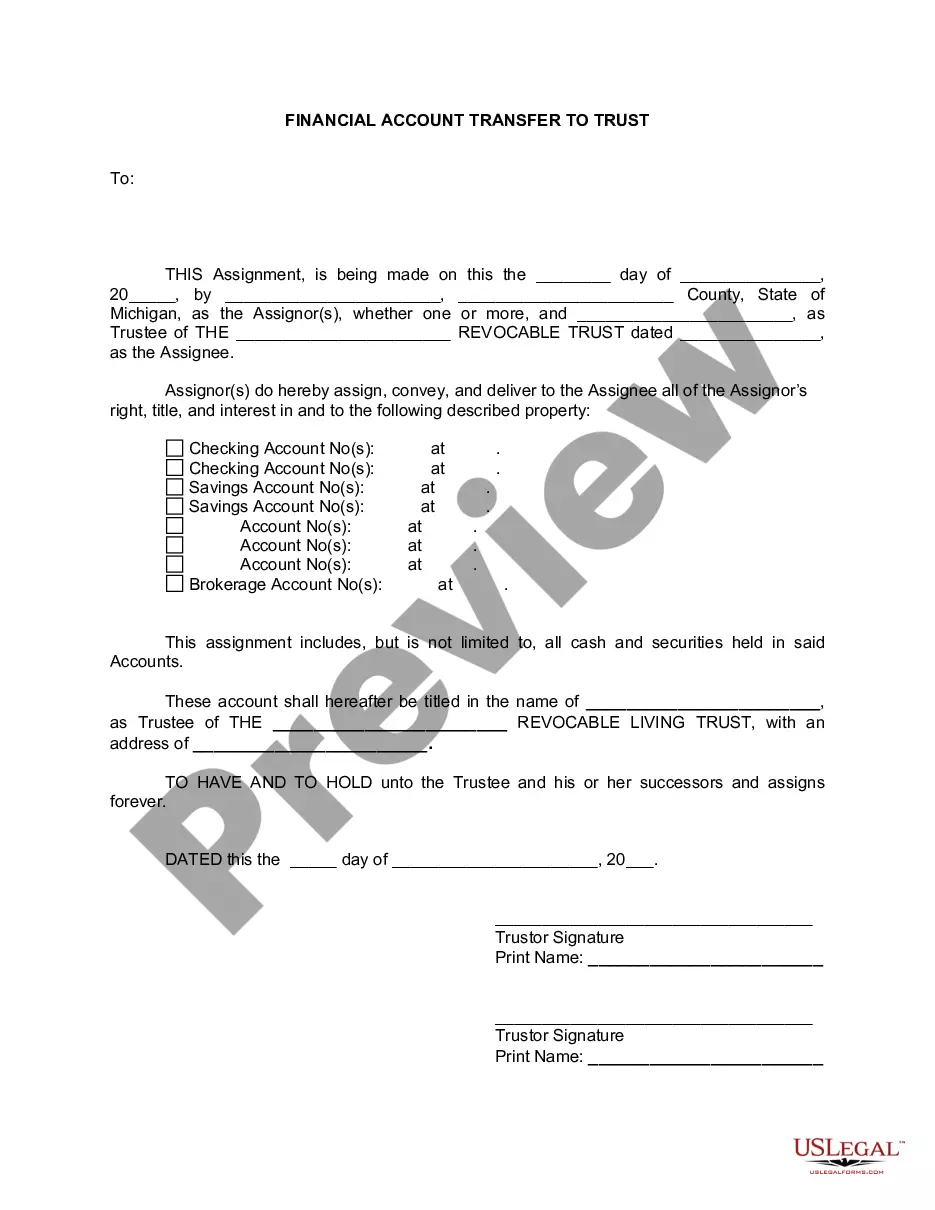

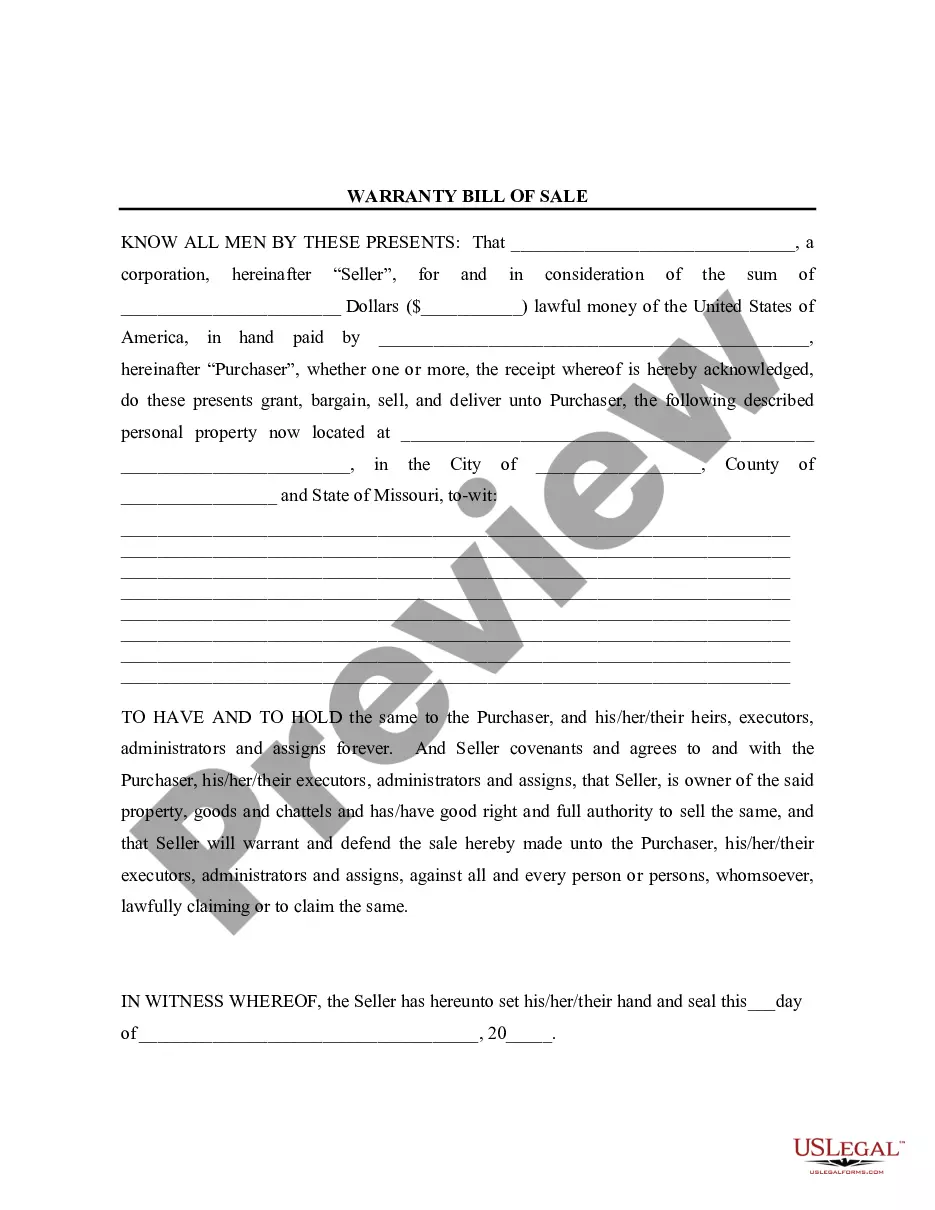

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Riverside Credit and Term Loan Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Riverside Credit and Term Loan Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Riverside Credit and Term Loan Agreement:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Riverside Credit and Term Loan Agreement and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

A credit agreement is a legally binding contract between a borrower and a lender that must be agreed by both parties. It holds the terms of any type of credit, such as overdrafts, credit cards or personal loans. That's why a credit agreement for a personal loan is normally referred to as a loan agreement.

While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

How do I find my Credit Agreements? Your reported Credit Agreements will appear on your Credit Report, giving you a detailed list of your current and past lenders, amounts owed, the status of the accounts, and more.

Key Takeaways. A term loan provides borrowers with a lump sum of cash upfront in exchange for specific borrowing terms. Borrowers agree to pay their lenders a fixed amount over a certain repayment schedule with either a fixed or floating interest rate.

Important lending terms included in the credit agreement include the annual interest rate, how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

Also known as a loan agreement. The main transaction document for a loan financing between one or more lenders and a borrower.

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

This article will go through eight key terms in a loan agreement and what you should consider about each of them. Interest.Default Interest.Prepayment.Events of Default.Committed or Uncommitted Loan Agreement.Repayment On Demand or Fixed Term.Secured or Unsecured.Bilateral or Syndicated.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan. Credits agreements are created for both retail and institutional loans.

Interesting Questions

More info

Discover the benefits of our online platform with our affordable offers, and personalized service. You can learn more about our services and fees for loans and credit cards. Please fill out this form, and click “Get Started” to begin your application for an online loan from the Austin Community Credit Union. If you'd like more information about our online products, or to set up a meeting with your advisor, please call the Austin Community Credit Union, at 512.734.1210. If you are a recent graduate or veteran, please call the Community Credit Union, at 512.734.1200. If you are an individual wanting to earn a few dollars per day, or to start earning money, just click here, and send us your information. If you want to become an investment manager, please contact the Community Credit Union, at 512.734.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.