The Harris Texas Plan of Merger is a legal arrangement that outlines the process of merging two corporations based in Harris County, Texas. It is a comprehensive document that provides a detailed description of various aspects involved in the merger, ensuring that both companies' interests are protected and that the merger is executed smoothly. Keywords: Harris Texas, Plan of Merger, two corporations, legal arrangement, Harris County, Texas, merging, detailed description, interests, executed smoothly. The Harris Texas Plan of Merger entails several key components, including: 1. Identification of Parties: This section of the plan enumerates the participating corporations involved in the merger, stating their legal names, addresses, and respective jurisdiction of incorporation. 2. Purpose of Merger: It is essential to specify why the two corporations have decided to merge. This section clearly states the intentions, objectives, and benefits that both companies aim to achieve through the merger, such as expanding market presence, diversifying product lines, or enhancing operational efficiencies. 3. Terms and Conditions: The plan outlines the terms and conditions that will govern the merger, which may include the exchange ratio of stock, cash considerations, or any other assets involved in the transaction. It also details the effective date of the merger and any contingency plans for unforeseen circumstances. 4. Corporate Governance: This section focuses on the post-merger structure of the resulting corporation. It addresses matters related to the board of directors, senior management positions, and the overall decision-making framework, ensuring transparency and compliance with regulatory requirements. 5. Shareholder Rights: The Harris Texas Plan of Merger acknowledges the rights and privileges of shareholders from both merging entities. It defines the treatment of stock options, voting rights, dividend entitlements, and any other pertinent matters concerning the shareholders' interests. Types of Harris Texas Plan of Merger may include: 1. Horizontal Merger: This type of merger occurs when two corporations operating in the same industry and at similar stages of the supply chain merge their operations. For example, two pharmaceutical companies combining to increase their market share. 2. Vertical Merger: In a vertical merger, two corporations engaged in different stages of a supply chain merge their operations. This enables the merged entity to have better control over the production process, reduce costs, and improve efficiency. For instance, a car manufacturer merging with an auto parts supplier. 3. Conglomerate Merger: Conglomerate mergers involve the merging of two companies operating in unrelated industries. This type of merger could be a strategic move to diversify risk, expand market reach, or leverage synergies in different sectors. For example, a technology company merging with a media and entertainment corporation. The Harris Texas Plan of Merger ensures that both corporations involved in the merger have a thorough understanding of the terms, conditions, and implications of the transaction. It protects the interests of all stakeholders involved, including shareholders, employees, customers, and suppliers. By providing a detailed blueprint, the plan guides the merging corporations through a structured process and safeguards against any potential legal or operational challenges that may arise during the merger.

Harris Texas Plan of Merger between two corporations

Description

How to fill out Harris Texas Plan Of Merger Between Two Corporations?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Harris Plan of Merger between two corporations without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Harris Plan of Merger between two corporations by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Harris Plan of Merger between two corporations:

- Look through the page you've opened and check if it has the document you require.

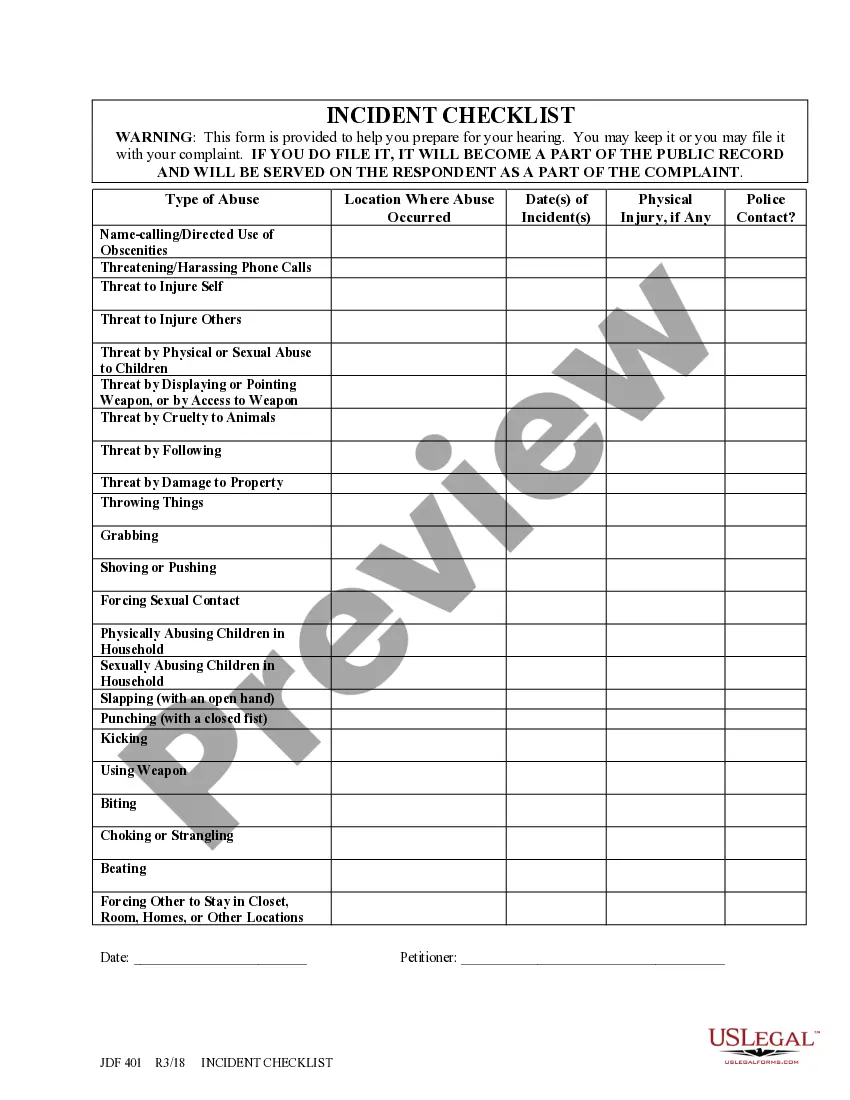

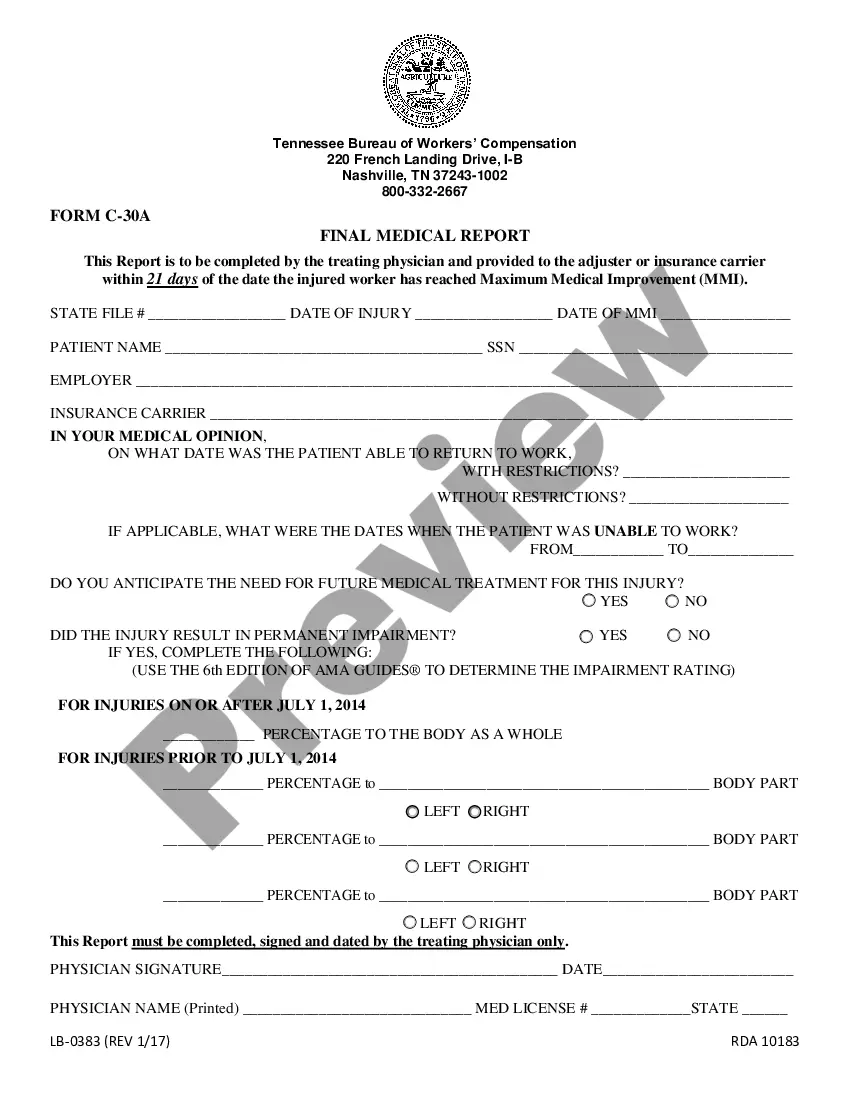

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!