Allegheny, Pennsylvania, has been witnessing various mergers and acquisitions between corporations, and understanding the different types of plans associated with these mergers is essential. This article provides a detailed description of the Allegheny Pennsylvania Plan of Merger between two corporations, including relevant keywords. 1. Vertical Merger: A vertical merger is a type of Allegheny Pennsylvania Plan of Merger where two corporations from different stages of the supply chain combine their operations. For example, a merger between a pharmaceutical manufacturing company and a wholesale distribution firm may reinforce the product's entire life cycle, from production to distribution. 2. Horizontal Merger: In Allegheny, Pennsylvania, a horizontal merger is another prevalent type of Plan of Merger between two corporations. This occurs when two companies operating in the same industry and at the same stage of the supply chain combine their businesses. For instance, the merger between two competing software development firms could consolidate their market share and increase their overall competitiveness. 3. Conglomerate Merger: Conglomerate mergers in Allegheny, Pennsylvania, involve two corporations operating in completely different industries or sectors. These mergers allow companies to diversify their product offerings or enter new markets. For example, a merger between an automobile manufacturer and a media conglomerate would create new opportunities for both companies to benefit from each other's expertise and customer base. 4. Reverse Merger: A reverse merger is an alternative type of merger often observed in Allegheny, Pennsylvania. In this scenario, a private company acquires a publicly traded company, allowing the private entity to become publicly listed without going through an initial public offering (IPO). This strategy offers a quicker and more cost-effective way for companies to go public and gain access to capital markets. 5. Hostile Takeover: Although less common, hostile takeovers can also occur in Allegheny, Pennsylvania. In this type of merger, a corporation acquires another company against its will. The acquiring corporation may directly approach the target company's shareholders or engage in aggressive tactics to gain control. Hostile takeovers often lead to corporate restructuring, cost-cutting measures, and potential management changes. 6. Merger of Equals: A merger of equals refers to a situation where two corporations, usually of similar size, combine their operations to create a single entity with shared control and ownership. In Allegheny, Pennsylvania, a merger of equals signifies that both companies hold equal influence and contribute their assets, technologies, and market positions to form a new, stronger organization. It is important to note that each Plan of Merger may have specific steps, legal requirements, and regulatory considerations that corporations must follow to ensure compliance. Companies engaging in mergers in Allegheny, Pennsylvania, must consult legal and financial professionals to navigate the complex merger landscape successfully.

Allegheny Pennsylvania Plan of Merger between two corporations

Description

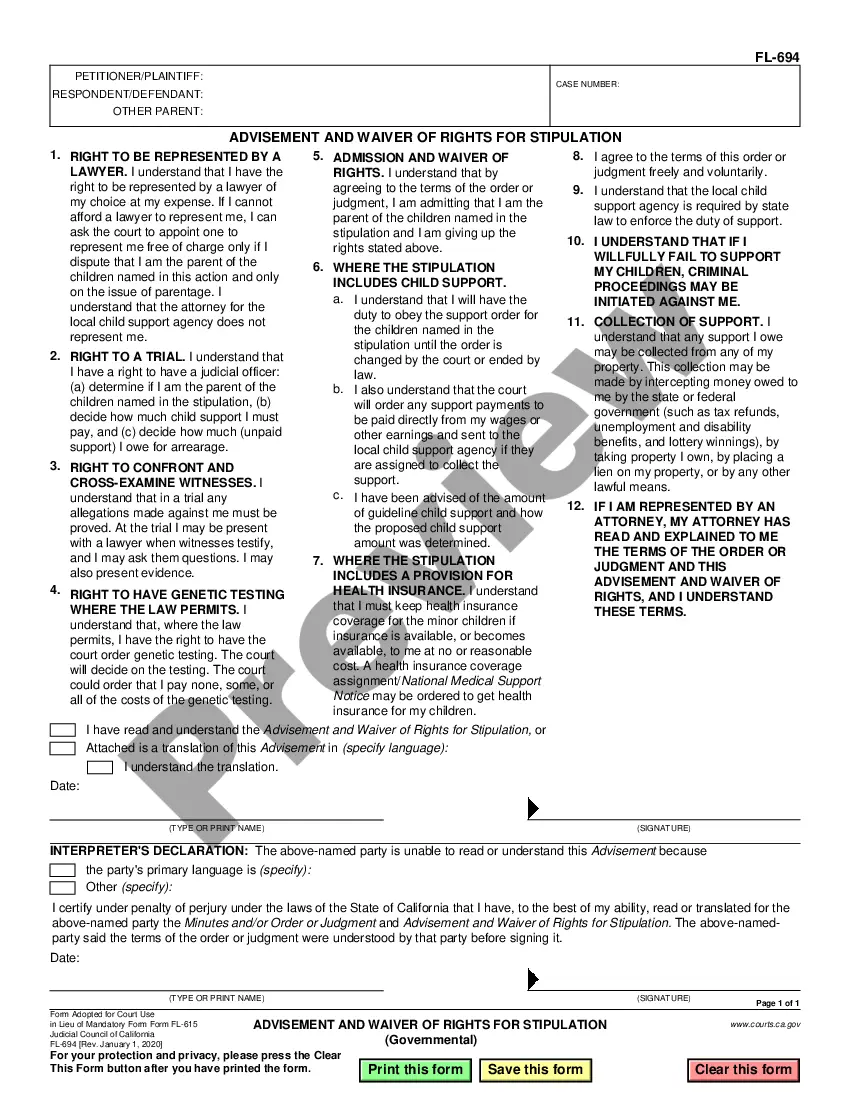

How to fill out Allegheny Pennsylvania Plan Of Merger Between Two Corporations?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Allegheny Plan of Merger between two corporations without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Allegheny Plan of Merger between two corporations on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Allegheny Plan of Merger between two corporations:

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

The term business consolidation refers to the combination of different business units or companies into a single, larger organization. Business consolidation is a legal strategy that is often initiated to improve operational efficiency by reducing redundant personnel and processes.

Key Takeaways A merger, or acquisition, is when two companies combine to form one to take advantage of synergies. A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock.

A merger happens when two companies combine to form a single entity. Public companies often merge with the declared goal of increasing shareholder value, by gaining market share or from entering new business segments. Unlike an acquisition, a merger can result in a brand new entity formed from the two merging firms.

The transactional costs of a merger can and do cause a dilutive situation short and possibly long-term. Experienced merger and acquisition professionals know that transaction costs, in the business community, can range between 6% and 8% of the gross revenues of the organizations.

In a merger agreement, the company owners of two or more businesses agree to combine their companies in an attempt to expand their reach, gain market share from competitors, and reduce the cost of operations.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

Steps to Merging a Business Step 1: Assess the Health of the Companies Involved in the Merger.Step 2: Set Goals for Your Merger.Step 3: Assemble a Team to Help You Through the Merger.Step 4: Determine the Terms of the Merger.Step 5: Create a Purchase and Sale Agreement.

The merge process creates a record that contains the most trustworthy data from all the participating records. At the parent level, the merge process merges the data of the parent record. At the child level, when the parent-to-child relationship is a one-to-one relationship, the merge process merges the child records.

Steps to achieve merger or consolidation The BoD of each corporation must draw up a plan of merger or consolidation. A plan must be submitted to the S/M of each corporation for approval.There has to be a formal agreement known as the articles of M/C by the officers of each of the constituent corporations.

Interesting Questions

More info

In 1906, Gould's son, John F. Gould, became the fifth president of the Philadelphia Gas Works. The company was then purchased from its French parent company by General Electric. The sale opened the door to a new era of American manufacturing. In 1914, the General Electric Company was founded and renamed in honor of Charles R. Ransom, who had created the Ransom Report for the federal government in 1913. It has since grown to a 33.5 billion corporation. More than 80,000 employees are employed in these branches of American manufacturing. The company is based in Scranton, Pennsylvania and has an annual turnover of 8.3 billion. The company is also in the business of supplying the heating and air conditioning systems, and the supply of building materials for commercial office buildings. One of its divisions, J.C. Penney, makes men's, women's, children's, children's shoes, clothing, and children's accessories.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.