Allegheny Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. is a legal document that governs the management and administration of trust assets held by the parties involved. This agreement outlines the rights, responsibilities, and obligations of Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. in managing the trust assets on behalf of the beneficiaries. Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. are the parties involved in this trust agreement. Nike Securities, L.P. serves as the trust or, who creates the trust and transfers the assets into it. The Chase Manhattan Bank functions as the trustee, responsible for safeguarding and managing the trust assets according to the terms specified in the agreement. First Trust Advisors, L.P. acts as the investment advisor, providing guidance and recommendations regarding the investment of the trust assets. The Allegheny Pennsylvania Trust Agreement can encompass different types of trusts, depending on the specific objectives and needs of the parties involved. Some common types of trusts that could be covered by this agreement include: 1. Revocable Trust: This type of trust allows the trust or to modify or revoke the trust during their lifetime, maintaining control over the trust assets. The trust assets are typically used for estate planning purposes, ensuring a smooth transfer of assets upon the trust or's death. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked by the trust or once it is created. This type of trust is often utilized for tax planning, asset protection, or charitable purposes. 3. Living Trust: A living trust, also known as an inter vivos trust, is created during the trust or's lifetime and becomes effective immediately. It allows the trust or to manage their assets during their lifetime and facilitates the easy transfer of assets to beneficiaries upon their death, avoiding the need for probate. 4. Testamentary Trust: This type of trust is established through a will and only becomes effective upon the trust or's death. It allows the trust or to specify how their assets should be managed and distributed to beneficiaries after their passing. The Allegheny Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. provides a comprehensive framework for the proper administration and investment of trust assets. It safeguards the interests of the trust or, beneficiaries, and all parties involved in the management of the trust.

Allegheny Pennsylvania Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Allegheny Pennsylvania Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

Drafting paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Allegheny Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Allegheny Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Allegheny Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.:

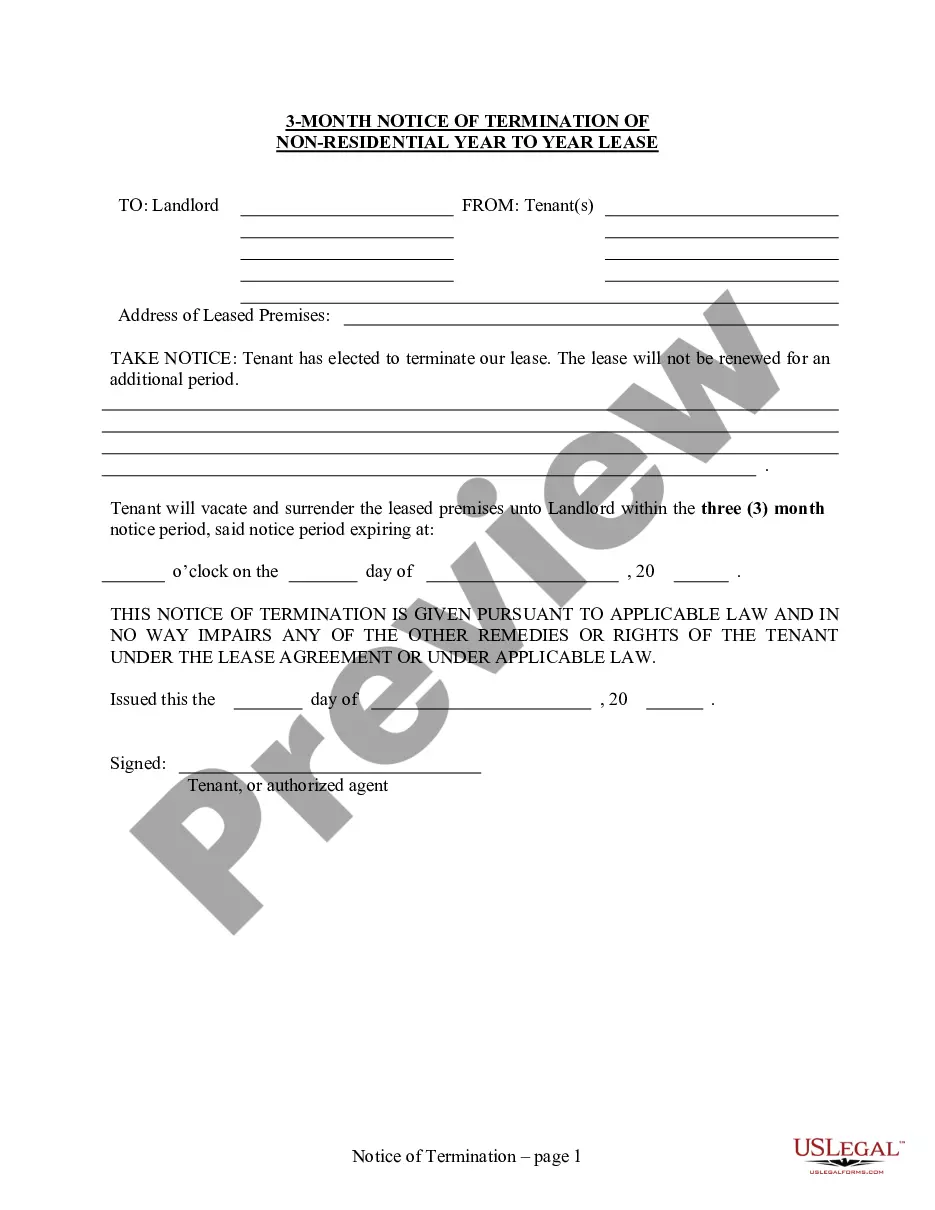

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!