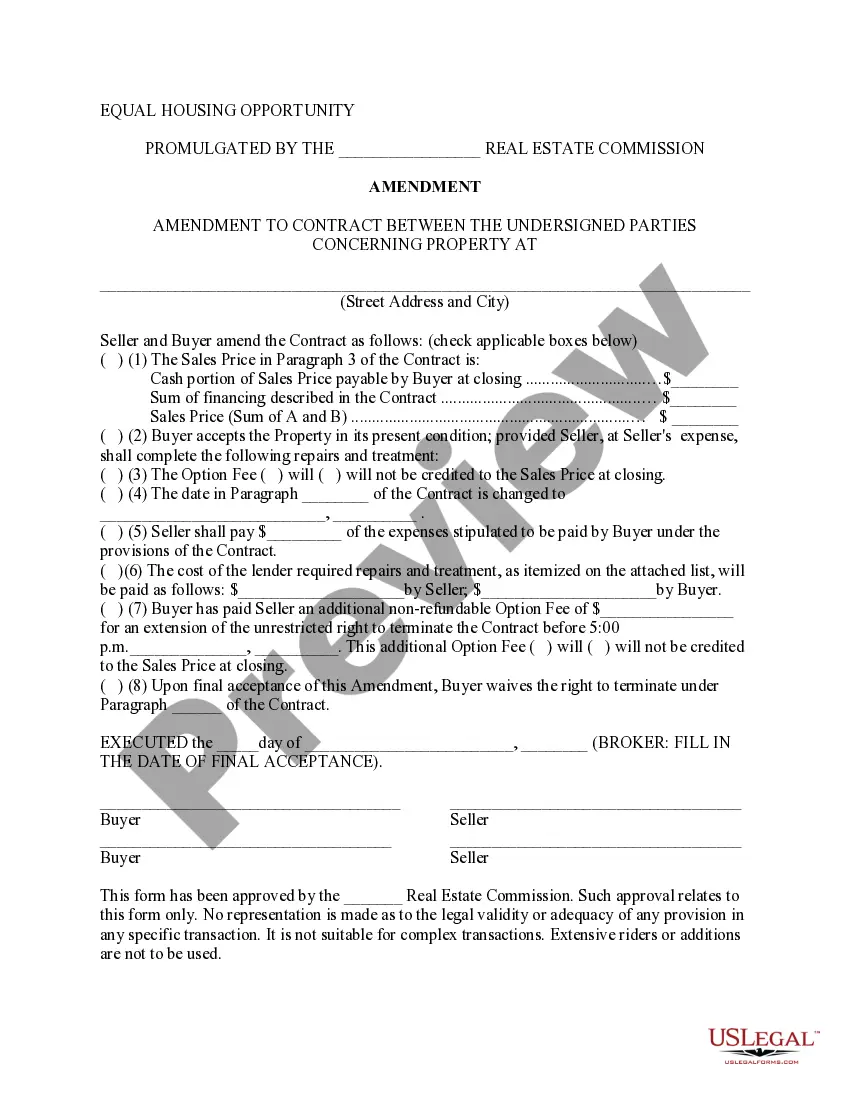

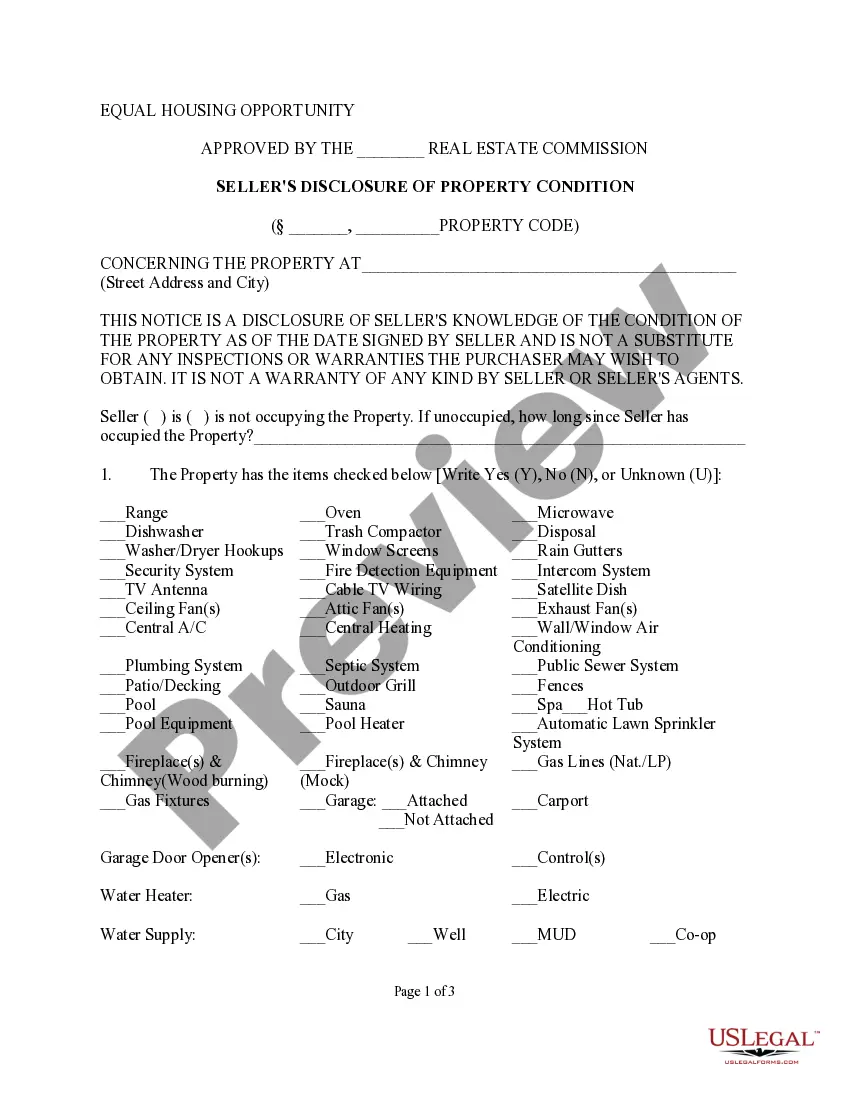

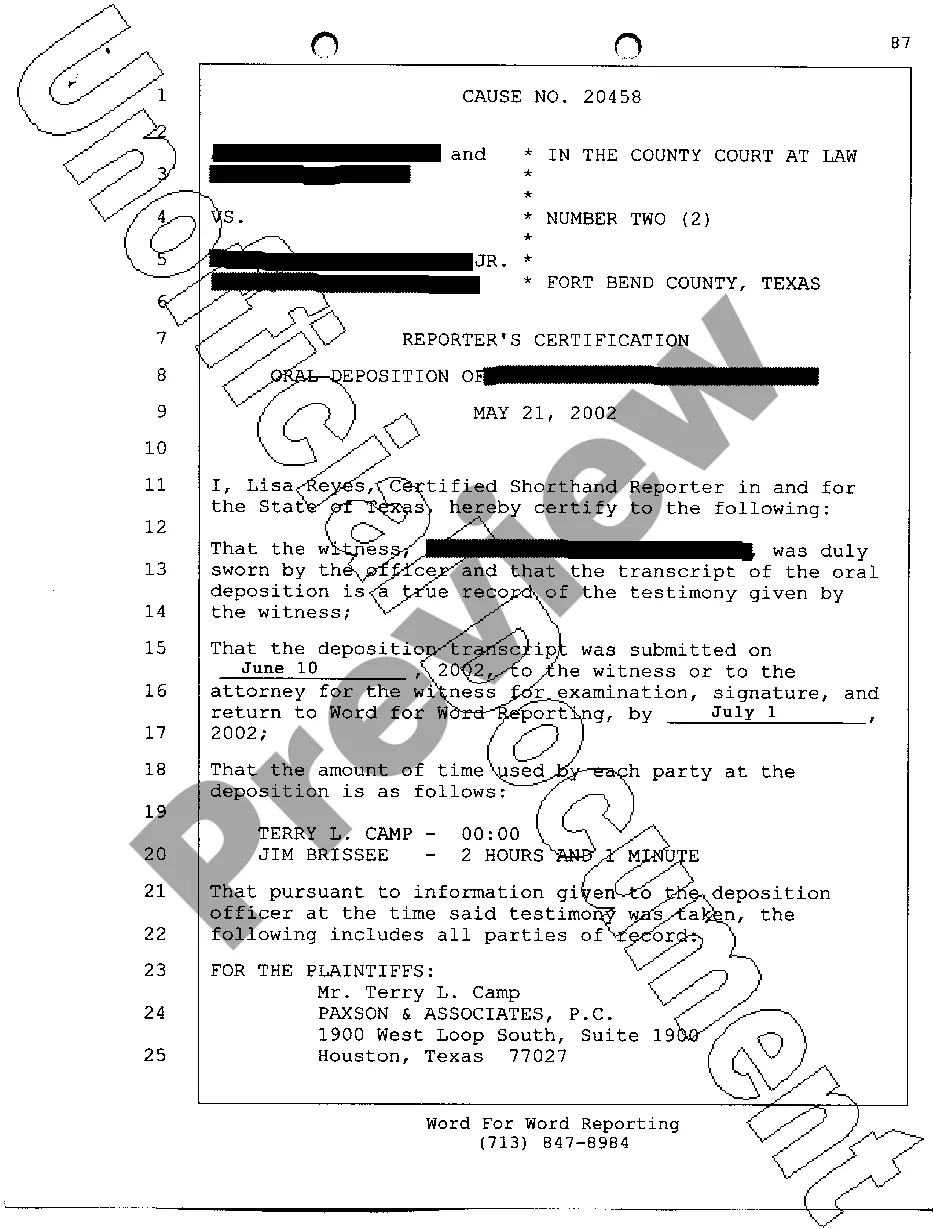

The Dallas Texas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P., is a legally binding agreement that outlines the terms and conditions governing the trust relationship between these entities. This agreement ensures that all parties involved adhere to specific guidelines and obligations, ultimately safeguarding the interests of the beneficiaries. There are different types of Dallas Texas Trust Agreements between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P., each serving a specific purpose: 1. Asset Management Trust Agreement: This type of trust agreement outlines the responsibilities and authorities granted to First Trust Advisors, L.P. in managing the assets held by Nike Securities, L.P. under the oversight of The Chase Manhattan Bank. It includes provisions for investment strategies, risk management, reporting requirements, and fee structures. 2. Trust Administration Agreement: This agreement specifies the duties and obligations of The Chase Manhattan Bank as the trustee. It lays out the necessary steps and procedures for administering the trust, including the distribution of income, record-keeping, legal compliance, and fiduciary responsibilities towards the beneficiaries. 3. Custody Trust Agreement: A custody trust agreement describes the arrangement between Nike Securities, L.P. and The Chase Manhattan Bank relating to the safekeeping and maintenance of the trust assets. This agreement highlights the bank's role in holding and safeguarding the assets, executing transactions, and providing periodic reports to Nike Securities, L.P. 4. Investment Advisory Trust Agreement: This type of trust agreement focuses on the relationship between First Trust Advisors, L.P. and Nike Securities, L.P., providing detailed guidelines for investment advisory services. It specifies the investment objectives, strategies, limitations, and terms of compensation for the advisory services rendered by First Trust Advisors, L.P. These Dallas Texas Trust Agreements play a crucial role in promoting transparency, accountability, and effective collaboration between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. Their comprehensive nature ensures that all parties involved are aligned in their goals and duties, while providing a framework to address potential disputes or conflicts that may arise during the trust's administration.

Dallas Texas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

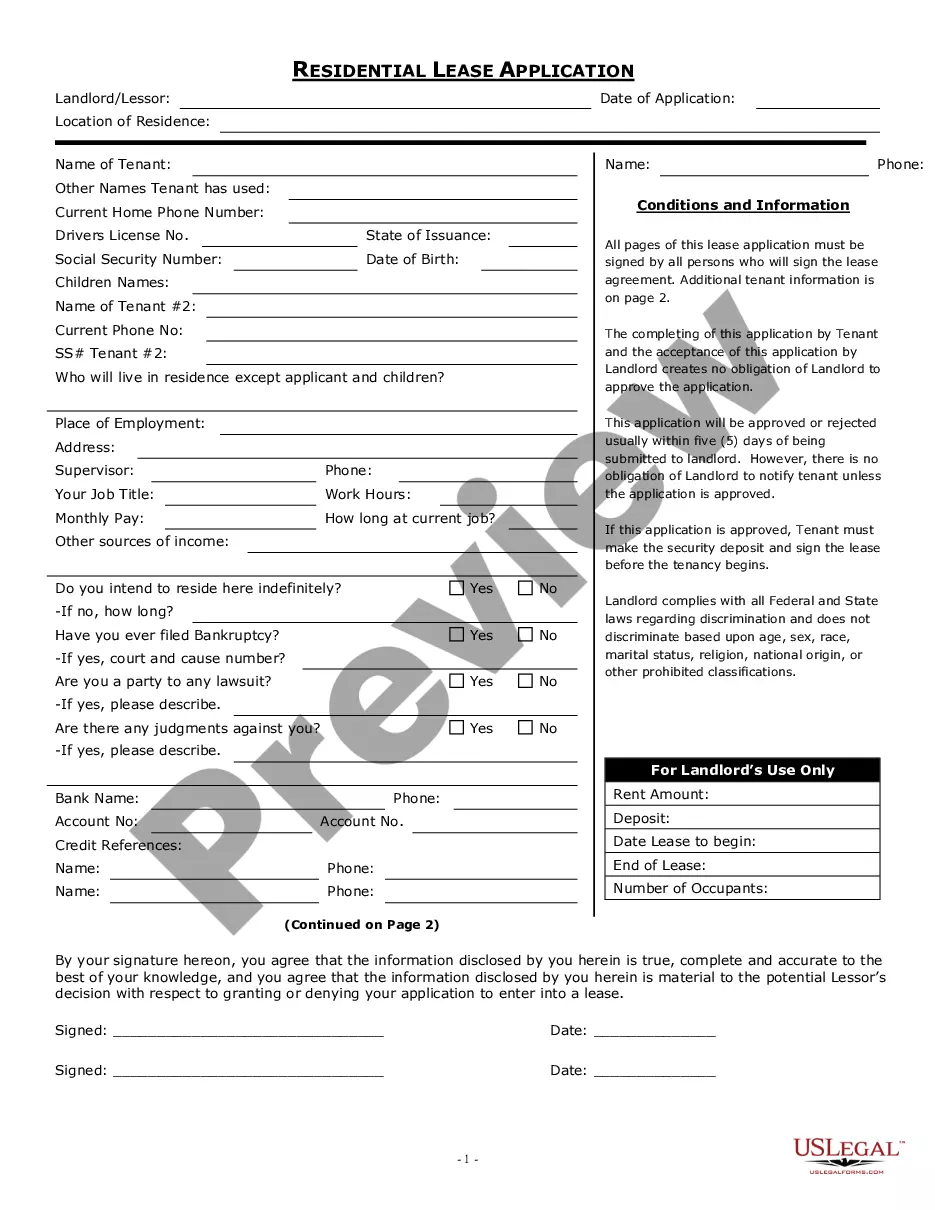

How to fill out Dallas Texas Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a Dallas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Dallas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Dallas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!