Maricopa Arizona Trust Agreement is a legally binding contract that establishes the terms and conditions for the management and administration of trust assets between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. This agreement ensures the protection and efficient handling of assets under the trust, serving both the trust beneficiaries and the entities involved. The Maricopa Arizona Trust Agreement outlines the roles and responsibilities of each party involved. Nike Securities, L.P., as the creator of the trust, transfers their assets, such as securities, real estate, or cash, into the trust for the benefits of designated beneficiaries. The Chase Manhattan Bank acts as the trustee, holding and managing the trust assets, executing investment decisions, and ensuring compliance with applicable laws and regulations. First Trust Advisors, L.P., plays a crucial role as the investment advisor, providing guidance and expertise in managing and growing the trust's portfolio. To meet the diverse needs of the trust beneficiaries, there can be different types of Maricopa Arizona Trust Agreements between these entities: 1. Revocable Living Trust Agreement: This type of trust agreement allows the trust creator (Nike Securities, L.P.) to retain control over the trust assets during their lifetime. They have the power to modify or revoke the trust, providing flexibility and estate planning benefits. 2. Irrevocable Trust Agreement: Unlike a revocable living trust, an irrevocable trust agreement cannot be altered or revoked without the consent of all parties involved. This type of agreement provides enhanced asset protection and potential tax advantages. 3. Testamentary Trust Agreement: This agreement becomes effective upon the death of the trust creator and is usually specified in their will. It allows for the orderly distribution of assets to beneficiaries as per the trust creator's wishes. 4. Special Needs Trust Agreement: This agreement is designed to provide for the financial needs of individuals with disabilities without jeopardizing their eligibility for government assistance programs. It ensures that the trust funds are used for supplemental needs, such as medical expenses or quality-of-life improvements. 5. Charitable Trust Agreement: This type of trust agreement allows Nike Securities, L.P. to designate a portion of their assets to be donated for charitable purposes. The Chase Manhattan Bank and First Trust Advisors, L.P. manage and distribute the assets to selected charities according to the trust's guidelines. In summary, the Maricopa Arizona Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. establishes the rules and guidelines for the management and distribution of trust assets. Different types of trust agreements cater to specific needs, such as estate planning, asset protection, charitable giving, or caring for individuals with special needs.

Maricopa Arizona Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

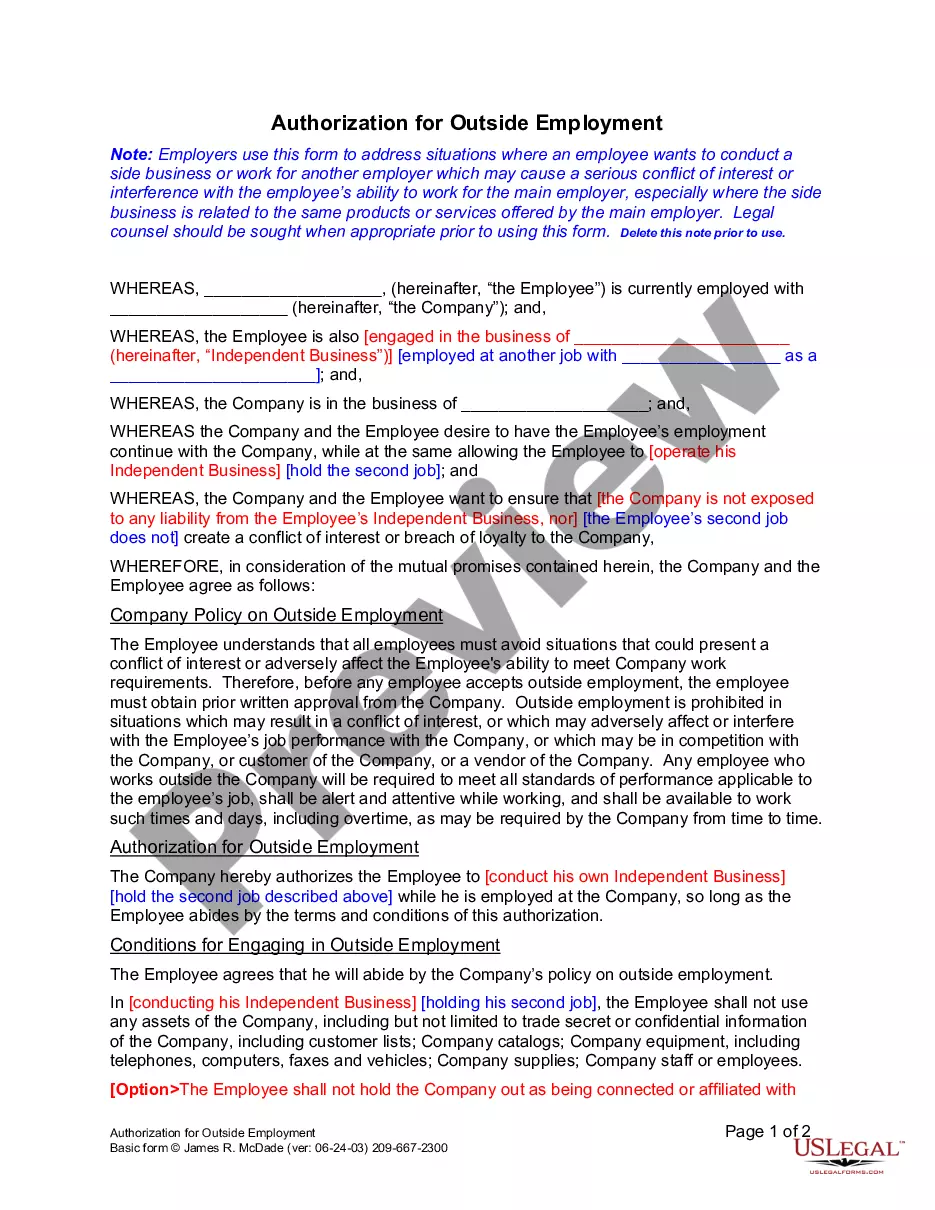

How to fill out Maricopa Arizona Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Maricopa Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Maricopa Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Maricopa Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Maricopa Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!