The Nassau New York Stock Pledge Agreement by Tortola Company IV LLC for Tortola Packaging, Inc. is a legally binding contract that outlines the terms and conditions surrounding the pledge of stock by Tortola Company IV LLC to secure the financial obligations of Tortola Packaging, Inc. It is crucial to have a thorough understanding of this agreement, as it plays a significant role in safeguarding the interests of both companies involved. The agreement serves as a crucial document in situations where Tortola Packaging, Inc. requires additional financing or seeks to secure a loan. By pledging their stock, Tortola Company IV LLC acts as a guarantor, assuring lenders that in case of default, the pledged stock will serve as a valuable asset that can be liquidated to recover the amount owed. This agreement is known for its comprehensiveness, covering various essential elements such as stock valuation, transferability, and restrictions. It establishes the details of the pledge, including the duration and conditions under which the pledged stock may be released back to Tortola Company IV LLC. Different types or variations of the Nassau New York Stock Pledge Agreement may exist, tailored to the specific needs and requirements of Tortola Packaging, Inc. Some variations could include: 1. Limited Pledge Agreement: This type of agreement may limit the scope of the pledged stock, either by a specific portion or by a particular class of shares. 2. Revocable Pledge Agreement: In certain cases, the pledge agreement may grant the pledge, Tortola Company IV LLC, the option to revoke the pledge, typically under predetermined circumstances such as fulfilling certain obligations or obtaining alternative collateral. 3. Cross-Collateralization Pledge Agreement: This type of agreement allows Tortola Packaging, Inc. to pledge multiple types of securities or assets as collateral, incorporating stock, real estate, or other valuable holdings. 4. Floating Lien Pledge Agreement: With this agreement, the stock pledge acts as a floating lien, serving as security for both existing and future loans or financial obligations of Tortola Packaging, Inc. It is important for both parties involved to seek legal advice before entering into the Nassau New York Stock Pledge Agreement. With the use of appropriate legal counsel, the agreement can be tailored to best protect the interests of Tortola Company IV LLC as the pledge and Tortola Packaging, Inc. as the borrower, ensuring a fair and mutually beneficial arrangement.

Nassau New York Stock Pledge Agreement by Portola Company IV LLC for Portola Packaging, Inc.

Description

How to fill out Nassau New York Stock Pledge Agreement By Portola Company IV LLC For Portola Packaging, Inc.?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Nassau Stock Pledge Agreement by Portola Company IV LLC for Portola Packaging, Inc..

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Nassau Stock Pledge Agreement by Portola Company IV LLC for Portola Packaging, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Stock Pledge Agreement by Portola Company IV LLC for Portola Packaging, Inc.:

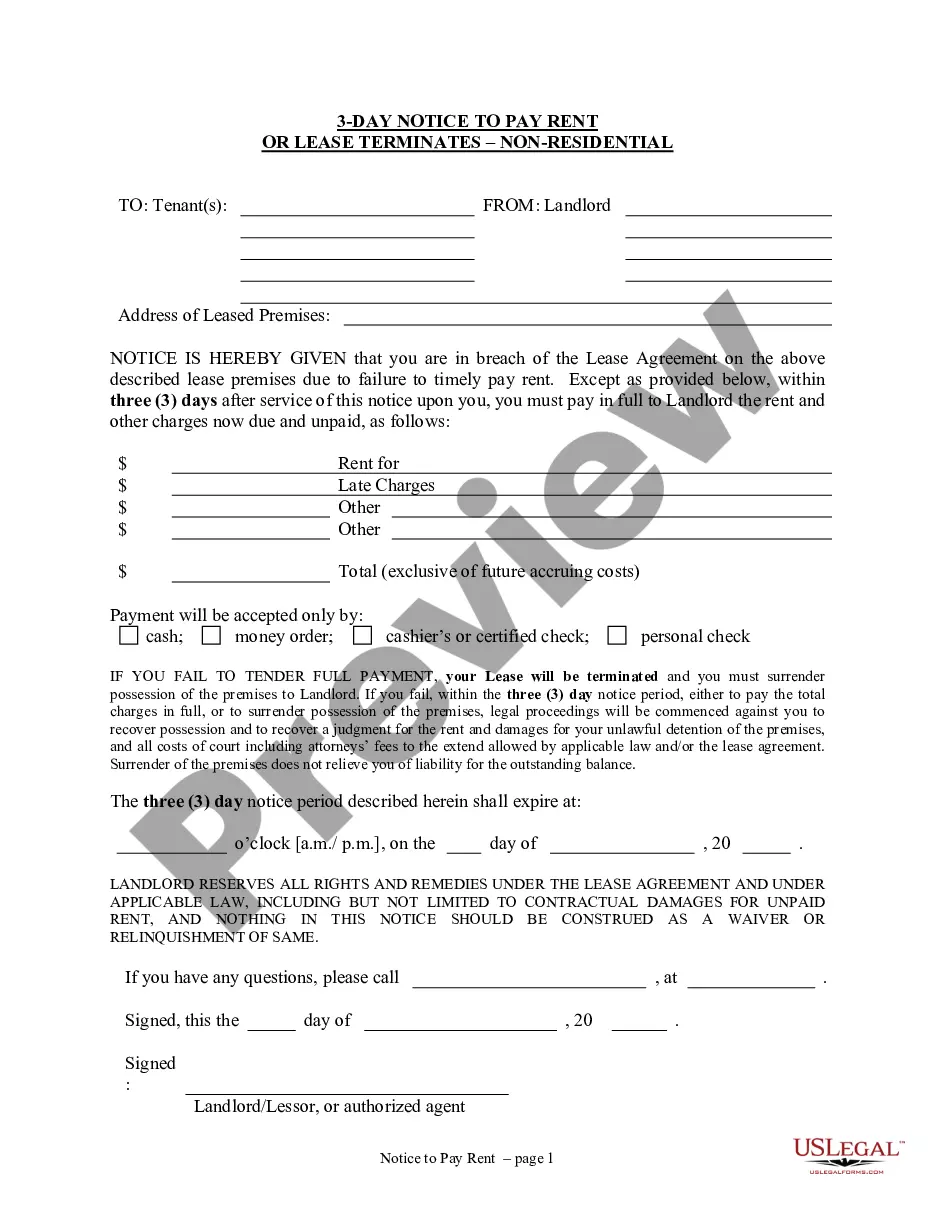

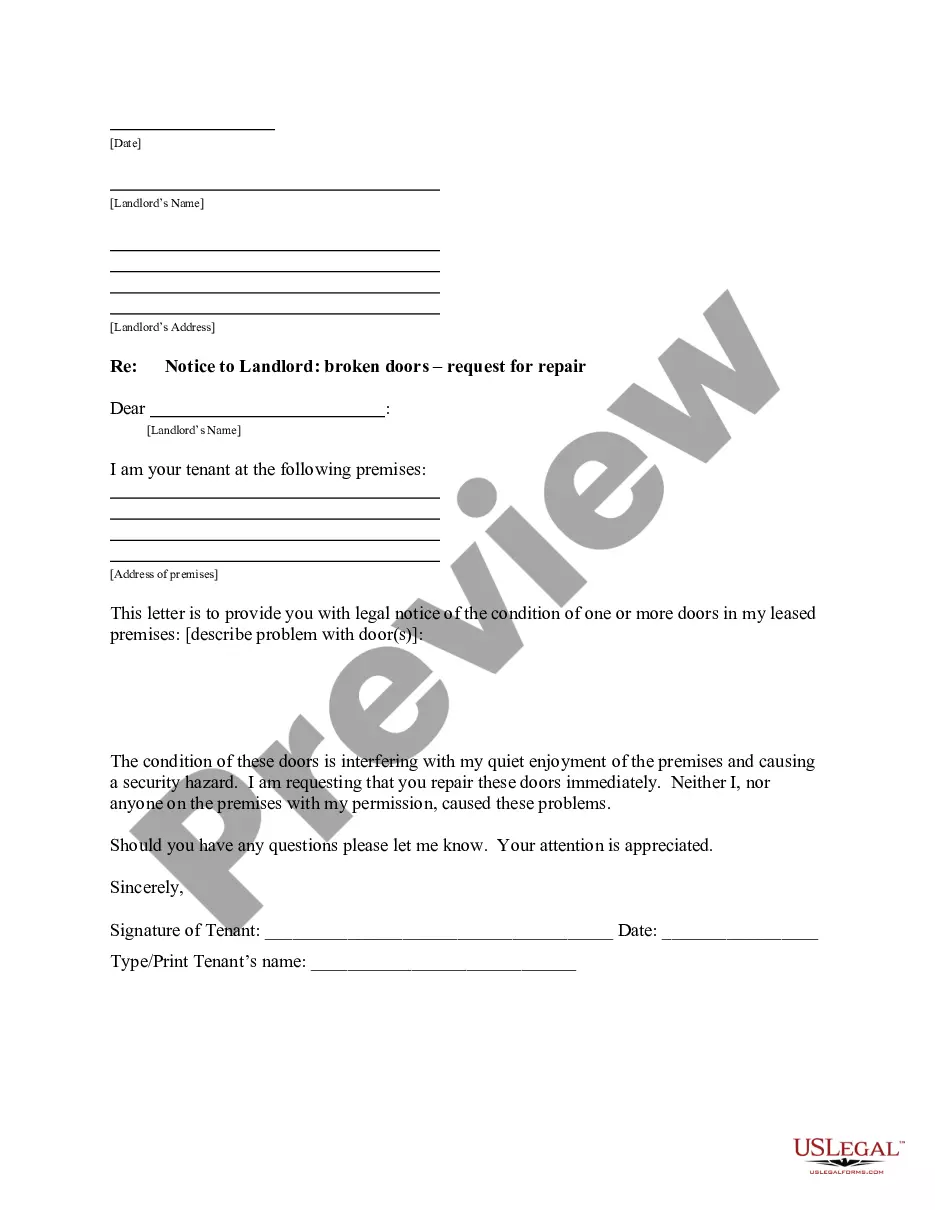

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Nassau Stock Pledge Agreement by Portola Company IV LLC for Portola Packaging, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!