Title: Exploring the Maricopa Arizona Credit Agreement between Southwest Royalties, Inc. and Bank One Texas Introduction: The Maricopa Arizona Credit Agreement between Southwest Royalties, Inc. and Bank One Texas represents a pivotal financial arrangement aimed at facilitating business operations and fostering growth opportunities. This comprehensive credit agreement outlines the terms, conditions, and responsibilities of both parties involved. Let us delve deeper into the specifics of this agreement, highlighting its various aspects and potential types. 1. Key Terms and Provisions: The Maricopa Arizona Credit Agreement encompasses various key terms and provisions that safeguard the interests of both Southwest Royalties, Inc. and Bank One Texas. It outlines the borrowed amount, interest rate, repayment terms, collateral, financial covenants, conditions precedent, and default provisions. This agreement sets clear guidelines for loan utilization and repayment, ensuring transparency and accountability. 2. Collateral and Security: To secure the credit facility, Southwest Royalties, Inc. pledges certain collateral as specified in the Maricopa Arizona Credit Agreement. Collateral may include assets such as equipment, inventory, accounts receivable, or real estate. The agreement identifies the collateral types, their valuation, and the steps to be taken in the event of default. 3. Principal Types of Maricopa Arizona Credit Agreement: a. Revolving Credit Agreement: This type of credit agreement allows Southwest Royalties, Inc. to borrow funds up to a specified credit limit, repay them, and borrow again. It offers flexibility by providing a revolving line of credit, enabling the company to manage its cash flow efficiently. Interest is charged only on the utilized funds, making it a useful tool to address short-term financing needs. b. Term Loan Agreement: A term loan agreement establishes a fixed loan amount, interest rate, and repayment schedule for Southwest Royalties, Inc. This type of agreement provides a lump sum amount that must be repaid within a predetermined timeframe. It is suitable for long-term investments or major business projects where a specific amount of funding is required. 4. Repayment Terms and Conditions: The Maricopa Arizona Credit Agreement delineates the repayment terms and conditions, including the amortization schedule, interest calculation methodology, and potential prepayment penalties. It is essential for Southwest Royalties, Inc. to adhere to these terms to maintain a positive financial relationship with Bank One Texas. 5. Financial Covenants and Conditions Precedent: This agreement often includes financial covenants that Southwest Royalties, Inc. must fulfill to secure the credit facility. These may include maintaining a certain debt-to-equity ratio, meeting financial performance targets, or providing timely financial statements. Additionally, certain conditions precedent, such as obtaining insurance coverage or fulfilling legal requirements, must be fulfilled to activate the credit agreement. Conclusion: The Maricopa Arizona Credit Agreement between Southwest Royalties, Inc. and Bank One Texas is a vital financial tool that facilitates business growth and stability. Offering various types of credit agreements based on specific needs, this arrangement supports Southwest Royalties, Inc. in managing cash flow, pursuing investments, and meeting financial obligations. By ensuring compliance with the agreement's terms, Southwest Royalties, Inc. can establish a strong financial foundation and foster a mutually beneficial relationship with Bank One Texas.

Maricopa Arizona Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

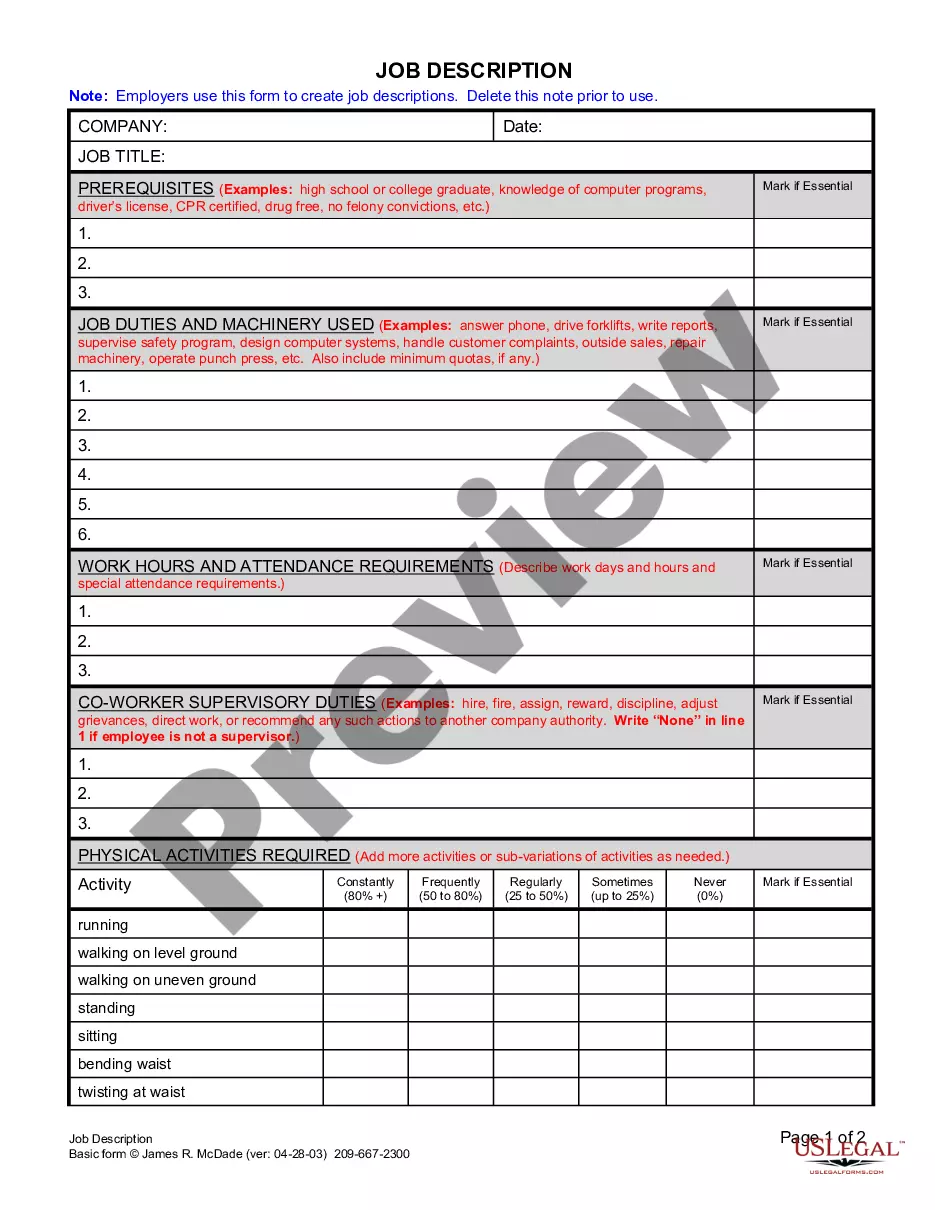

How to fill out Maricopa Arizona Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Maricopa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Credit Agreement between Southwest Royalties, Inc. and Bank One Texas:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!