Contra Costa California Credit Agreement is a legally binding contract entered into by Southwest Royalties, Inc. and Bank One Texas. This agreement outlines the terms and conditions for extending credit facilities from Bank One Texas to Southwest Royalties, Inc. The credit agreement is vital for businesses to secure financing and meet their financial needs. The agreement typically consists of several key provisions, including: 1. Parties involved: The Contra Costa California Credit Agreement is signed between Southwest Royalties, Inc. as the borrower and Bank One Texas as the lender. This ensures clarity regarding the responsibilities and obligations of each party. 2. Loan amount and purpose: The credit agreement specifies the maximum amount of credit extended by Bank One Texas to Southwest Royalties, Inc. This can be used for various purposes such as funding ongoing operations, expansion plans, or capital investments. 3. Interest rates and fees: The agreement stipulates the interest rates to be charged on the borrowed amount. It may also include details about any additional fees, such as annual maintenance or late payment fees. 4. Repayment terms: The credit agreement outlines the repayment schedule and terms. It specifies if the loan is to be repaid in installments over a set period or in full at a predetermined maturity date. Additionally, any grace periods, prepayment options, or penalties for default might be mentioned. 5. Collateral and security: If required, Southwest Royalties, Inc. may pledge certain assets or properties as collateral to secure the loan. The agreement specifies the type and value of collateral accepted by Bank One Texas. 6. Financial covenants: The credit agreement may include financial covenants that Southwest Royalties, Inc. must comply with during the term of the loan. These covenants can include maintaining a certain debt-to-equity ratio, achieving minimum profitability, or submitting regular financial reports. 7. Events of default: The agreement outlines various events that, if triggered, would constitute a default. These may include missed payments, breach of covenants, insolvency, or bankruptcy. Consequences for default, such as acceleration of loan repayment or foreclosure proceedings, are also mentioned. Different types of Contra Costa California Credit Agreements between Southwest Royalties, Inc. and Bank One Texas may include revolving credit agreements, term loan agreements, or lines of credit. These provide flexibility in terms of borrowing and repayment options, catering to the specific financing needs of Southwest Royalties, Inc. Overall, the Contra Costa California Credit Agreement between Southwest Royalties, Inc. and Bank One Texas acts as a crucial legal document governing the terms, conditions, and obligations related to credit facilities extended to Southwest Royalties, Inc. It ensures transparency and clarity between the borrower and lender, enabling the smooth functioning of their financial relationship.

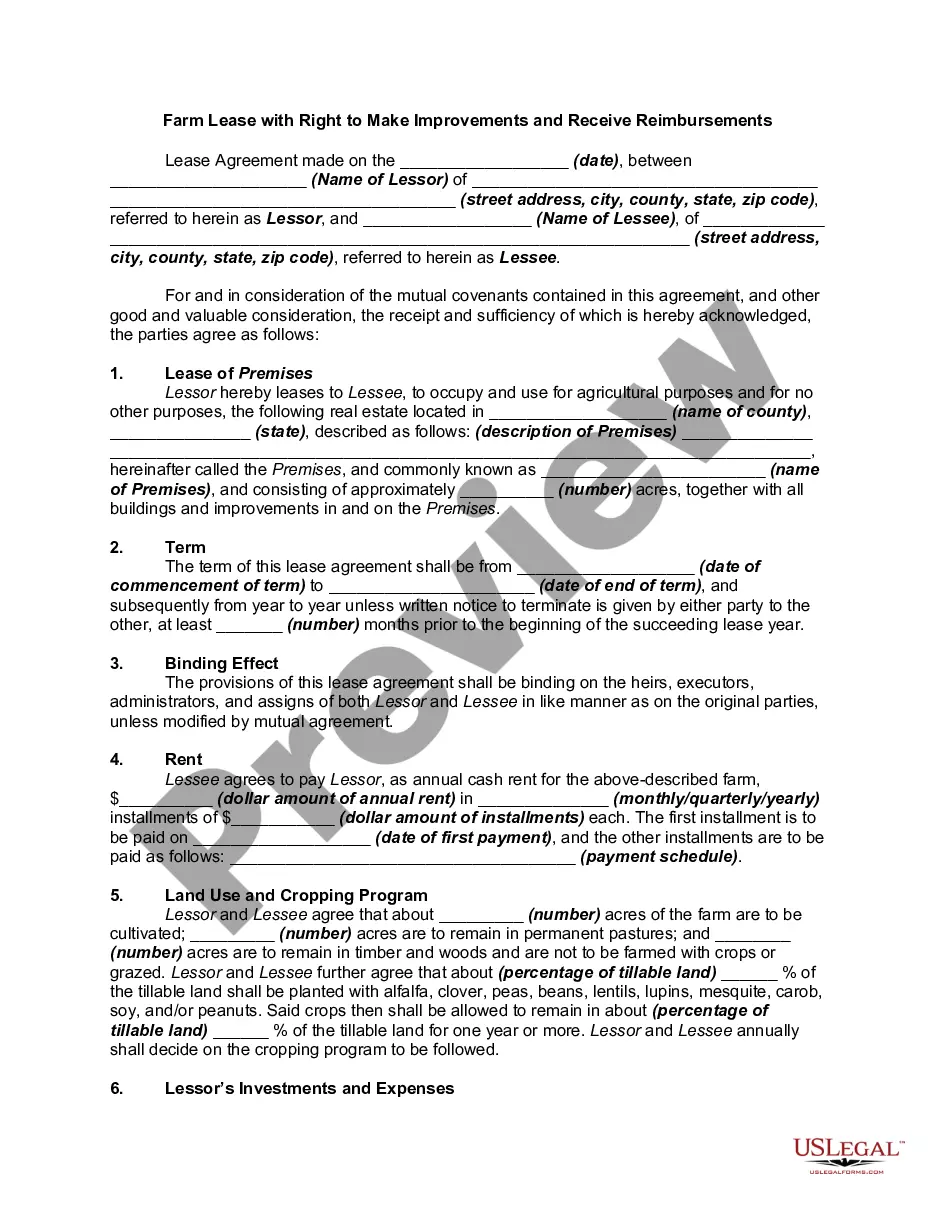

Contra Costa California Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

How to fill out Contra Costa California Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your county, including the Contra Costa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Contra Costa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Contra Costa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas:

- Ensure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Contra Costa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!