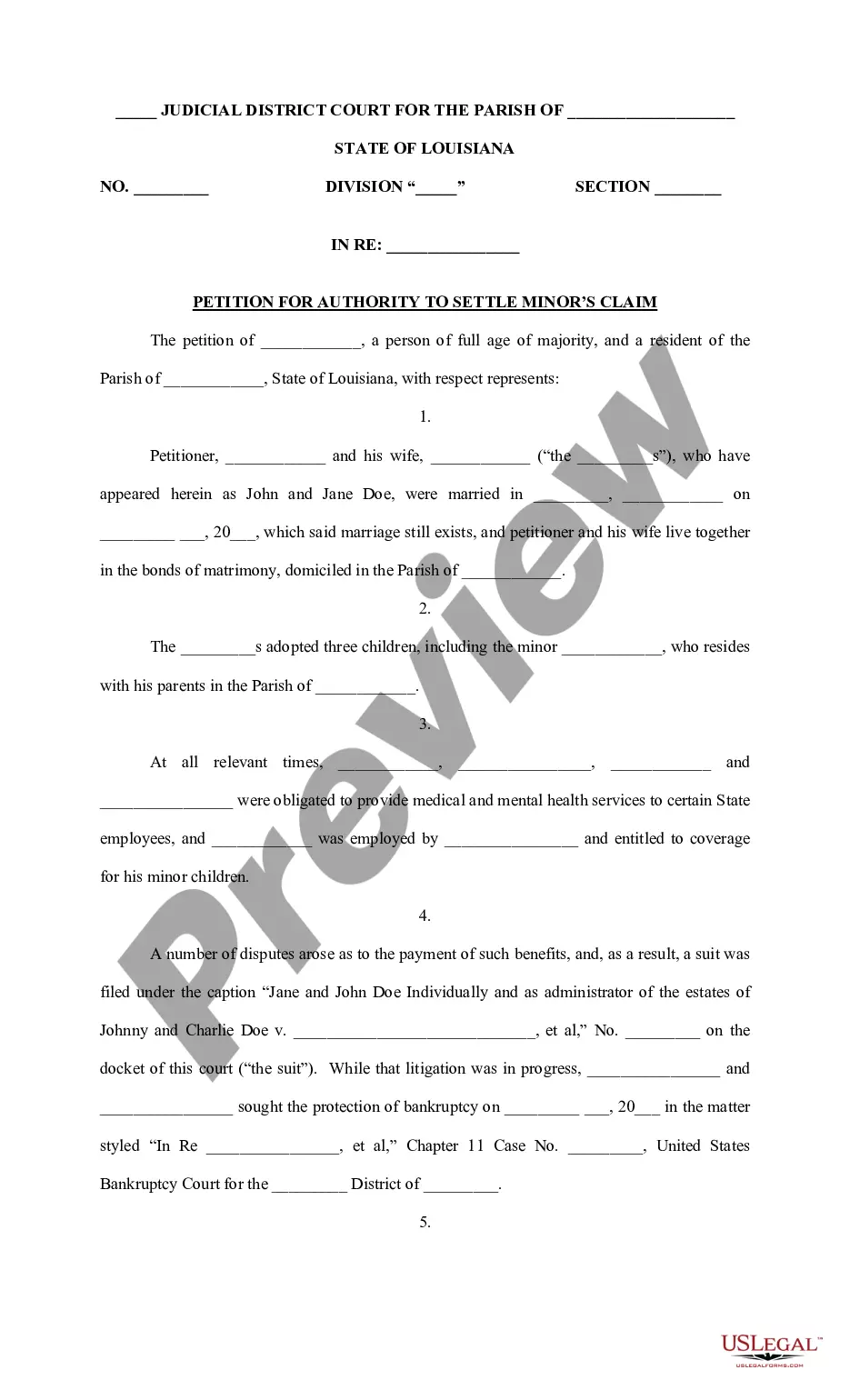

San Antonio Texas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. The San Antonio Texas Trust Agreement is a legally binding document that outlines the terms and conditions of the trust established between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. This agreement ensures asset management and financial protection for the beneficiaries involved. This trust agreement serves as a framework for investment strategies, risk management, and financial decision-making. It allows Nike Securities, L.P. to entrust its assets to The Chase Manhattan Bank, acting as the trustee, who then collaborates with First Trust Advisors, L.P. to provide expert advisory services. Key terms and provisions of the San Antonio Texas Trust Agreement include: 1. Parties: The agreement is between Nike Securities, L.P., a renowned investment firm, The Chase Manhattan Bank, a trusted financial institution, and First Trust Advisors, L.P., a reputable investment advisory firm. 2. Purpose: The agreement aims to establish a trust that ensures the efficient management, growth, and protection of Nike Securities, L.P.'s assets, with the expertise and guidance of The Chase Manhattan Bank and First Trust Advisors, L.P. 3. Responsibilities: The Chase Manhattan Bank serves as the trustee and is responsible for managing and safeguarding the trust assets. First Trust Advisors, L.P. acts as the investment advisor, offering strategic advice and support regarding investment decisions. 4. Asset Management: The agreement outlines the types of assets that can be held within the trust, such as stocks, bonds, real estate, and other investment instruments. The trustee and advisor work collaboratively to optimize and diversify the trust's portfolio. 5. Investment Strategy: The agreement provides details on the investment objectives, risk tolerance, and guidelines for investment decisions. This ensures that the trustee and advisor adopt an investment strategy aligned with Nike Securities, L.P.'s goals. 6. Reporting and Communication: The agreement establishes regular reporting mechanisms to keep Nike Securities, L.P. informed about the trust's performance, investment updates, and any changes in the market landscape. This facilitates transparency and accountability. Different types of San Antonio Texas Trust Agreements between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. may include: 1. Revocable Living Trust: This type of trust allows the trust creator (Nike Securities, L.P.) to make changes or revoke the trust during their lifetime. It provides flexibility and estate planning benefits. 2. Irrevocable Trust: An irrevocable trust is a type of trust that cannot be altered or revoked once it has been established. It offers additional asset protection and tax-saving benefits. 3. Charitable Trust: A charitable trust is designed to benefit charitable organizations or causes. Nike Securities, L.P. may contribute a portion of its assets to this type of trust for philanthropic purposes. In conclusion, the San Antonio Texas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank, and First Trust Advisors, L.P. serves as a comprehensive framework for asset management, investment strategies, and financial protection. It outlines the roles and responsibilities of the parties involved and ensures transparent communication. Various types of trusts can be established within this agreement, catering to specific needs and objectives.

San Antonio Texas Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out San Antonio Texas Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the San Antonio Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the San Antonio Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the San Antonio Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.:

- Make sure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Antonio Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!