A Chicago Illinois Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. is a legally binding document that outlines the terms and conditions of a trust relationship established between these entities. This agreement enables them to collaborate and manage a variety of trust-related activities, ensuring the protection and efficient handling of assets and investments. In its essence, a trust agreement serves as a framework for the administration and utilization of funds, assets, or investments entrusted by one entity (granter) to another (trustee) for the benefit of a third party (beneficiary) or a specific purpose. Chicago Illinois Trust Agreement is specifically governed by the laws and regulations applicable in the state of Illinois, ensuring compliance with local legal requirements. One type of Chicago Illinois Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. could be an Investment Trust Agreement. This type of agreement focuses on the management and investment of the trust assets, aiming to maximize returns and minimize risk while adhering to the investment objectives and guidelines set by the granter and the applicable legal framework. It clarifies the roles and responsibilities of each party involved, the investment strategies to be employed, and the mechanisms for regular reporting and communication. Another type of trust agreement that could exist between these entities is a Revocable Living Trust Agreement. This type of agreement is typically created by an individual or a family to provide for the management, protection, and distribution of their assets during their lifetime and after their passing. It grants the trustee (in this case, The Chase Manhattan Bank and First Trust Advisors, L.P.) the authority to administer and distribute the assets in accordance with the granter's wishes. The granter retains the flexibility to amend or revoke the trust during their lifetime, offering a higher degree of control and privacy compared to other estate planning tools. Furthermore, a Special Needs Trust Agreement could be established between the entities. This type of agreement is designed for individuals with disabilities and aims to provide for their financial well-being while preserving their eligibility for government assistance programs. The trustee ensures the appropriate use of trust funds, considering the beneficiary's special needs and adhering to the guidelines set forth by the granter and applicable laws. In conclusion, the Chicago Illinois Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. encompasses various types of trust agreements such as Investment Trust Agreements, Revocable Living Trust Agreements, and Special Needs Trust Agreements. Each type serves a specific purpose, ensuring the efficient management and safeguarding of assets while addressing the unique requirements and objectives of the granter and beneficiaries.

Chicago Illinois Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Chicago Illinois Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Chicago Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Chicago Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Chicago Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.:

- Make sure you have opened the correct page with your localised form.

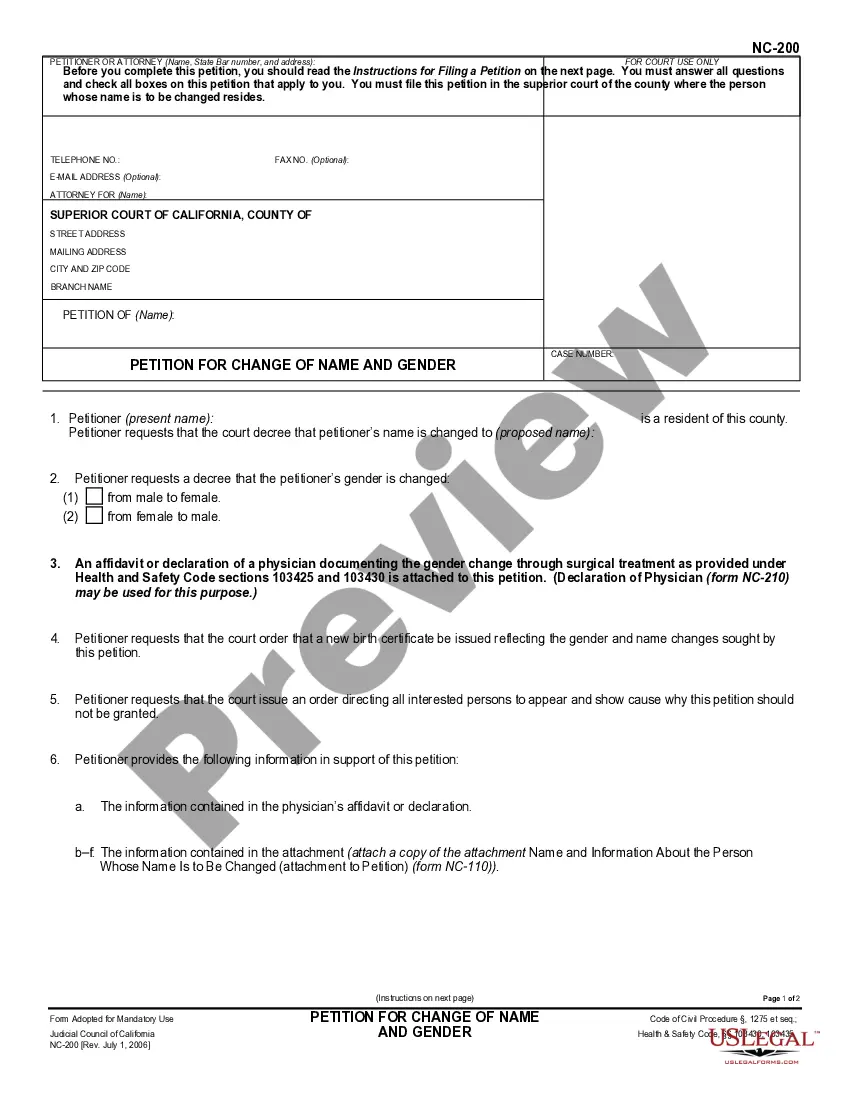

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Chicago Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!