Fairfax Virginia is a city located in Northern Virginia, just outside of Washington, D.C. Known for its rich history, vibrant culture, and thriving business community, it serves as an ideal location for corporate mergers and acquisitions. When two corporations decide to merge in Fairfax Virginia, they typically prepare a detailed plan of merger to outline the terms and conditions of the consolidation. This plan is a legally binding document that specifies the rights, obligations, and responsibilities of the merging companies, as well as the post-merger structure and operations. The Fairfax Virginia Plan of Merger between two corporations can vary depending on the nature and objectives of the merger. While there may not be specific types or categories of these plans, they are typically tailored to suit the specific needs of the corporations involved. Here are a few key components commonly included in a Fairfax Virginia Plan of Merger: 1. Parties Involved: The plan identifies the merging entities, providing their legal names, registered offices, and other relevant details. This section also includes information on any subsidiary or affiliated companies involved in the merger. 2. Background and Purpose: The plan outlines the reasons behind the merger, such as strategic growth, market expansion, or operational synergy. It may also include a brief history of the corporations involved and their respective industries. 3. Merger Structure: This section explains the structure of the merger, whether it is a statutory merger or consolidation, an asset or stock sale, or other forms of combination. It specifies the legal framework under which the merger will take place. 4. Consideration: The plan defines the consideration to be exchanged between the merging companies, such as cash, stock, or a combination of both. It outlines the valuation methods used and any adjustments or conditions associated with the consideration. 5. Treatment of Shares: This section describes how the shares of both corporations will be affected by the merger. It may address issues such as share conversion, share exchange ratios, or the issuance of new shares. 6. Governance and Management: The plan details the post-merger governance structure, including the composition of the board of directors and the management team. It may also specify the key executives and their roles within the merged entity. 7. Employee Matters: This section outlines the treatment of employees, including any changes to their terms of employment, benefits, or stock options. It may also address integration plans and any potential workforce restructuring. 8. Regulatory and Shareholder Approvals: The plan identifies any regulatory approvals required for the merger, such as antitrust clearances or industry-specific licenses. It also specifies the procedures for obtaining shareholder approvals. 9. Effective Date and Implementation: This section sets out the anticipated effective date of the merger and the timeline for completing the necessary steps, such as filing documents with regulatory authorities or amending bylaws and articles of incorporation. 10. Miscellaneous and General Provisions: The plan includes miscellaneous provisions, such as dispute resolution mechanisms, confidentiality obligations, and contractual representations and warranties. In summary, a Fairfax Virginia Plan of Merger between two corporations serves as a comprehensive roadmap for merging companies. It addresses all the essential aspects of the merger, including legal, financial, operational, and managerial considerations. By outlining the terms and conditions in a detailed manner, the plan provides clarity, transparency, and legal protection for both corporations involved.

Fairfax Virginia Plan of Merger between two corporations

Description

How to fill out Fairfax Virginia Plan Of Merger Between Two Corporations?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Fairfax Plan of Merger between two corporations, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Plan of Merger between two corporations from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Plan of Merger between two corporations:

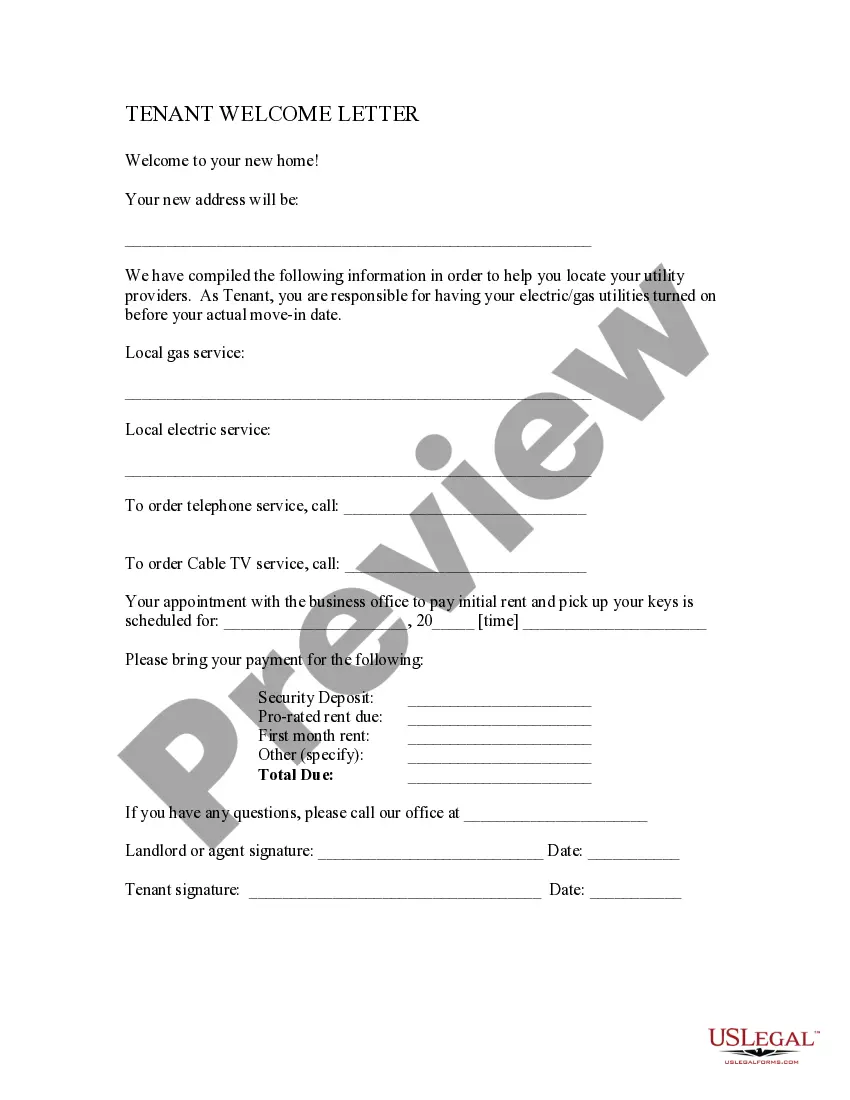

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!