The Bexar Texas Plan of Merger is a legal framework that governs the consolidation of two corporations in the Bexar County region of Texas. This plan outlines the process, terms, and conditions involved in merging two entities into a single, unified corporation. This Plan of Merger is designed to facilitate a smooth and efficient transition, ensuring that both corporations' interests and stakeholders are protected throughout the merger process. It outlines the necessary steps, including corporate approvals, shareholder meetings, and regulatory compliance, to ensure compliance with state and federal laws. Key provisions within the Bexar Texas Plan of Merger include determining the exchange ratio for the shareholders of each corporation, which determines the amount and type of consideration they will receive. This consideration can include cash, stocks, or a combination of both, depending on the negotiation and agreement between the two corporations. Additionally, the plan includes provisions for the treatment of minority shareholders, protecting their rights and ensuring fair treatment during the merger. It may address issues such as governance structure, board composition, and executive management positions within the newly merged corporation. Different types of Bexar Texas Plans of Merger between two corporations may include: 1. Horizontal Merger: This type of merger occurs when two corporations within the same industry and market segment combine their operations to achieve economies of scale, enhance market power, or gain a competitive advantage. 2. Vertical Merger: In a vertical merger, two corporations engaged in different stages of the production or distribution process merge to streamline their operations, reduce costs, and improve efficiency. 3. Conglomerate Merger: A conglomerate merger refers to the consolidation of two corporations operating in unrelated industries or markets. This type of merger allows for diversification of business interests and potential synergies between different business segments. 4. Reverse Merger: This type of merger involves a private company acquiring a publicly traded company, allowing the private company to go public without undergoing the traditional initial public offering (IPO) process. In summary, the Bexar Texas Plan of Merger is a comprehensive legal document that regulates the merger process between two corporations in the Bexar County region. It addresses various aspects, including shareholder consideration, minority shareholder rights, governance structure, and the different types of mergers that can take place.

Bexar Texas Plan of Merger between two corporations

Description

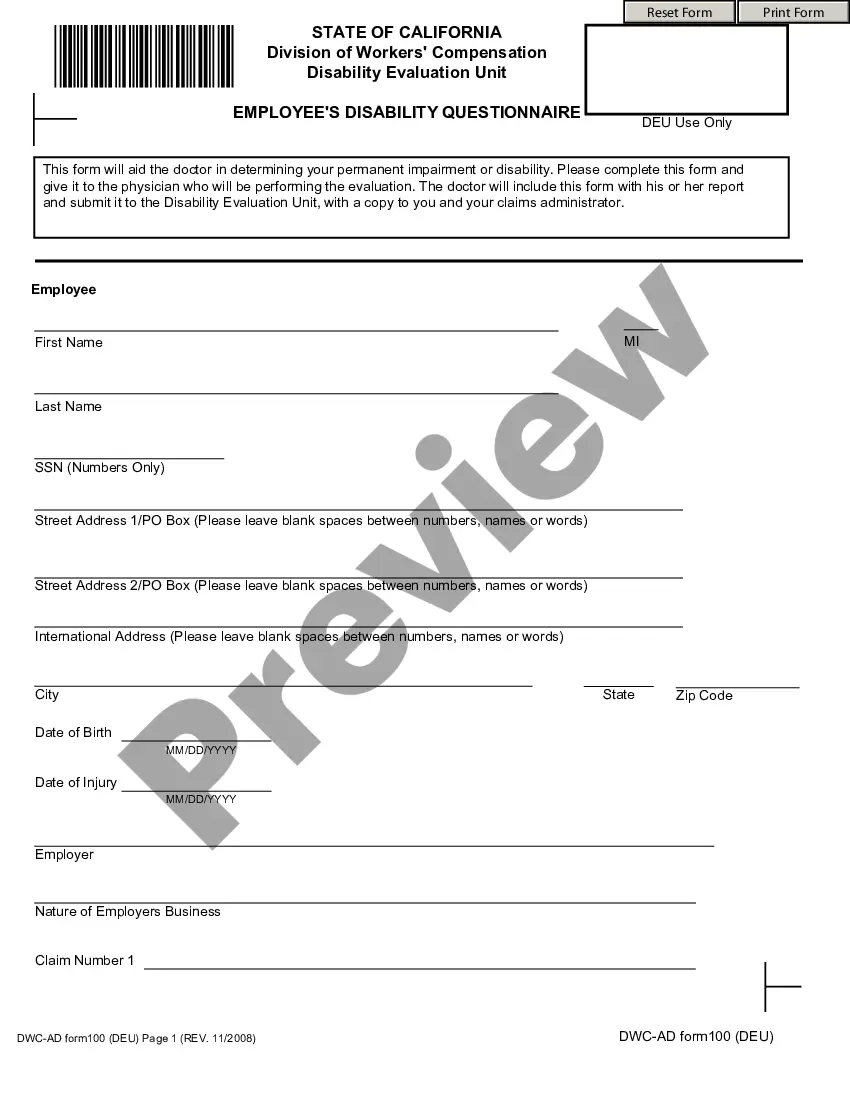

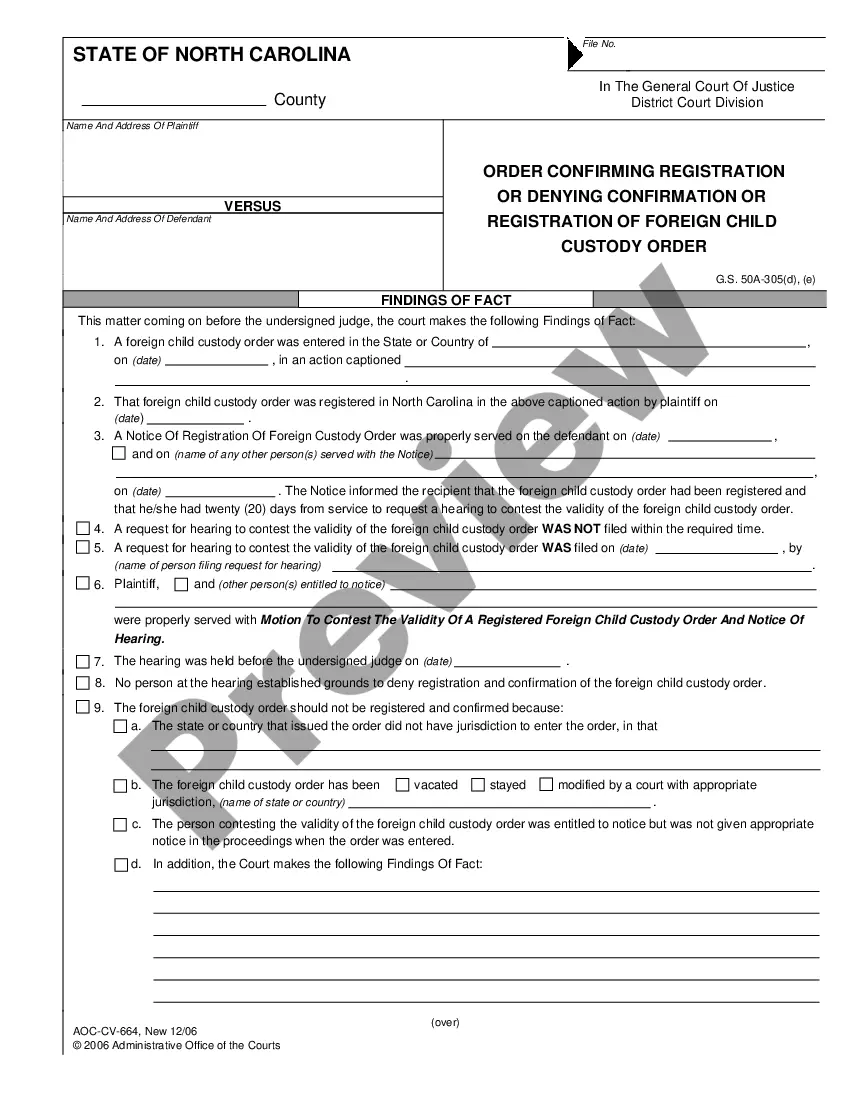

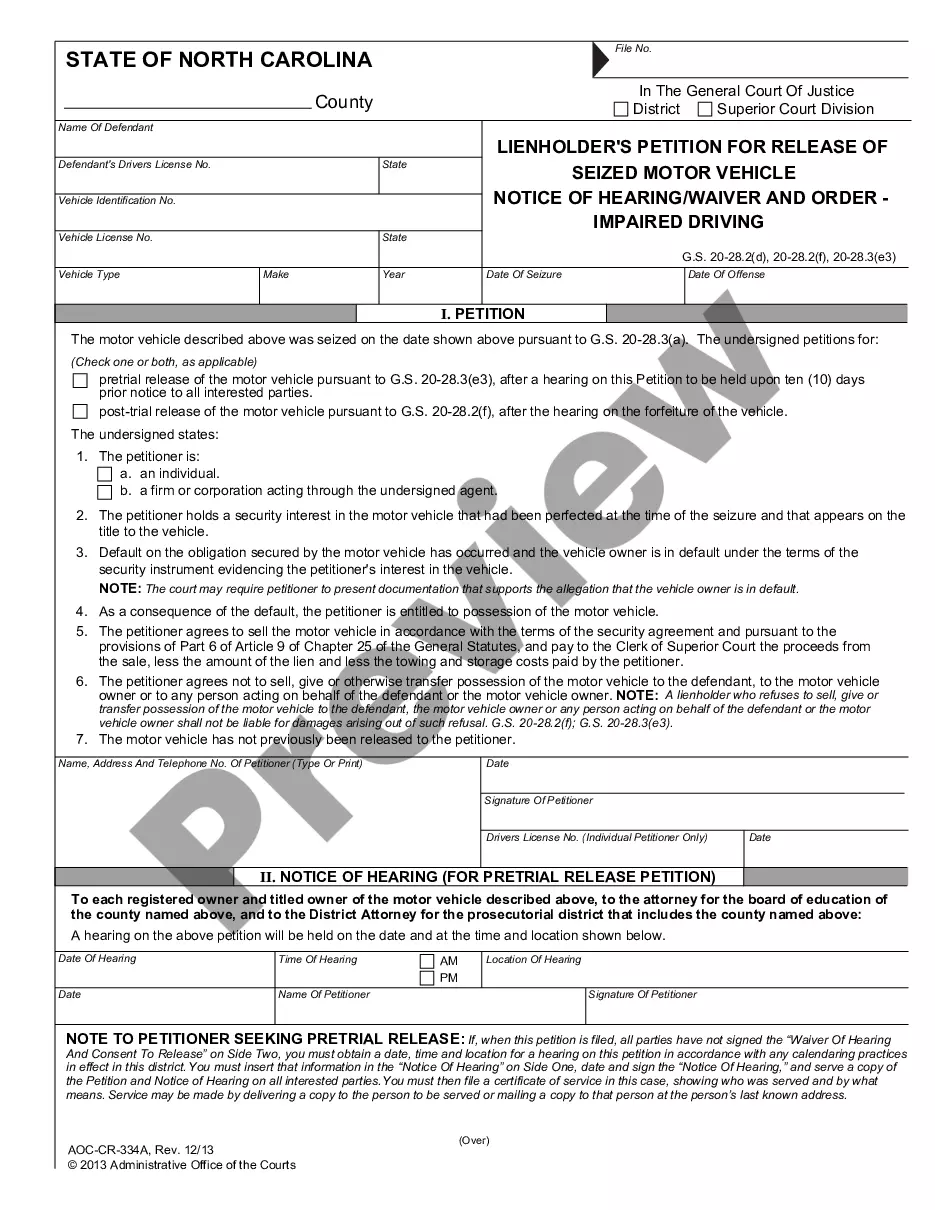

How to fill out Bexar Texas Plan Of Merger Between Two Corporations?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Bexar Plan of Merger between two corporations is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Bexar Plan of Merger between two corporations. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Plan of Merger between two corporations in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

A merger happens when a company finds a benefit in combining business operations with another company in a way that will contribute to increased shareholder value. It is similar in many ways to an acquisition, which is why the two actions are so often grouped together as mergers and acquisitions (M&A).

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

The stocks of both companies in a merger are surrendered, and new equity shares are issued for the combined entity. An acquisition is when one company takes over another company, and the acquiring company becomes the owner of the target company.

The transactional costs of a merger can and do cause a dilutive situation short and possibly long-term. Experienced merger and acquisition professionals know that transaction costs, in the business community, can range between 6% and 8% of the gross revenues of the organizations.

A merger happens when two companies combine to form a single entity. Public companies often merge with the declared goal of increasing shareholder value, by gaining market share or from entering new business segments. Unlike an acquisition, a merger can result in a brand new entity formed from the two merging firms.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

Issuer 251(g) Merger Event means a merger of an Issuer pursuant to which such Issuer becomes a wholly-owned subsidiary of a holding company; provided.